US indices are testing the uptrend’s strength

April 03, 2024 @ 13:23 +03:00

The US markets start the new quarter with a decline and are already testing the support of the uptrend.

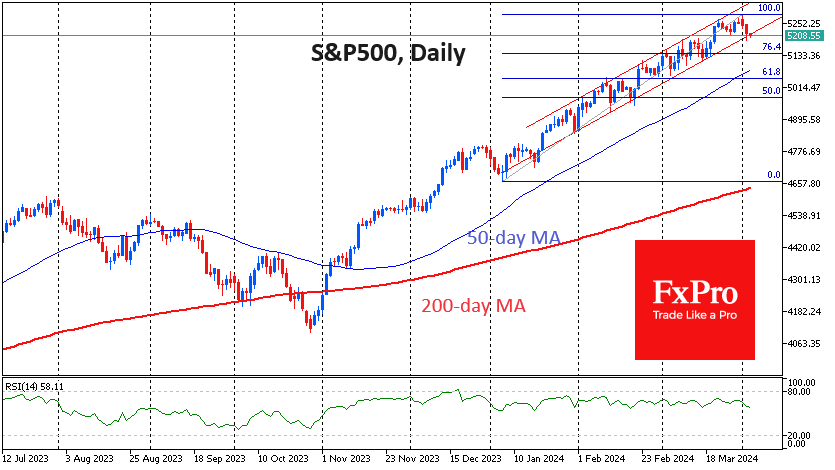

The S&P500 index is moving in a rather narrow uptrend from the January lows. The index tested the lower boundary of the channel on Tuesday, and index futures are hovering around that line on Wednesday morning, not far from the 5200 level. In such patterns, there is a higher probability of renewed growth and new momentum towards the upper boundary (now at 5330).

The index needs to pull back under the previous local lows at 5130 to cancel the bull scenario. A deeper dive is also possible – to 5075, where the 50–day moving average passes and where the market consolidation was in early March. A dip into the 5050– 5075 area would be a classic Fibonacci retracement of the rise from the January lows, allowing the market to run out of steam.

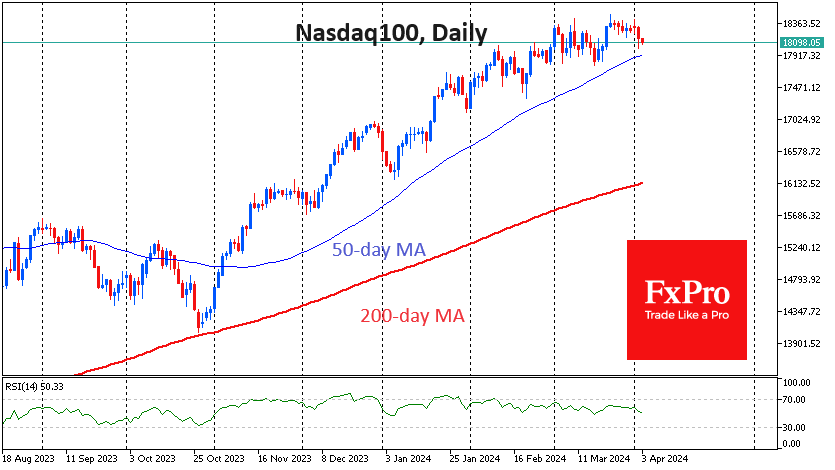

The Nasdaq100 index temporarily looks heavier, pulling back from the highs of the last week and a half. Here, the approach to the 50-day MA has attracted buying interest more than once since the beginning of the year. The 18000 area is in the spotlight now. The ability to turn to growth from here will be another demonstration of the strength of the bull market.

A failure below 18000 in the Nasdaq100 within a week could start a deeper correction like the one we saw last July-October. The sell-off in March and October 2023 was stopped after touching the 200-day MA. It is now passing through 16150 but will reach 16500 by the end of the month.

It is easy to understand the wariness of investors and traders after the impressive rise in stocks and other risk assets following the first quarter results and ahead of Friday’s labour market report, as counter-trend moves are part and parcel of the trend. However, it will be premature to draw any conclusions about the recovery of growth or deepening of the correction until we see the market reaction to the NFP.

The FxPro Analyst Team