US dollar benefits from soaring oil and gas prices

April 15, 2022 @ 12:41 +03:00

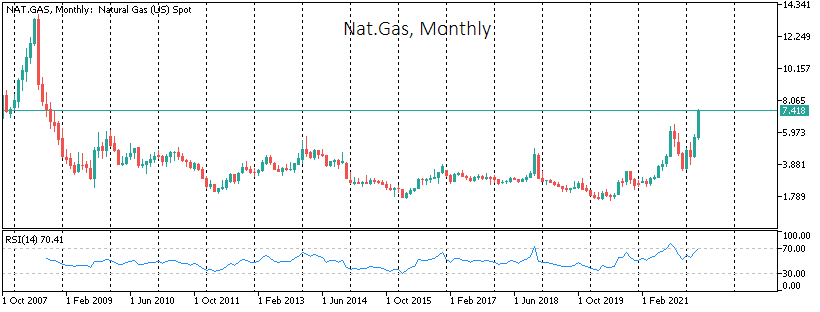

Energy prices continue to fly into the stratosphere, adding 30% since the start of April, strengthening at twice the rate of March. The last time US gas was this expensive was in October 2008.

Demand for American gas has surged as Europe tries to cut back on purchases from Russia as much as possible. But this also puts the current commodity sharply in short supply. Energy, oil, and gas have a very high price elasticity, meaning that a supply or demand shift of just a couple of per cent leads to a much higher price change.

Thus, the US provokes soaring prices on domestic markets by providing Europe with gas. Oil also receives a strong upward march, not only as of the closest substitute but also as another Russian export that the world is in a hurry to abandon.

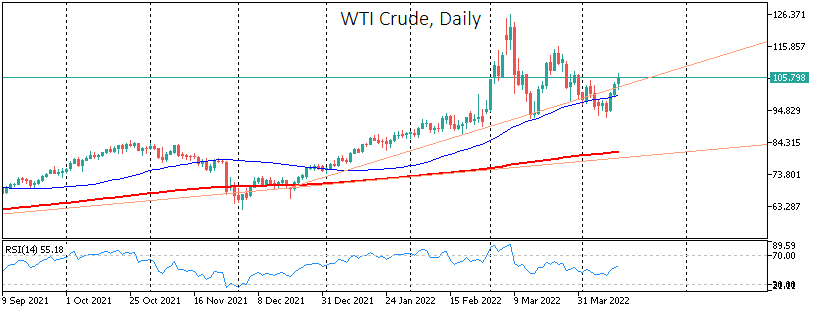

WTI was back above $105, and Brent closed Thursday above $110, returning to levels of two weeks ago. Oil prices managed to stay in an uptrend, albeit this time as a slider amid accelerating gas prices.

The performance of oil and gas prices is supported by US export figures, which is favourable for the Dollar. Notably, in contrast to the historical correlation, energy is rising with the Dollar, although often, a rising dollar pressures energy.

As one of the leading energy exporters, having strengthened its position, the states will economically have the most negligible impact on the economy compared with most developed countries that are net importers of oil and gas.

Higher energy costs may not prevent the Dollar from moving somewhat up further but may strengthen it by giving the Fed carte blanche to tighten policy more forcefully. The Fed can raise interest rates more quickly, but it can also push them to higher levels without the risk of seriously hurting the economy.

The FxPro Analyst Team