US CPI release will determine the dollar’s trend

August 10, 2022 @ 13:22 +03:00

It is definitely inflation day today. China, Germany, and Italy have released their consumer inflation data, while the US will release theirs before the New York session begins. Historically, inflation data has rarely deviated from expectations without triggering a market reaction, but in recent months the release of data from the USA has the potential to set trends.

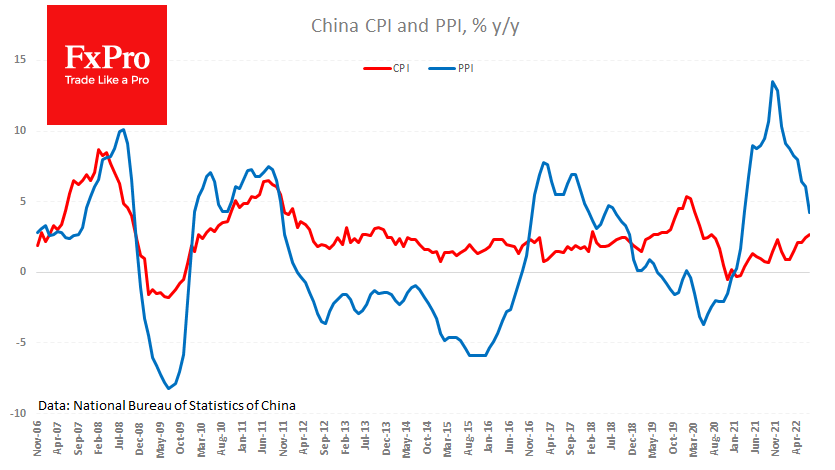

China is showing the world that this year’s inflation problem is not theirs. The Chinese data release was surprised by its weakness. CPI accelerated from 2.5% y/y in June to 2.7% in July vs 2.9% expected. The producer price index slowed from 6.1% to 4.2% (4.9% anticipated).

It may take up to three quarters before producer prices end their pro-inflationary push. Nevertheless, the second world economy is not contributing to global inflation.

By comparison, Japan’s Domestic Corporate Goods Price, also out today, showed a slowdown to 8.6% y/y from 9.4% a month earlier and a peak of 9.7% in February – a very gradual cooling.

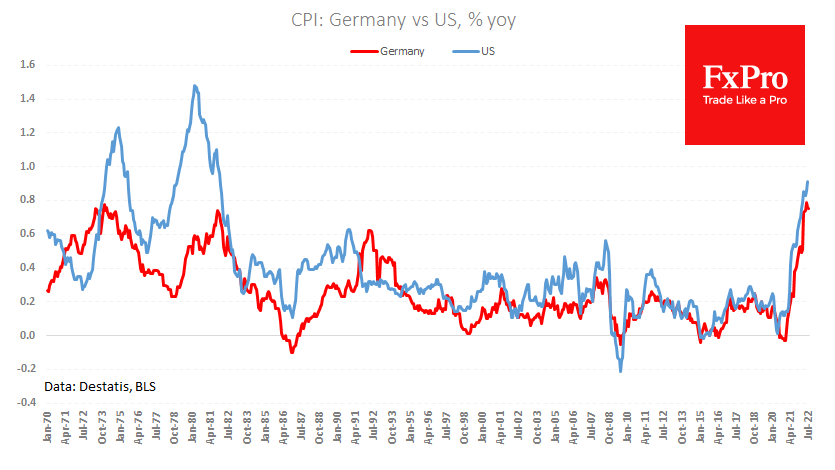

Germany confirmed preliminary estimates for July inflation at 7.5% y/y for CPI and 8.5% for Harmonised CPI. The latter continues accelerating, putting additional pressure on the ECB to tighten policy.

From the data from the USA, it is expected that consumer inflation has passed its peak. Prices are assumed to have risen by 0.2% last month, which is the historical norm, and the year-over-year rate has slowed from 9.1% to 8.7%. In the previous 11 months, US data has methodically exceeded expectations, pulling the Fed’s increasingly hawkish approach.

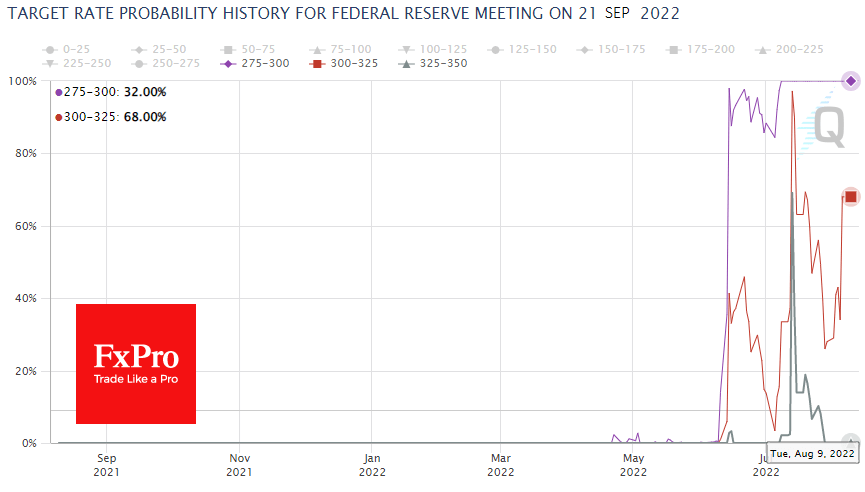

We must be prepared that the investors will scrutinise how fact correlates with expectations. If prices for July are down or unchanged, it could return the markets to bullishness as it spurs speculation that the Fed may not need to step on the brake pedal so sharply.

Fed rate futures continue to lay down a 68% chance of a 75-point hike in September. A sharp change in this sentiment in the debt markets could set all other related sectors in motion. Thus, if expectations soften, pressure on the dollar would increase. Conversely, a further increase in the chance of a 75-point tightening would return strength to the dollar bulls and stock market bears.

The FxPro Analyst Team