Unsustainable divergence in Nasdaq100 and Russell 2000

June 08, 2023 @ 17:52 +03:00

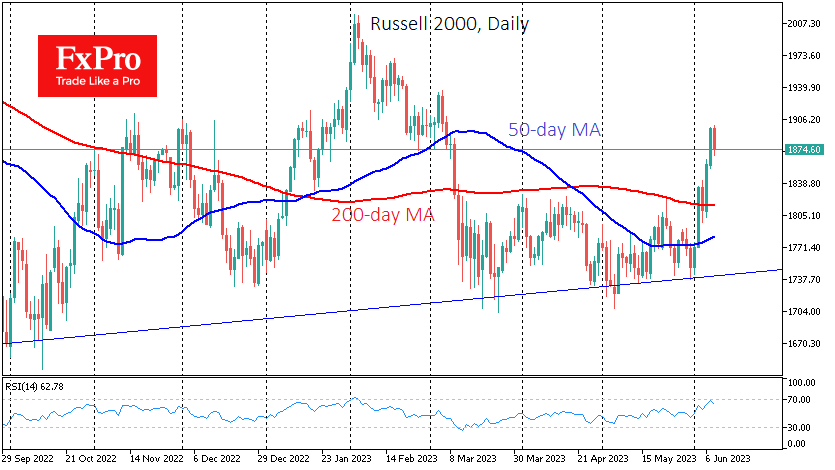

The US indices had a strong but sharp divergence on Wednesday, a rare event to see. The Nasdaq100 index lost 1.75% on Wednesday, pulling back close to 14300 and almost wiping out the gains made since the beginning of the month. Meanwhile, the Russell 2000 index of small-cap companies rose almost 1.8% to reach a three-month high.

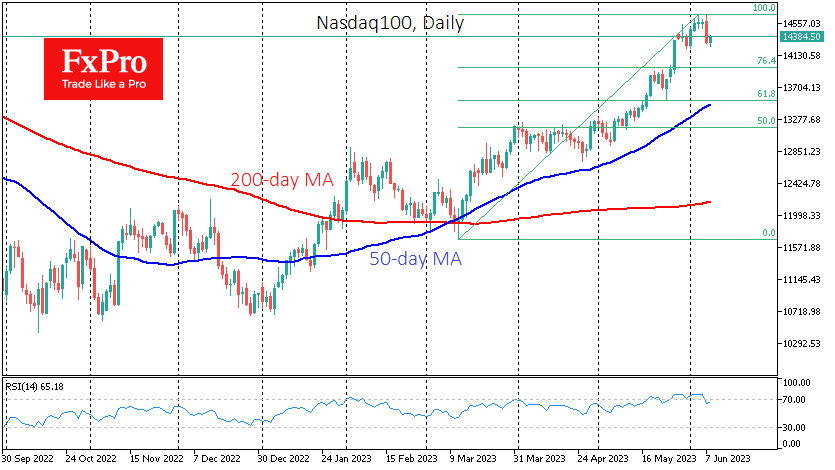

The decline in the Nasdaq100 is much easier to explain. The main reason is fatigue from the 25% rally since the March lows, which has been almost without pullbacks and with only brief interruptions. The AI-driven hype has driven the growth of the last three months, although the initial start was driven by hopes of a Fed rate cut due to the regional banking crisis.

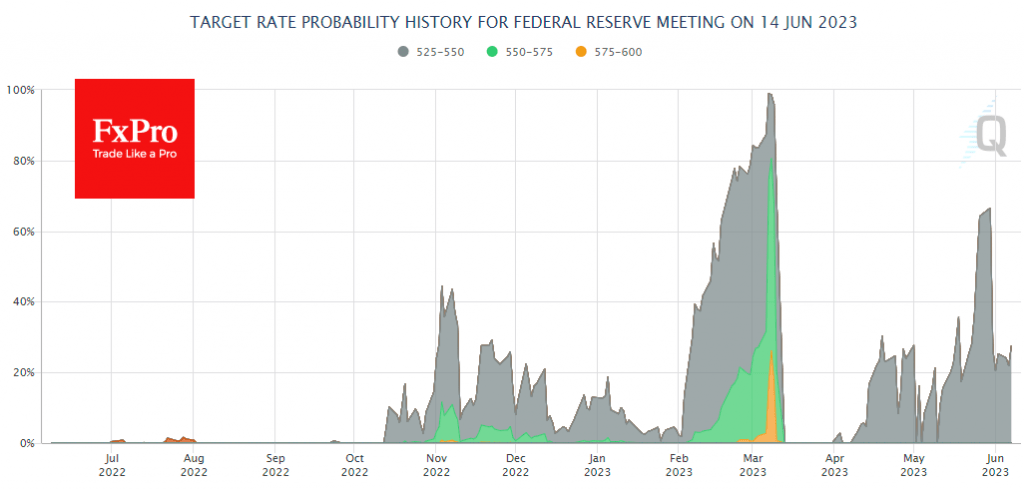

A change in Fed policy expectations has triggered a sell-off in an index filled with high-tech stocks. However, such a trigger looks suspicious. According to the CME’s FedWatch tool, markets are now pricing in the same 27.5% chance of a rate hike next Wednesday as they were the day before. At the beginning of last week, for example, the probability was 66.5%, and the index was at the same level.

Yesterday’s decline was likely the start of a correction in the overheated, tech-heavy Nasdaq100 index. Technically, yesterday’s RSI on the daily chart made a sharp retreat from the overbought territory after the indicator reached its highest level since November 2021.

A full correction of the rally from the March lows would be 800 points below the current level of 13500. The 50-day moving average could also be an important turning point for the market. It currently stands at 13474 but is pointing up. However, be prepared for the Nasdaq100 to fall back to 13,000, which has been consolidating for most of April, before finding meaningful buying support.

If the Nasdaq100 falls into a correction, we should expect a pullback, albeit not as deep, in the Russell 2000. This index could return to the long-term support line (1750 by the end of the month) from which it bounced in early June. However, a corrective pullback here will likely lose strength as early as 1800, between the 200- and 50-day moving averages.

The FxPro Analyst Team