Unprecedented S&P 500 Volatility Imminent Ahead of Major Options Expiration

June 18, 2020 @ 13:33 +03:00

The S&P 500 Index may face a heightened level of volatility on June 19.

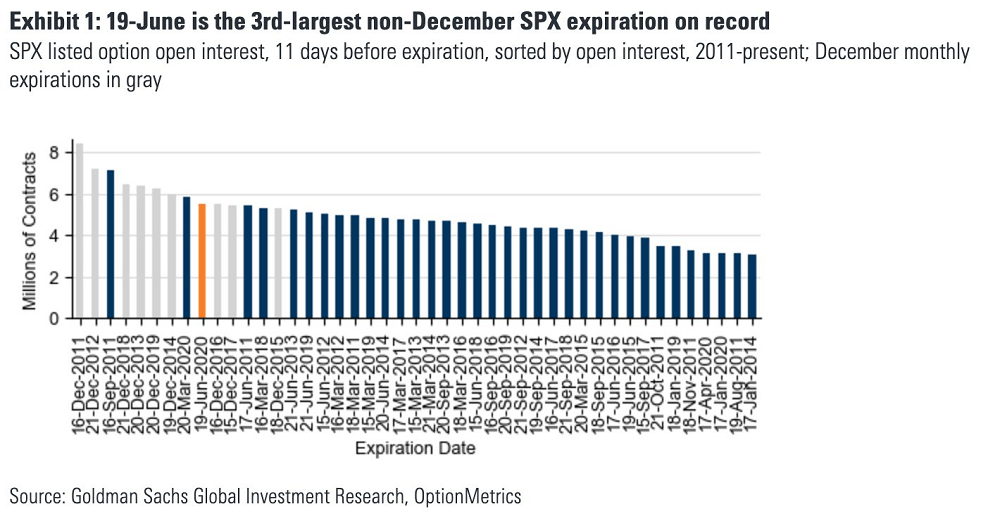

According to FT finance correspondent Robin Wigglesworth, $1.8 trillion worth of S&P 500 options are expiring in the next 48 hours.

The analyst said: Massive amount of options expiring on Friday. $1.8tln of SPX options – making it the third-largest non-December expiration on record -in addition to $230bln of SPY options and $250bln of options on SPX and SPX E-mini futures.

A massive options expiration day could fuel intense movements in the stock market because options contracts allow investors to buy or sell stocks at a specific price and date.

When an options contract is purchased, a trader is essentially buying the right to buy or sell the asset at an agreed-upon price.

For example, let’s say a trader previously bought a $100 June call option for a stock, and it is currently trading at $120. Before the options contract expires, the trader has the right to purchase the stock at $100. But the trader can also choose not to buy it.

On Friday, up to $2.2 trillion worth of options may expire. It means a large number of traders will be looking to buy or sell stocks based on call or put options, which will likely cause a massive spike in daily volume.

The S&P 500 has already been volatile in recent weeks, especially following the June 11 crash. The index dropped from 3,190 to 3,002 within 24 hours as major stocks recorded a double-digit plunge.

Uncertainty in the U.S. stock market can also lead to a more volatile options expiration date.

Data show that options traders are generally expecting large movements in the S&P 500 in the next 48 hours.

Other than the expiration of options contracts, two factors can impact the S&P 500 in the near term: progress of Moderna’s vaccine and rising trading activity on Robinhood.

In recent weeks, retail demand for stocks has risen to a point where Wall Street is taking notice.

Based on the high level of retail trading activity, Bancel’s positive speculation about a vaccine could further spur investors’ appetite in the short term.

Unprecedented S&P 500 Volatility Imminent Ahead of Major Options Expiration, CCN, Jun 18