UK PMI grew on inflation, rolling back pandemic restrictions

October 22, 2021 @ 18:11 +03:00

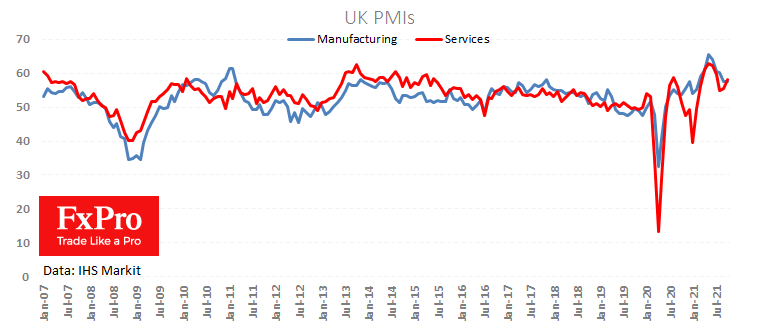

Flash UK PMIs for October beat expectations after a weak retail sales report earlier today. The manufacturing PMI rose from 57.1 to 57.7, and the service sector index rose from 55.4 to 58.0. Both were expected to show slowing growth, with indices forecasted to fall to 56.1 and 54.5, respectively.

Businesses reported a recovery in consumer activity “due to roll back of pandemic restrictions”. Besides, a jump in the input price component supported the rise in the indices. Although technically, a rise in input prices boosts PMIs, it should be attributed to bad inflation, which creates a short-term rush for some commodities but subsequently eats away at corporate profits and activity.

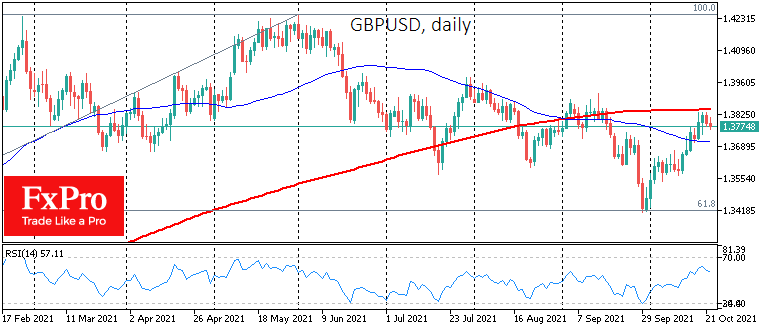

Thus, the stock market should look through this better than forecasted data, as it is unlikely to translate into profit growth. But it is good news for the Pound, as accelerating inflation increases the chances of a rate hike by the Bank of England soon.

The British Pound has been flirting with levels above 1.3800 this week, repeatedly pulling back from resistance in the form of the 200-day moving average. Most likely, traders are waiting for signals from the BoE that it is ready to raise rates in the coming months. If such calls come shortly, the Pound could finally shake off the June-September correction sentiment. And this looks like the most likely scenario. Should the Fed show more vigour, GBPUSD runs the risk of being pushed back to the September lows at 1.34.

The FxPro Analyst Team