UK Inflation turnaround lifted the Pound

July 15, 2020 @ 15:11 +03:00

Consumer prices in the UK turned to growth in June and were stronger than expected. The ONS on Wednesday morning reported CPI growth of 0.6% YoY against 0.5% a month earlier and outlined a likely reversal in the inflationary trend.

Interestingly, the data on inflation in the USA published overnight also noted such a reversal, but due to entirely different drivers (food products and medical care).

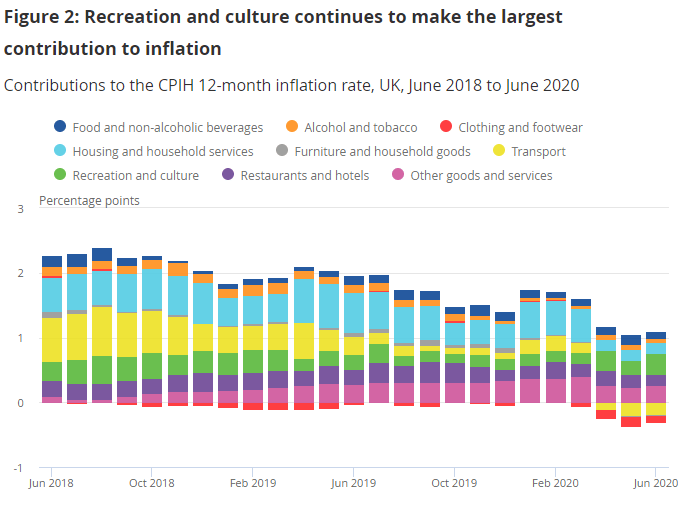

In Britain, the recreation and cultural sectors make the largest contribution to price gains. The previous price driver – transportation costs – has been pulling inflation down since April. Food products make a small contribution to the overall price increase, about 0.1%.

Transport costs make a negative contribution, but this seems to be temporary, as stock exchange oil prices have gone up, and consumers are moving more and more freely.

Thus, in the coming months, an increase in the general price level may well continue, marking a smooth return to the economy. This is good news for the British pound. GBPUSD managed to return to growth from the level of 1.25, adding 1 cent by midday Wednesday. The short-term attention of traders in the pair is concentrated at 1.2650, the level from which the pair has repeatedly rolled back this month. A breakdown of this level and steady growth above 1.2700 will open a direct path to levels near 1.3000, where the pair was holding until the market collapse in February-March.

The FxPro Analyst Team