UK economy revives, helping the pound to rise against the euro

July 13, 2022 @ 15:23 +03:00

A new package of UK macro statistics showed some recovery and exceeded expectations, supporting pound buying, although it did not help the stock market.

The monthly economic growth is estimated at 0.5% in May after a decline of 0.2% in April and +0.1% in March. And this is significantly better than the 0.1% expected.

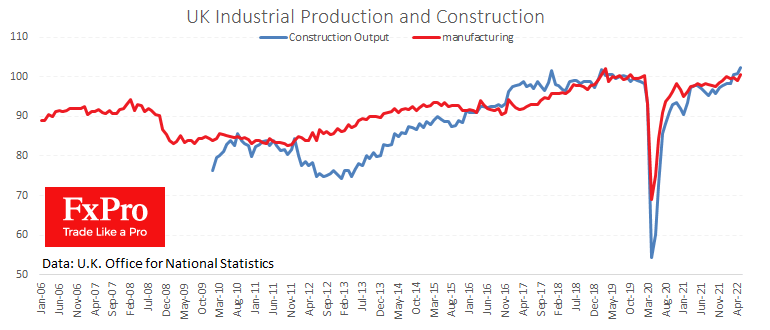

Manufacturing showed an impressive jump, adding 1.4% for May – the best growth in 14 months.

The service sector grew by 0.4% m/m, contrary to expectations of a 0.1% increase.

Equally surprising was the construction sector, where workloads grew by 1.5% mom and 4.8% YoY, coming out of the lockdown pit, renewed historical highs.

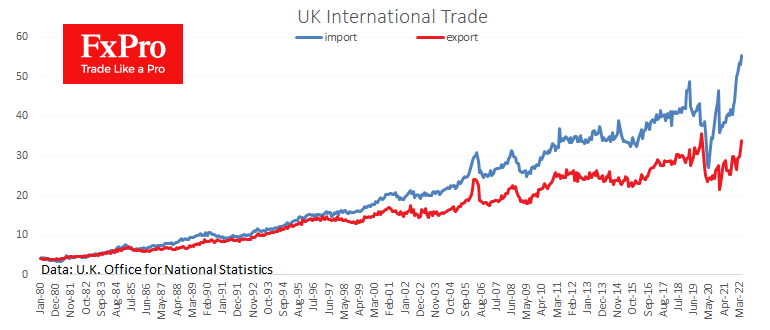

The foreign trade deficit of 21.4B was higher than the expected 19.8B, but this widening came at the expense of faster growth in imports, although exports also added impressively. The UK’s trade deficit was 24% of trade turnover. These are historically high figures but a marked improvement on the record 30% in January.

Much of the credit for the recovery can be attributed to a weaker pound, which has boosted export competitiveness and increased construction activity. The latter can be attributed to the tailwinds from historically low-interest rates, while there are questions about whether the housing boom will continue.

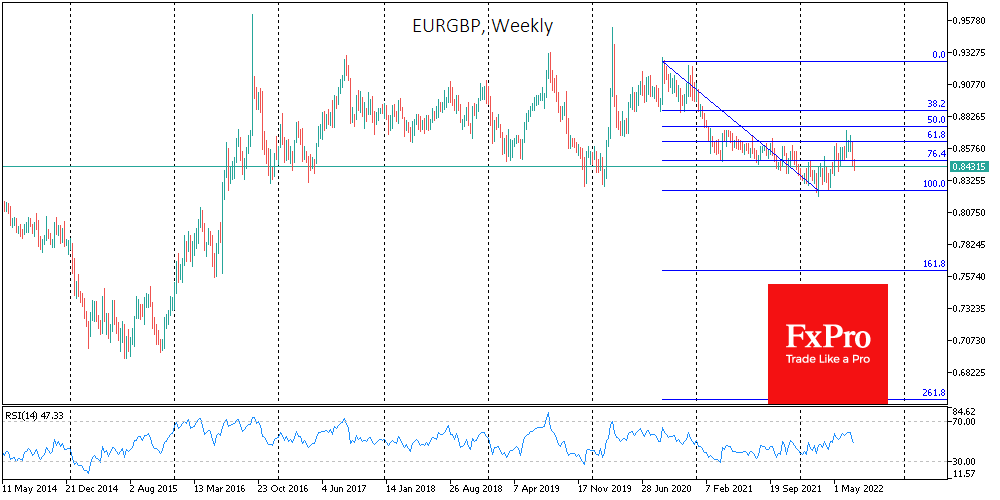

A positive batch of data will likely provide the pound only a temporary respite in its decline against the dollar and spur gains against the euro. The EURGBP pair seems to have completed its corrective rebound after a long decline between September 2020 and March 2022. By the end of the year, the pair may fall to the last six years area near 0.8250. In the event of further problems in the Eurozone, the EURGBP could lose support and move towards 0.75, which has not been since the Brexit referendum.

The FxPro Analyst Team