U.S. trade negotiations with Mexico have stopped flight to the dollar, but hardly for long

August 28, 2018 @ 10:34 +03:00

Mexico agreed to review the trade agreement with the United States on NAFTA. This became the good news for risky assets, including Asian stock markets, inspiring optimism that the trade disputes between the countries will be resolved further in the future.

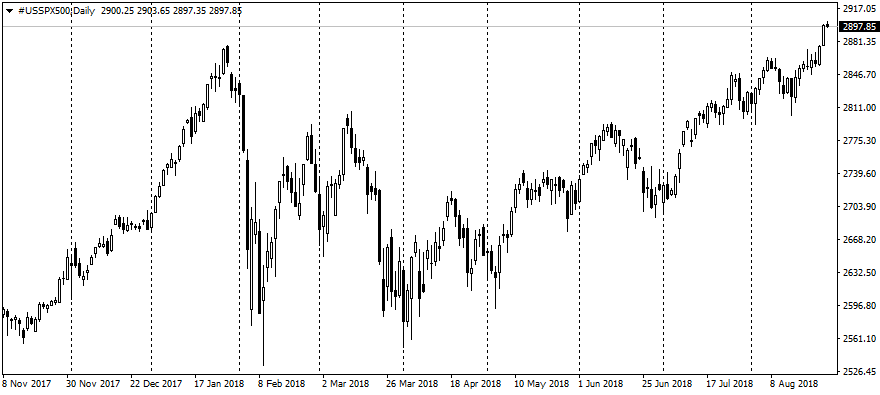

The Mexican peso gained 1.7% at one point on Monday after this news. The U.S. stock markets continued to renew their historical highs. The futures on S&P500 took a height of 2900 points, having added 0.6% in 24 hours. MSCI for Asia-Pacific has added up 0.6% since morning on speculation that the agreement with Mexico will begin to reduce of the tensions around the international trade.

However, this news looks rather like one of the few sunny days during the hurricane season.

It is increasingly likely that we will see a renewed pressure on Canada. In addition, having tasted the sense of victory in trade disputes, the Americans are unlikely to soften their rhetoric with Europe and China. Most likely, the tensest moment in both cases is just ahead, which is able to return the dollar to growth in the coming weeks.

The market participants had repeatedly hastened to bet on a breakthrough in negotiations earlier. In fact, the situation with tariffs is still worsening, but the markets are living with expectations, and it explains their growth this week.

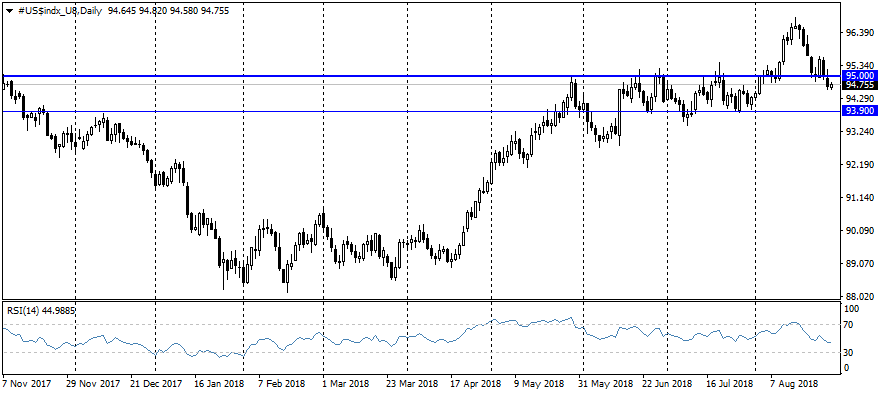

The news on Mexico has caused pressure on the American currency. Earlier in August we had observed the demand for the dollar as safe-heaven, now these bets bonus back. The dollar index lost 0.3% in the past 24 hours, falling to the lows since August 2 to 94.60. This returns DXY to the trading range of May and, in terms of technical analysis, can become a signal to further increase of the pressure on the dollar and can send it to the previous local lows at 93.90 relatively quickly.

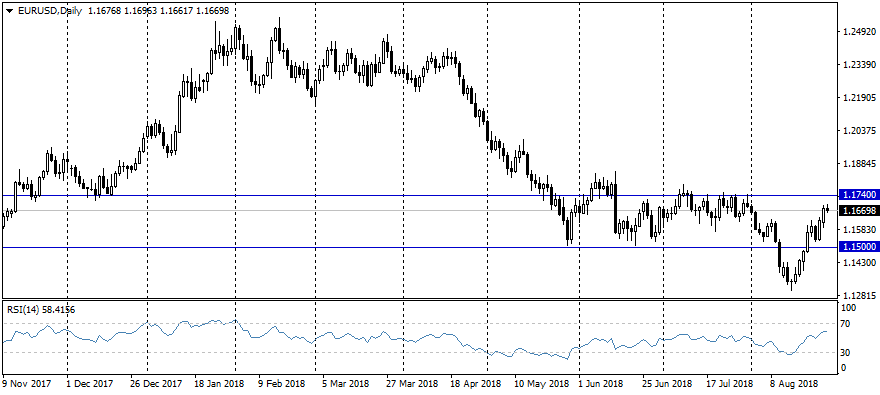

The EURUSD pair rose on Tuesday morning to 1.1696, and completely erased its fall earlier in August. The prospects of the pair on the part of tech analysis had noticeably improved during the previous week, having put the pair within the reach of the important resistance on 1.1740.

However, the short-term technical picture risks to be destroyed by unexpected turns in the rhetoric on international trade negotiations. The harsh rhetoric of the US and the reluctance of China and other countries to make quick concessions was the key driver of the dollar’s growth by more than 9% from April to August. And this situation can easily return in the spotlight.