U.S. loses in its tech race with China because of unwillingness to spend money

September 11, 2020 @ 11:39 +03:00

The United States’ unwillingness to spend money is its biggest disadvantage in a tech race with China, according to a cybersecurity and technology expert. From imposing restrictions on telecommunications giant Huawei to issuing executive orders banning transactions with ByteDance, and forcing the company to sell the U.S. operations of the popular app TikTok, Washington has stepped up efforts to put pressure on China’s technology firms in recent years.

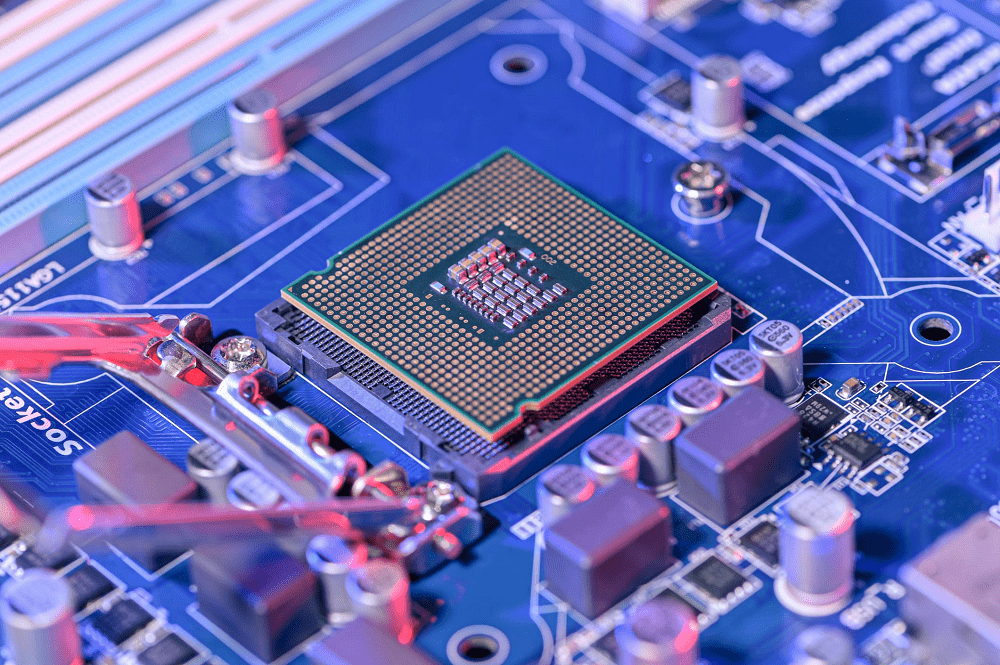

“The U.S.′ biggest disadvantage in this tech race is its unwillingness to spend money,” James Andrew Lewis, senior vice president and director of the Technology Policy Program at CSIS, said on CNBC’s “Squawk Box Asia” on Thursday. “China might outspend us a 1,000-to-1 when it comes to investing in semiconductors and a 1,000-to-1 is no way to win the race,” said Lewis, who previously worked for the U.S. Departments of State and Commerce. He explained that while there is bipartisan support for a bill to increase federal incentives to boost American leadership in semiconductor manufacturing, so far “it hasn’t translated into money.”

This month, the U.S. Department of Defense said it is in discussions over whether Semiconductor Manufacturing International Corporation, China’s largest chip manufacturer, should be subjected to export restrictions. Semiconductors make up an important part of the tech race that also includes the U.S. and China competing for dominance in areas such as artificial intelligence and quantum computing.

A lot of the funding in the Chinese semiconductor sector comes from the government. Reuters reported that the National Integrated Circuit Industry Investment Fund put up 139 billion yuan ($20 billion) for chip projects in 2014 and added another 204 billion yuan (about $29.8 billion) in 2019. There is also growing interest among private investors.

Unwillingness to spend money is a disadvantage for the U.S. in its tech race with China, expert says, CNBC, Sep 11