Turkish lira under sustained pressure due to energy, food prices

March 11, 2022 @ 12:55 +03:00

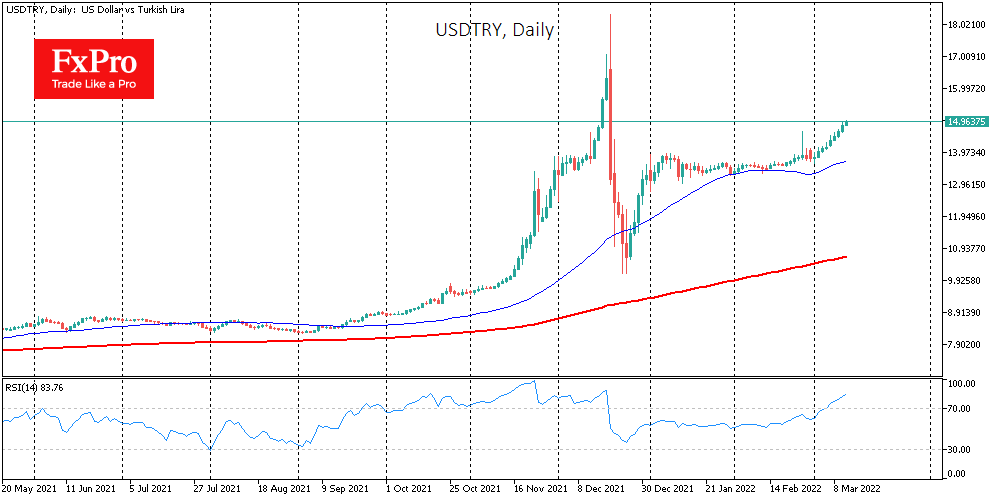

The Turkish lira has fallen back-to-back on each working day in March, having weakened against the US Dollar by 8.2% over this time and coming close to 15.0, where it was last seen in mid-December.

The current development of the lira is reminiscent of the early October-November situation when we have seen a similar sustained decline, but the volatility (by the standards of the Turkish lira) has remained subdued.

The pressure on the lira is due to the country’s heavy reliance on imports of oil, gas, and agricultural commodities, mainly wheat. Turkey’s Current Account deficit rose to 7.1bn in January from 3.8bn a month earlier. In February and early March, we see a gloomier picture in commodity prices, promising to put even more pressure on the balance of payments.

The jump in the price of basic commodities has caused a decline in industrial production, and the situation could worsen in the coming months. The exchange rate, in this case, is a natural damping mechanism unless it is maintained artificially through currency interventions or severe capital controls. In Turkey, the second variant is now the case, but these controls merely stretch out the natural self-adjustment of the economy over time.

The FxPro Analyst Team