Trump tosses dollar from highs, now move is up to ECB

July 23, 2018 @ 11:51 +03:00

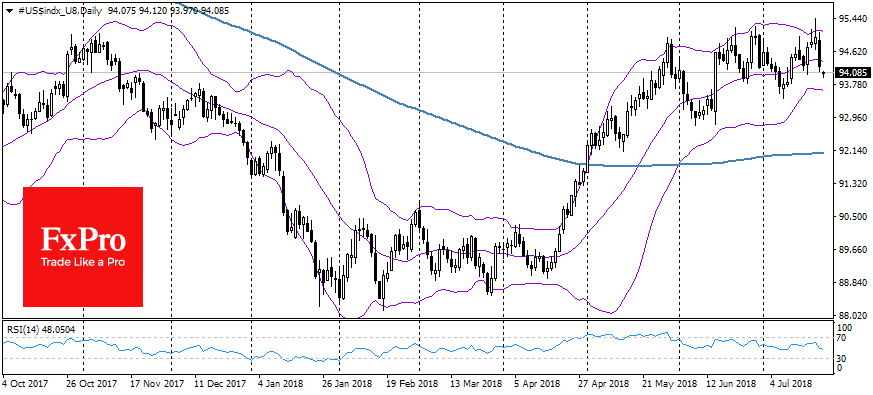

The dollar remained under pressure after the Trump’s criticism about the strengthening of the national currency. Despite doubts that the influence of the president’s comments will be long, tactically they came out at an opportune moment, not allowing the growing index of the dollar to gain momentum after touching highs for the last year.

At least for the short-term the scales turned to dollar bears and sent DXY (Dollar Index) from the recent highs. In addition to the direct reaction of the currency market, it is worth noting the flattened yield curve for of U.S. treasuries. This is good news for the markets, mostly for the EM, that slightly decreases the degree of uncertainty around the trade wars.

Besides, a company’s strong reporting helped the markets last week. Now this factor is temporarily suppressed by uncertainty about the prospects of trade wars, but in general is a significant positive theme.

Despite the weakening of the dollar in the second half of last week, the upcoming ECB press conference this week has a chance to exacerbate the competition of bulls and bears on the currency markets. After ECB head’s comments on previous meeting the Euro collapsed by 2.5% and returned the EURUSD in the area of 12-month lows.

However, it is more likely that there will develop the balanced-comments-scenario of Draghi in the range from neutral to positive for the currency after a portion of criticism from the American president about the active pressure on their currencies in Europe and China. The weakening of the dollar also helped gold, oil, and Chinese exchanges to grope some support last week. On Friday, the oil also gained some help from the reports about a reduction in drilling activity. As a result, Brent trades near $73 a barrel against last week’s lows at 71.30.