Trump is a bit of a paper tiger at this point

August 06, 2020 @ 12:42 +03:00

China’s economic growth indicators are lopsided, pointing to possible downside risks for the country in the second half of 2020 as it tries to recover from the coronavirus pandemic, an analyst said Thursday. “On Covid, the Chinese deserve a lot of credit. They certainly locked down much of the country,” said Andrew Collier, managing director at Orient Capital Research, a Hong Kong-based research firm. “Even though they may have launched the virus, they were pretty good at quelling it. That’s the advantage of an authoritarian regime,” he told CNBC’s “Squawk Box Asia.”

The coronavirus was first reported in China late last year, prompting the government to shut down more than half of the country as part of its efforts to contain the virus. China has since been trying to bolster its soft power by trying to take the lead in a global response to the public health crisis as U.S. infections soar and those in the Asian country fall. Recent data showed China’s June retail sales fell 1.8% from a year ago, much worse than the 0.3% growth analysts forecast in a Reuters poll. That came after a 2.8% drop in May. But that was still better than sharp drops in the rest of the world, said Collier.

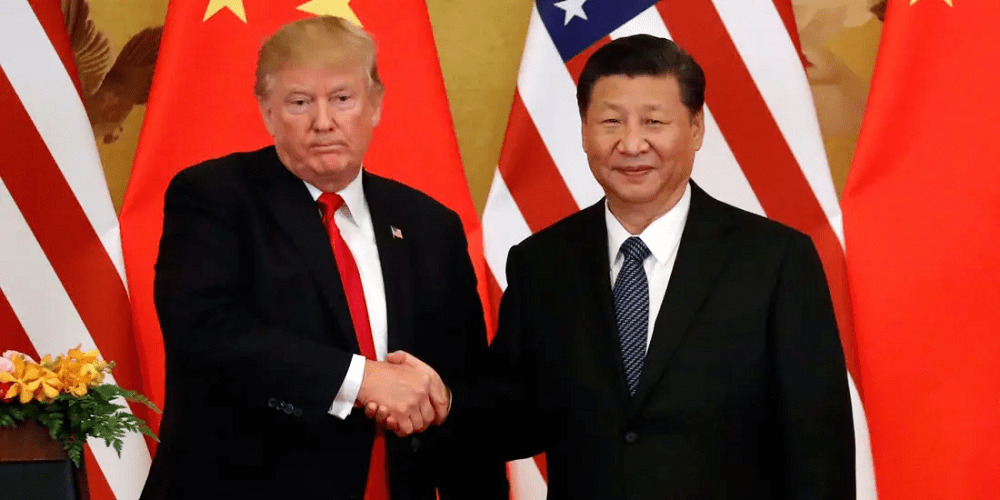

Tensions between the U.S. and China are “worrisome” with President Donald Trump seeming to use Secretary of State Mike Pompeo as a way to reignite hostilities toward Beijing as the president falls behind in the polls. But, investors will likely shrug this off, Collier said. “It is quite true that Trump is a bit of a paper tiger at this point … A lot of what he does is more flash than actual changes and it doesn’t look like they are going to rewrite the script on the U.S.-China trade relation, so there probably is going to be more noise than it is actual reality,” said Collier.

Senior U.S. and Chinese officials are reportedly expected to review the implementation of their phase one trade deal next week.

China’s economic growth indicators are ‘lopsided,’ analyst says, CNBC, Aug 6