The world is likely on the verge of seeing multiple increases across agricultural commodity prices

October 08, 2020 @ 13:10 +03:00

Prices for oil and agricultural products rose significantly from multi-year lows earlier this year, where the pandemic sent them. With governments and central banks focusing on supporting household consumption, the cost of food and energy may continue to rise for quite a long time. As a result, we can see a repeat of the growth in 2010-2012.

In low-income countries, where gasoline and food products account for most of the expenditure, this could lead to an acceleration of inflation, which could hurt living standards.

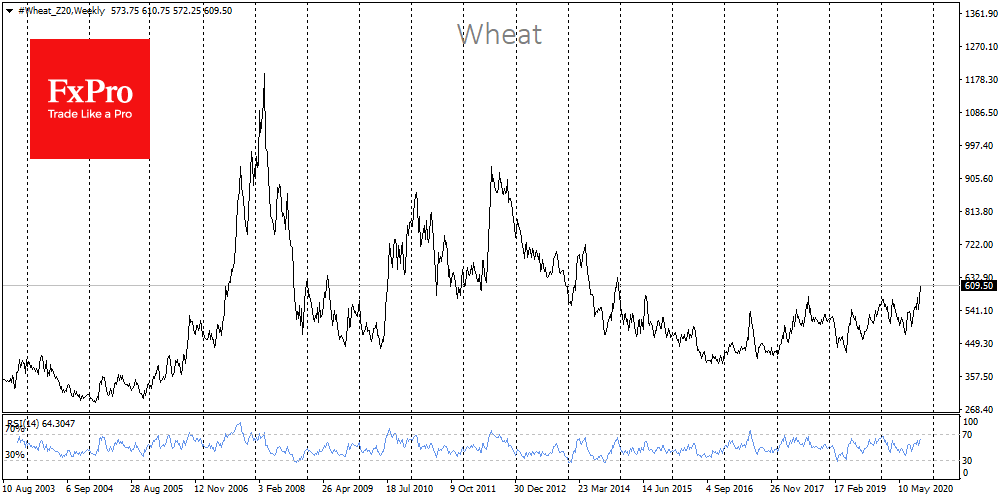

At the same time, prices for another critical product, wheat, reached a 5-year high this week, going above the round $6 per bushel mark and adding over 30% to the June low. Grain prices more than doubled between June 2010 and February 2011, rising from $4.2 to $9+, when government stimulus measures brought financial markets and the economy back towards growth.

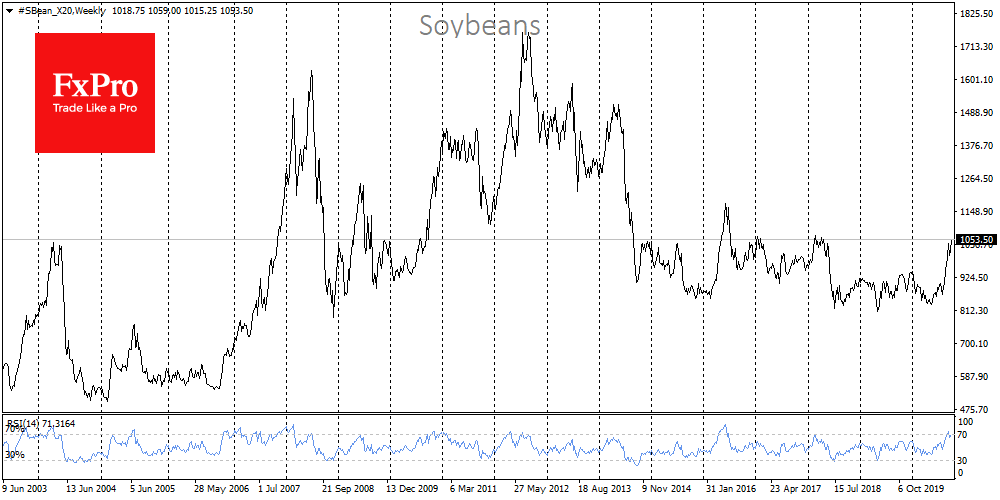

The value of soybeans rushed to new two and a half year highs, exceeding $10.5 per bushel. Earlier this year, soybean prices were at a 13-year low of $8.2, but they were also much stronger. In the 16 months since October 2006, its price has tripled, exceeding $15 at some points.

Buyers try to assess supply risks due to dry weather in the Black Sea region, as well as in Argentina and the USA.

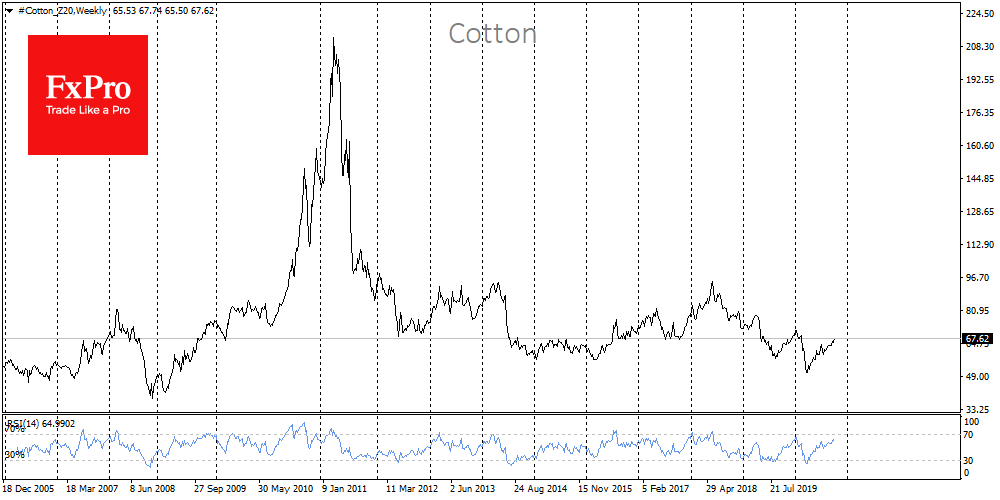

Cotton grew five times between 2009 and 2011 after multi-year lows, clearly replicating the heat of passion in the financial system. In March-April 2020, its price was returning toward its lowest level since 2009, but since then prices have been rising for the several months in a row, adding more than 40% over this period.

Unlike the metal and energy markets, the pandemic has not had a significant impact on the softs market. Demand and prices for food are also supported by massive customer support packages, which feeds the high rate of price increases for segment products.

The value of other agricultural products – corn, sugar – has also been on the upward trend in recent months but has not yet been able to overcome the drop of the first four months of the year.

Agricultural products rarely move in unison based on their own, often heterogeneous, factors. However, the period of 2009-2012, when the economy was recovering from the financial crisis, was marked by multiple increases in agricultural commodity prices. And this growth is likely to repeat itself in 2020-2021, reinforced by even stronger incentives from world central banks and governments due to broken supply chains.

The FxPro Analyst Team