The US plans to sell off reserves won’t turn Crude prices around

March 31, 2022 @ 13:32 +03:00

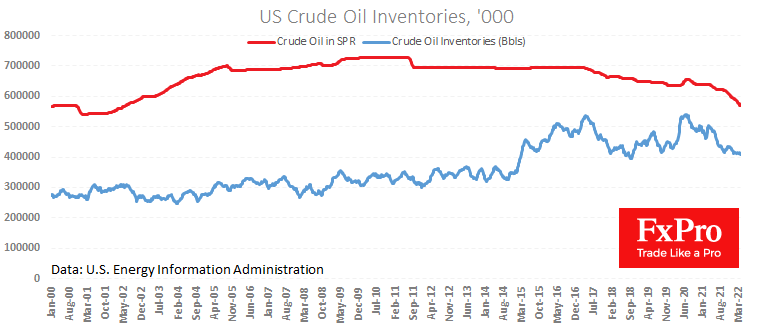

Biden’s team has announced that it is considering releasing up to 180 million barrels of Oil from Strategic Petroleum Reserves over the next 180 days. According to the latest weekly estimate, about one-third of the existing Strategic Petroleum Reserve of just over 568M barrels.

Since last September, the USA has been actively cutting this reserve, selling around 9%, with an 8% cut since October, when Biden announced coordinated market interventions with other countries to bring down the price of Oil and influence inflation.

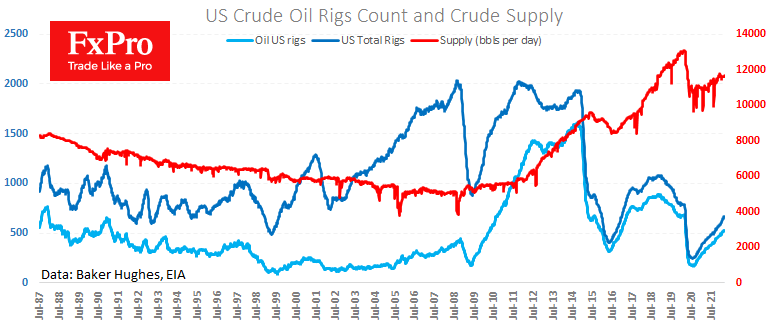

Interestingly, however, US producers are still unable to increase supply substantially. According to the latest data, production last week averaged 11.7m barrels, having been stuck near these levels for six months. But it is clear from the trend of declining commercial and strategic reserves that the US needs to produce significantly more to reverse the trend.

America is also promising to ramp up gas supplies to Europe to help it move away from Russian gas. But it is also increasing the depletion of Oil as a first gas substitute.

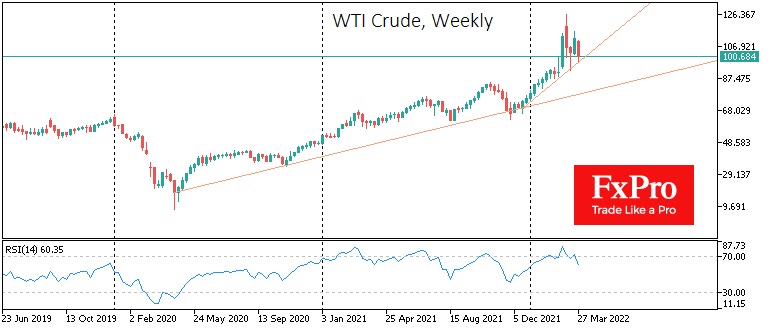

The large-scale selling looks like a broad-based measure, and the market has reacted accordingly at the moment, with WTI down 5%, testing the $100/bbl mark again.

However, such sales look like a temporary measure as they do not represent a credible long-term solution, which could be a production stimulus in both the US and OPEC countries.

At its peak in March 2020, the USA was producing 13m barrels per day, 1.3m barrels above current levels. However, it is clear to see how the pandemic has crippled the industry in the US, where production growth has slowed sharply compared to the 2011-2015 and 2017-2020 momentum.

Furthermore, it is logical to expect the US and Europe to step up efforts and offer more ‘carrots’ to OPEC and sanctioned Iran and Venezuela, which have a spare production capacity in the short term and the potential to increase production multiples in the long term.

Until then, we should expect the upward trend in Oil that emerged last December to remain in place, taking the price steadily above $120 before the end of the year.

The FxPro Analyst Team