The US labour market has already turned a corner

March 12, 2024 @ 10:16 +03:00

Friday’s employment report caused a mixed reaction in the markets, with an initial surge of optimism followed by a deterioration in sentiment as we delved into the details of the release.

The headline number in the report beat forecasts, something that everyone has pretty much become accustomed to over the past few years. The US economy created 275K jobs in February, much better than the 200K expected.

But most of the other numbers were not so rosy. First, last month’s gain was revised down from 317K to 229K. This changes the perception of the labour market in January from “dangerously overheating” to “within trend”.

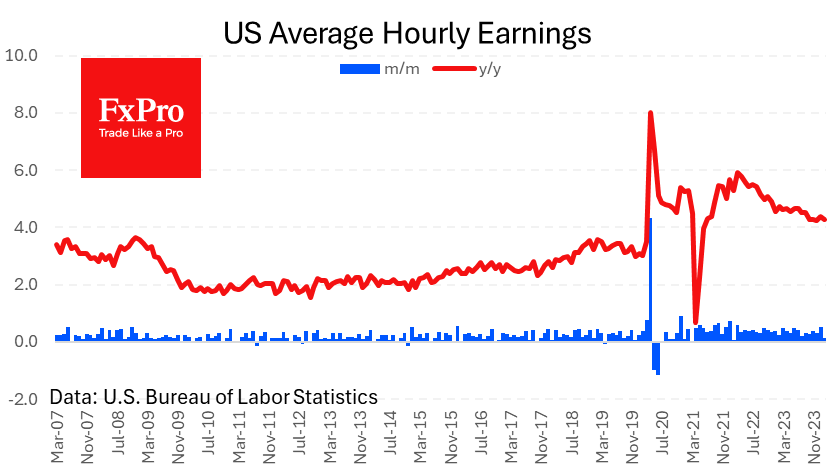

Wages rose 0.1% m/m and 4.3% y/y, 0.1 pp weaker than expected for both measures. The pace has been around this level for the past 12 months. While this is above the 2.0-2.5% pace we saw from 2009 to 2017, it does not increase the risk of accelerating inflation.

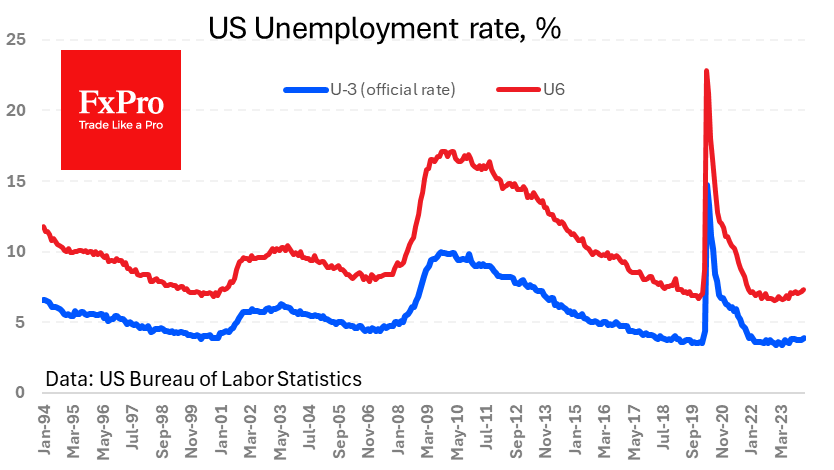

The BLS gave an even softer reading in another report based on a survey of households. The official unemployment rate rose from 3.7% to 3.9% in February (no change was expected). The labour force participation rate was unchanged at 62.5%.

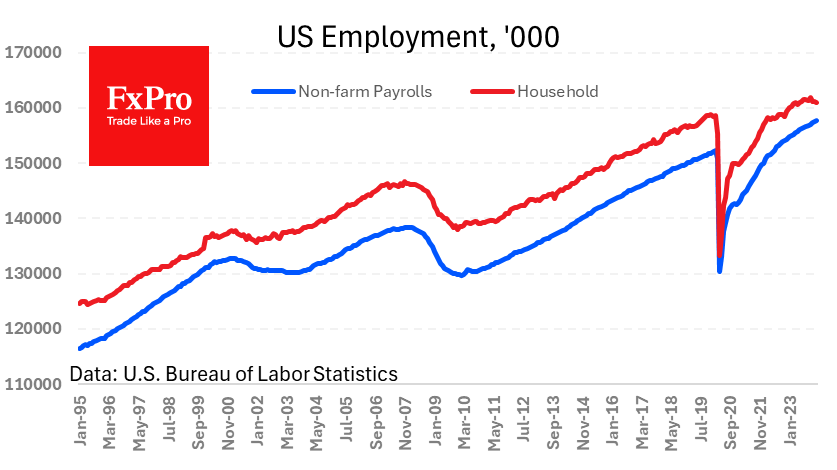

According to the survey, the number of people in employment has fallen for three consecutive months, dropping by 898K to 160.97 million. This is the lowest level since April 2023. The expanded U-6 unemployment rate, which takes into account those wanting to work full-time, etc., is 7.3%, the highest since December 2021 and on an upward trend for the past 10 months.

The gap between the NFP and the household survey employment figures has fallen to an all-time low of 3.16 million (April 2020 only).

Thus, the US labour market report was relatively weak, suggesting that some metrics are already turning for the worse. On the one hand, this brings the date for a Fed rate cut closer. But let us be realistic: rate cuts follow volatility and a sharp sell-off in the markets. At least that’s been the case for the past half a century.

The FxPro Analyst Team