The strong UK labour market opens the door to 50 b. p. BoE rate hike

March 16, 2022 @ 12:24 +03:00

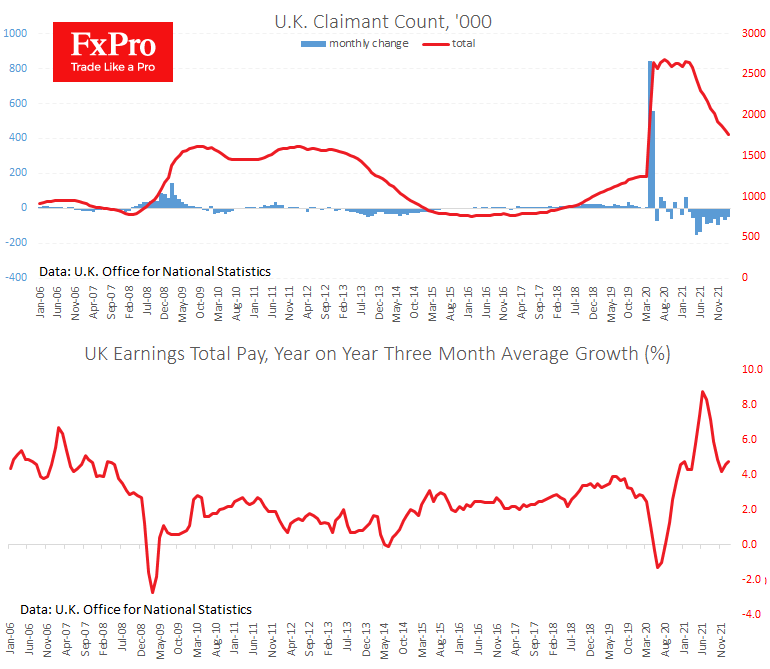

The UK economy continues to show strength in the January-February economic reports. A fresh batch of data noted a fall in the number of people receiving unemployment benefits of 48.1k last month. The January statistics have improved and now show a fall in those receiving benefits from -31.9k to -67.3k.

Wage growth continues to gain momentum to 4.8% against 4.6%.

This data reinforces the view of the UK finance minister. Rishi Sunak expressed confidence that the labour market is in good shape and that the economy will cope with the challenges ahead.

The confidence of UK officials should also be taken as a signal that the Bank of England might decide to accelerate its tightening. Market participants, on average, expect the third hike of 25 points on the coming Thursday. However, in light of the strong labour market and wage growth figures, combined with actual and expected price rises, the Bank of England could decide on a move of 50 points at once. The central bank had previously warned that it might take such a step.

If the Bank of England hikes the rate from 0.5% to 1.0%, it could support the Pound markedly. Its appreciation would further reduce inflationary pressures from import prices and stabilise the economy as quickly as possible.

The FxPro Analyst Team