The RBA’s hawkish pause did not hurt the AUD

July 05, 2023 @ 09:18 +03:00

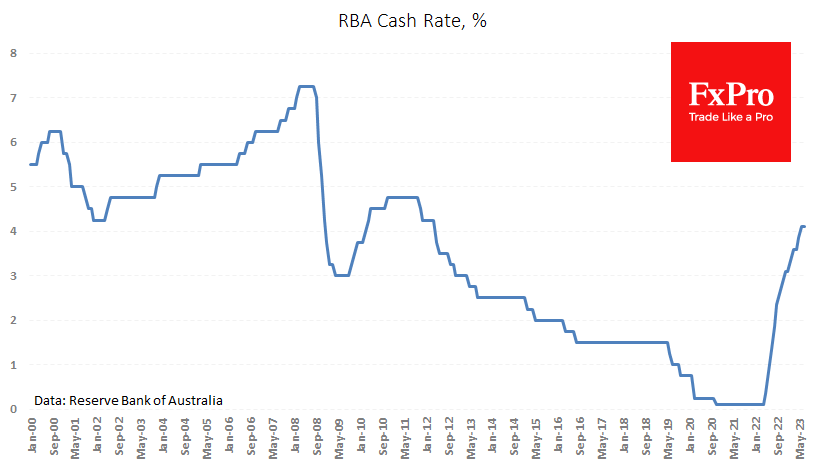

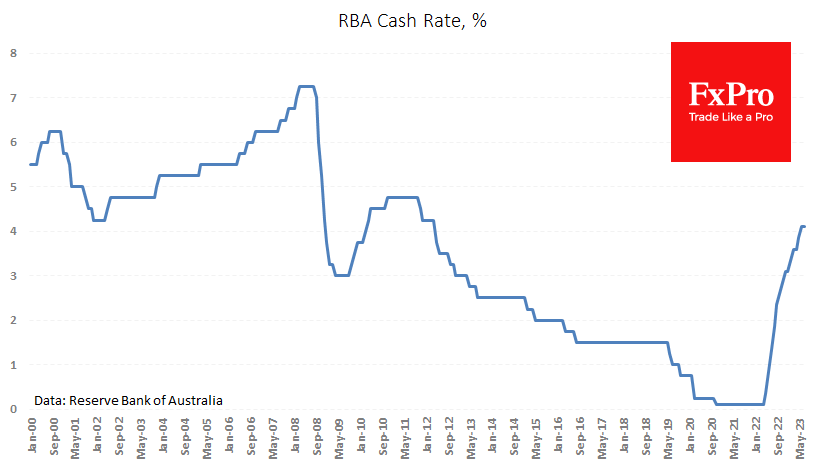

On Tuesday morning, the Reserve Bank of Australia left its key rate at 4.10%, somewhat surprising markets where expectations of a 25-point increase were relatively high. It was a hawkish pause with a warning of its intention to raise the rate further in the coming months.

As many traders expected to see a hike as early as today, the robotic reaction to the headlines triggered an impulsive decline in AUDUSD from 0.6680 to 0.6640 in just over half an hour. However, near the previous day’s local lows, the Aussie received support from buyers and, by the end of Tuesday’s European session, was near 0.6700, marking a series of four sessions of gains.

Technically, AUDUSD tests the 200-day moving average after taking the 50-day. The ability to develop an offensive above 0.6700 in the coming days will be a significant show of strength. However, the ability of the Aussie to rise against the RBA’s dovish surprise looks like an impressive show of strength.

The FxPro Analyst Team