The old economy fights back against big tech

February 12, 2026 @ 18:16 +03:00

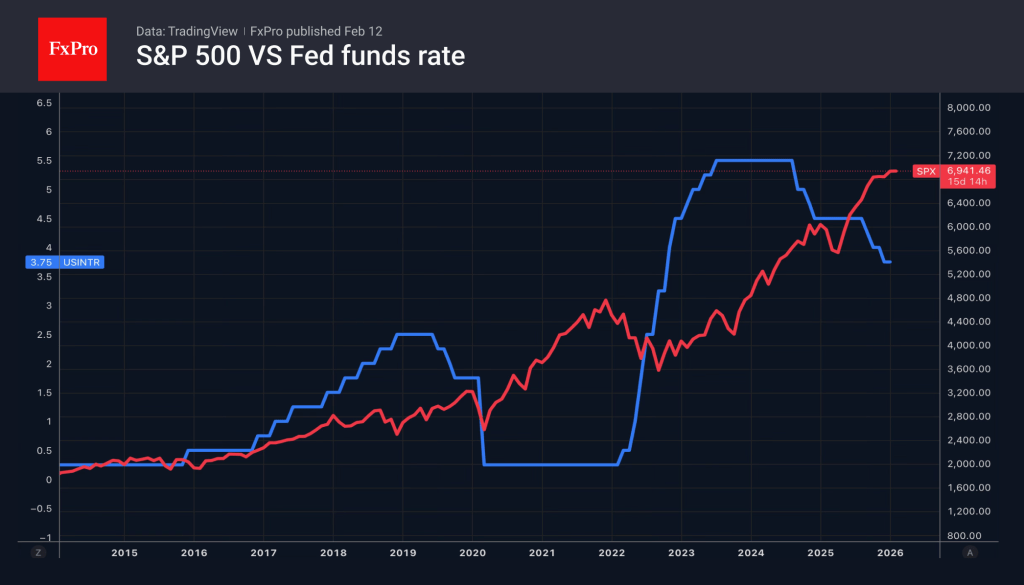

US stock indices went on a rollercoaster ride after the release of January jobs data. They first hit new local highs but then fell sharply. Good news for the economy was bad news for the S&P500. Investors reacted to the lower chances of the Fed easing. However, it was just another consequence of the ongoing rotation from big techs to old economy stocks.

Deutsche Bank notes that in the first five weeks of 2026, funds focused on stocks outside the technology sector attracted $62 billion, which is a record high and exceeds inflows for the whole of 2025. Investors are shifting from software manufacturers and financial services providers due to developments in artificial intelligence by Anthropic and Altruist.

At the same time, rotation is amplifying volatility in the stock market. According to Citigroup, significant deviations in companies’ actual results from Wall Street forecasts lead to an average decline or increase in their shares of 5.2%. This is the highest figure since 2012.

The FxPro Analyst Team