The Hang Seng Is Too Hot Now, but Long-Term Attractive

October 02, 2024 @ 16:31 +03:00

The Chinese stock market is closed for a national holiday, but futures and ETFs are trading and are on another strong run today. The Hang Seng Index is up 9.6% from its close on 30 September (there was no trading on Tuesday), the second strongest rise since the surge on 16 March 2022. Then it rebounded after a setback, but now it is an acceleration of the rally, taking the index cumulatively up 34% from the 11 September lows.

Wednesday’s rally is the result of a short squeeze, as it comes at the close of the main Chinese markets and is not fuelled by optimism on global exchanges. On the contrary, global markets have moved away from risk in recent days, and the S&P 500 has been trading near the top for almost a week.

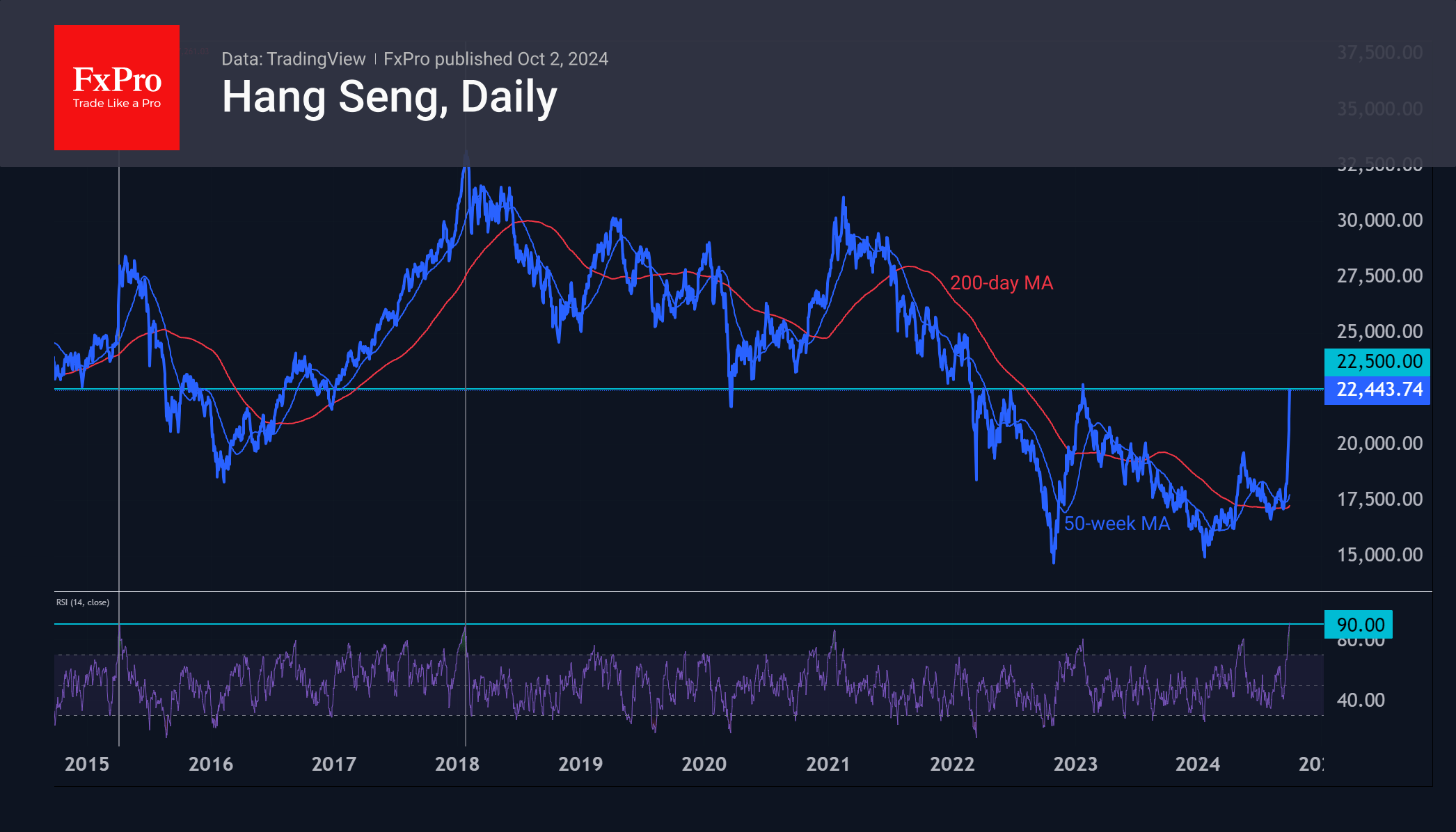

On a daily timeframe, RSI is approaching 91, the highest reading since 1987. The market was almost as hot in recent years in January 2018 and April 2015. In both cases, it fell for almost a year.

While this is a different case, and the multi-year sell-off in Chinese equities should be considered, the current overbought situation on daily timeframes could still be a good reason to shake out positions locally when the major Chinese markets open on 8 October.

Moreover, at current levels, the Hang Seng is approaching the 22500-resistance area, which has been in place since March 2022, and this will strengthen the resistance to growth in the short term.

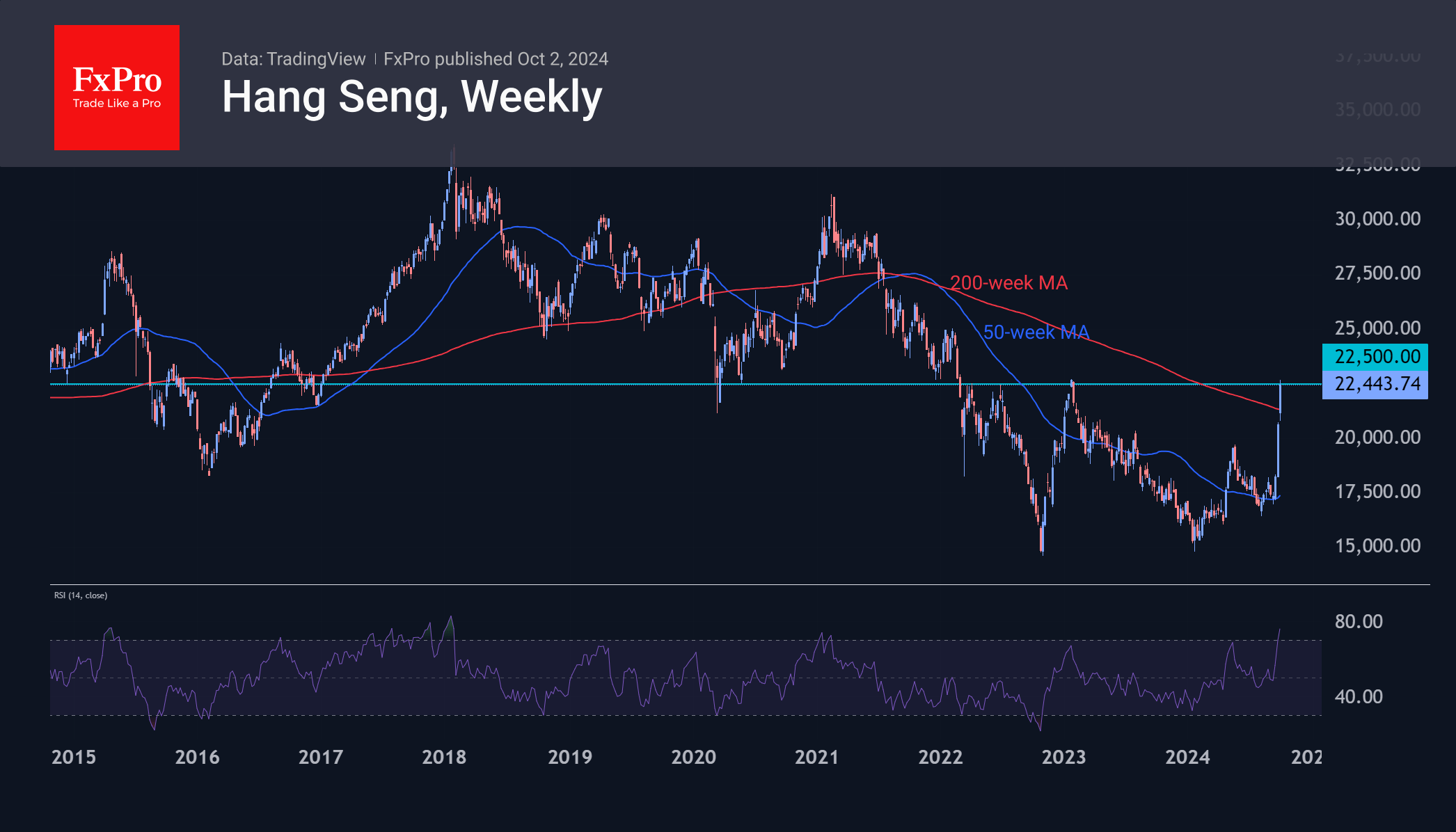

However, one cannot overlook the more global picture emerging on the weekly timeframe. This week, the price has broken above the 200-week moving average after retreating from the 50-week average in early September.

This could potentially attract more capital and provide fuel for further upside. The RSI is also moving into overbought territory (above 70), but past examples suggest further upside, and a sharp drop to levels below 70 should be seen as a correction signal.

In the long term, a successful break of 22500 would open the door to 25000 and on to 30000, where we have seen major portfolio corrections in the past.

The FxPro Analyst Team