The false lull in global markets

May 28, 2019 @ 13:04 +03:00

Market focus The Chinese market on Tuesday grew by more than 1% on hopes for renewed government stimulus. In April, Chinese companies showed a sharp decline in profits, reinforcing hopes that further measures would reduce the tax burden on companies. Above this, China stopped buying Iranian oil. This news is perceived by markets as a China concession in trade disputes. Trump is now in Japan with a state visit. He gave cautious hints at a possible announcement of the deal with Japan in August, but the representatives of Japan were quick to soften the degree of expectations. All this creates a positive background, but markets are in no hurry to buy stocks in anticipation of direct signs of progress.

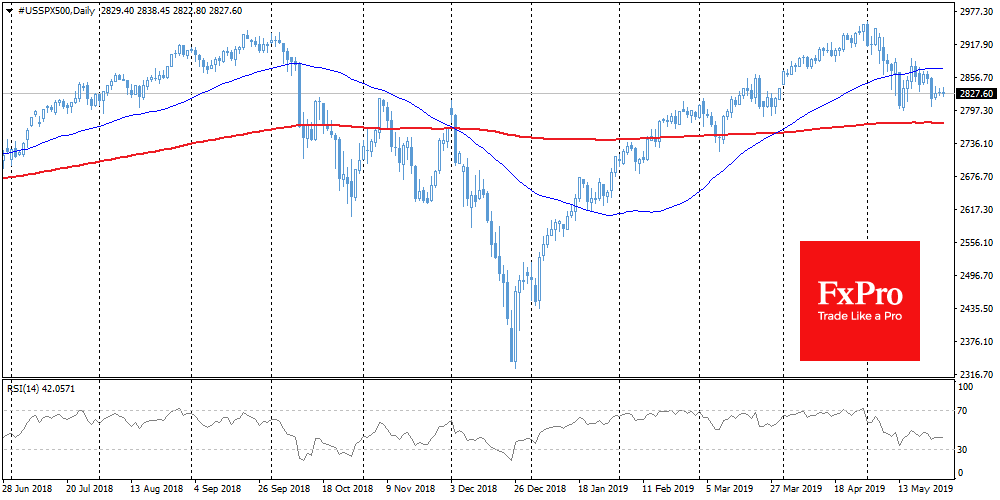

Stocks Stock indices are growing due to the hopes of Chinese government stimulus and easing fears around US trade conflicts with other countries. However, the dynamics of debt markets still calls for caution. The 10-year Treasuries yields fell to 2.28% yesterday, to October 2017 lows, and the futures for Fed rate show an 83% chance of rates cut by January 2020. The decline in the yield on debt markets supports stock purchases but it is also an important sign of growing investor anxiety.

EURUSD The pair once again turned to decline, failing to stay above 1.1200, trading at the time of writing at 1.1180. The pair remains in a downtrend, showing a series of lower highs and lows. But at the same time, EURUSD received support on the downturns to 1.1100 in April and earlier in May, which increases attention to this level.

Chart of the day: Gold The gold rebound this week could not hit the resistance level near 1285. Sellers increased the pressure on gold after the rebound by 50% from a decline from 1303 to 1269 from May 14 to 21. Technically, one can also say that gold was not allowed to climb over the 50-day average due to the growth of the dollar and news of the Chinese economic weakness. Despite the fact that gold is often called a safe haven, a surge in prices often happens because of the risk aversion, and the current sluggish sale-off is more likely to be harmful because of the thrust into protective dollars and bonds.

The FxPro Analyst Team