The euro is making the ECB nervous

January 30, 2026 @ 19:05 +03:00

- The ECB is ready to act if the EURUSD growth continues.

- Investors are unsure whether Japan can cope on its own.

Speculations and the recent nomination of Kevin Warsh to become Fed chair have allowed the US dollar to find its footing. In the past, this former FOMC official has shown himself to be a ‘hawk’. Markets saw his appointment as a reduction in the risks of the central bank losing its independence and returned to fundamentals for a while. The greenback is backed by a strong US economy and a prolonged pause in the cycle of monetary expansion.

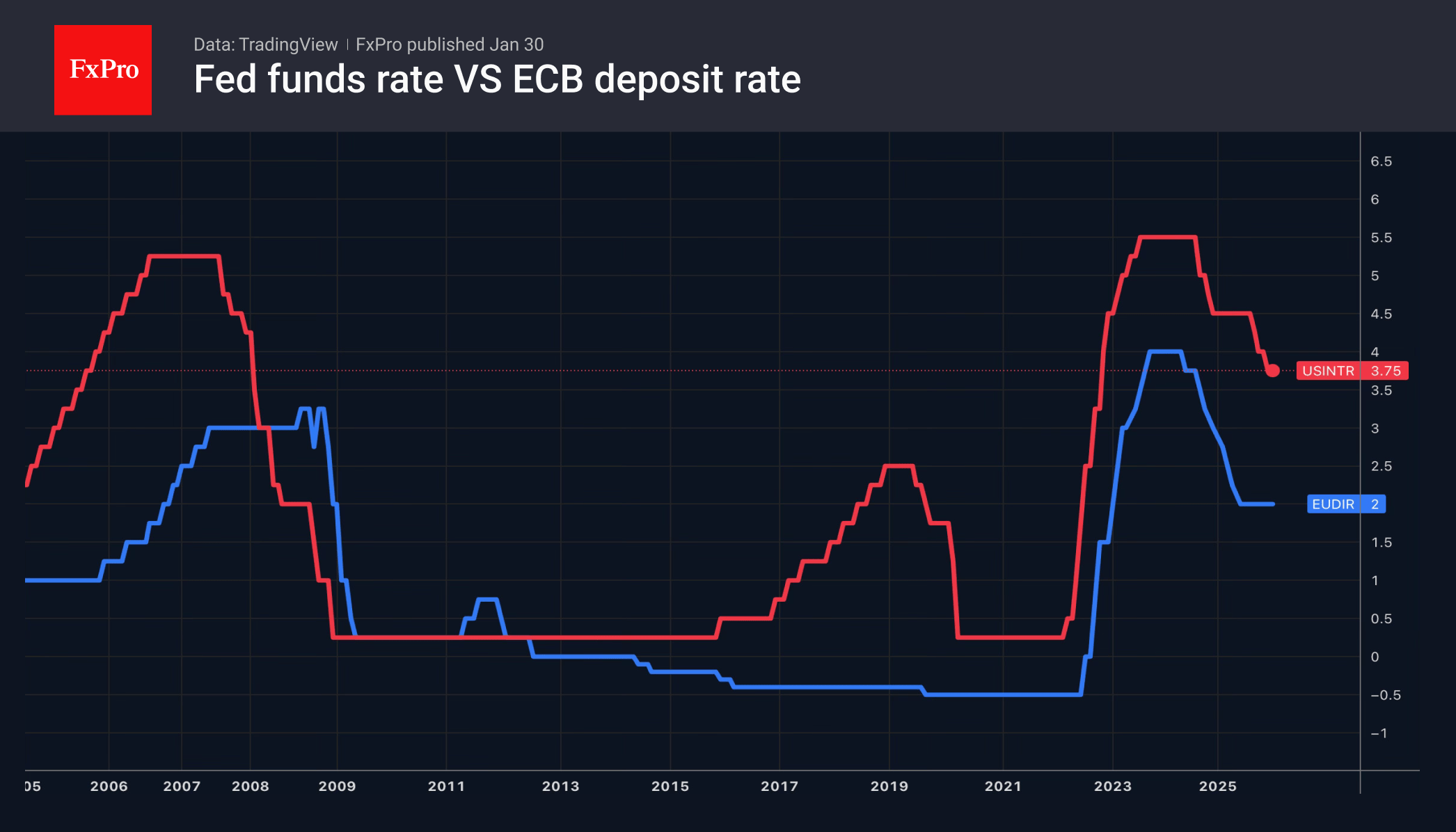

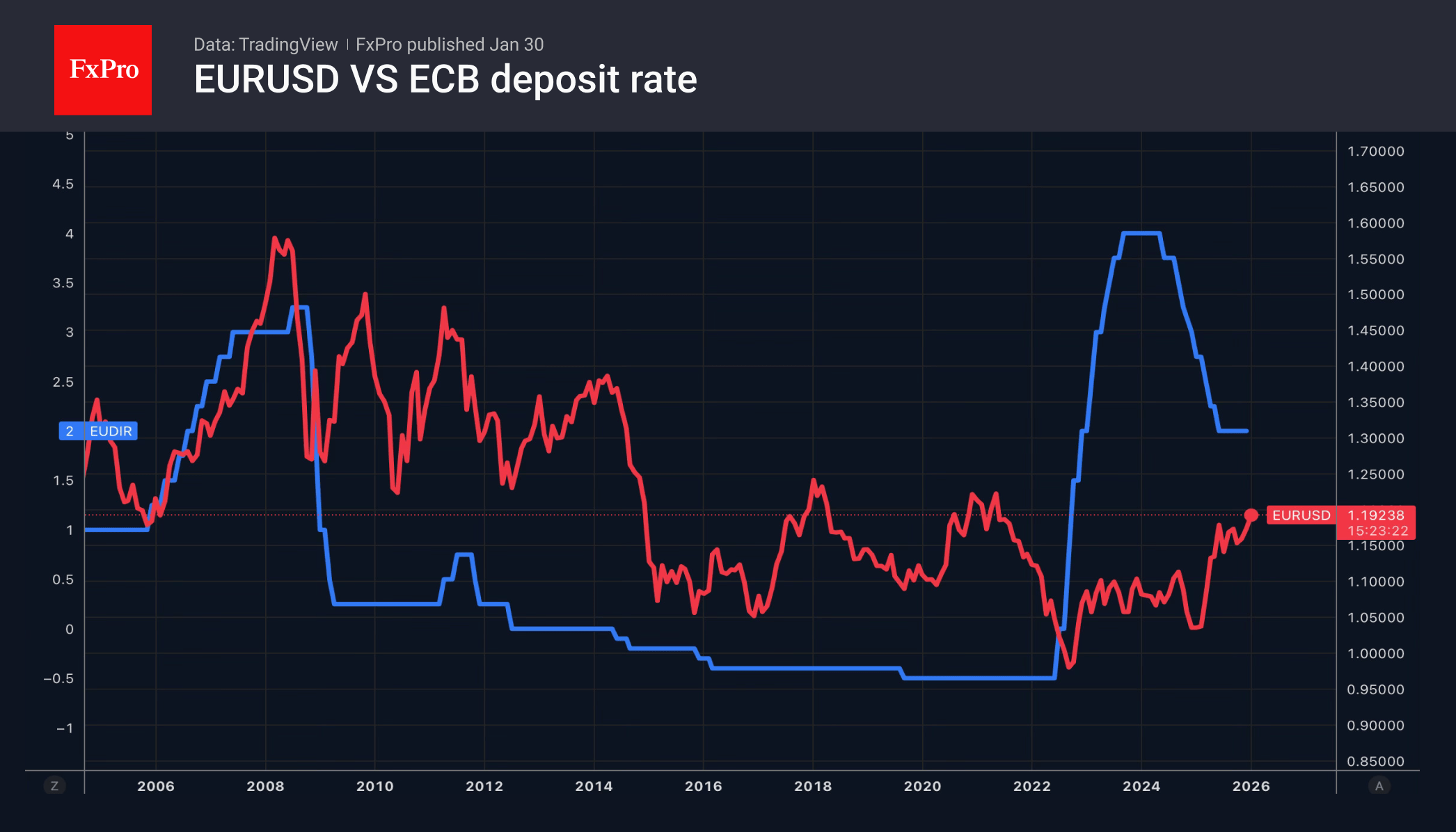

The explosive rally of the EURUSD is beginning to cause discontent at the European Central Bank. Investors recall the speech by Vice-President Luis de Guindos. In 2025, he argued that with the euro at $1.2 and above, the eurozone economy would have a hard time. The head of the Bank of Austria, Martin Kocher, believes that the ECB will be forced to act by cutting rates if the euro continues to strengthen, which damages its inflation plans. His colleague from France, François Villeroy de Galhau, claims that the Governing Council will take Forex events into account when making decisions on interest rates.

Bloomberg experts do not expect the ECB to change them at its meeting on 5 February. Although most still agree that the next step will be a rate hike, fewer of them expect this to happen this year. However, the EURUSD rally may adjust these forecasts. There are big bets in the currency market that the European Central Bank will return to easing monetary policy. On paper, it has no target for the euro exchange rate, but a strengthening currency will hamper the export-oriented economy.

The strengthening of the US dollar has allowed the USDJPY to rise. Investors are asking themselves whether Japan’s currency interventions would be effective if it acted alone, without the US. Finance Minister Scott Bessent made it clear that the Americans were not involved.

Kevin Warsh’s nomination to Fed chair had a sobering effect on gold. Its collapse from record highs showed the overly speculative nature of the previous rally. It was based on debasement trading, fuelled by mistrust of the White House’s policies and the US dollar. However, if the Fed’s independence remains intact, the market will begin to ask an uncomfortable question. Has its rally gone too far too fast?

The FxPro Analyst Team