The dollar’s wings have been clipped

December 18, 2025 @ 16:02 +03:00

- Christopher Waller’s dovish rhetoric halted the bears’ attack on EURUSD.

- Slowing British inflation caused the pound to fall, while the Bank of Japan is preparing to raise rates.

Christopher Waller’s comments had as much of an impact on the US dollar as the US labour market statistics. The rise in unemployment to 4.6% and the acceleration in average private sector employment over three months from 13,000 in the summer to 75,000 in the autumn forced investors to change their views. They began to expect a prolonged pause in the monetary expansion cycle and a reduction in the federal funds rate to 3.75% in 2026. However, a senior FOMC official thinks differently.

Christopher Waller is one of the candidates for the position of Fed chair. He believes that the neutral rate is 2.75%, which is 100 basis points below current levels. This is significantly lower than the forecasts of the futures market. If the cost of borrowing falls to this level, Treasury yields will decline and the USD index will collapse.

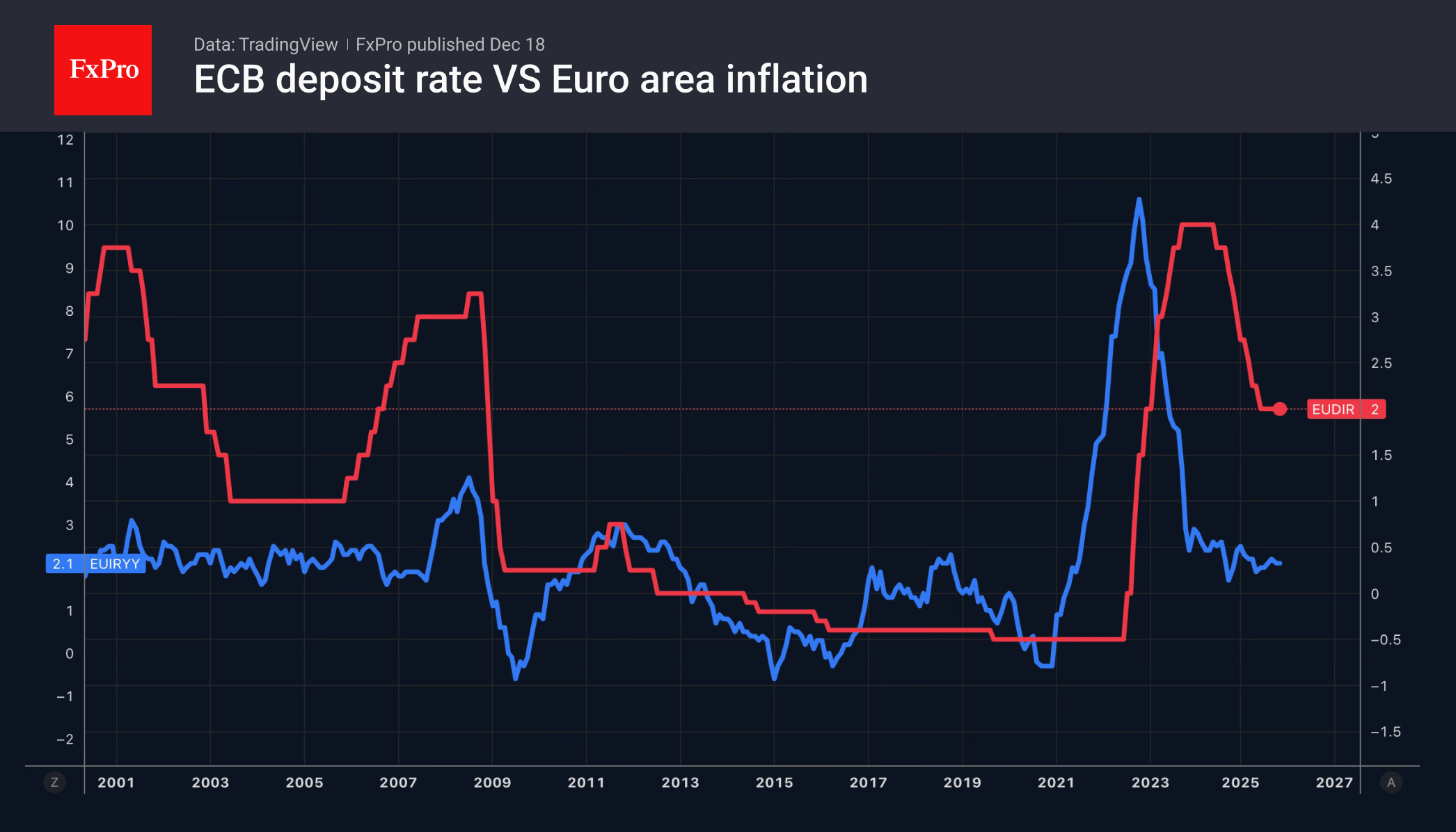

Moreover, the futures market is confident that the ECB’s monetary expansion cycle is coming to an end. Investors are beginning to price in expectations of a rise in deposit rates. This is usually done when the risks of inflation accelerating increase or monetary policy becomes too loose. Neither of these conditions applies to the eurozone. It is too early to talk about a new trump card for EURUSD.

On the contrary, weak data on business activity in the currency bloc and German business confidence from the IFO are disappointing ECB hawks and putting pressure on the euro. The regional currency appears too expensive.

Japan has a different problem. The yen appears too cheap for a government fighting inflation. Therefore, Prime Minister Sanae Takaichi will not stand in the way of the Bank of Japan’s intention to raise rates. Investors are eagerly awaiting Kazuo Ueda’s signals about the regulator’s actions in 2026. The BoJ is expected to very slowly normalise monetary policy. This fact supports the bulls on USDJPY.

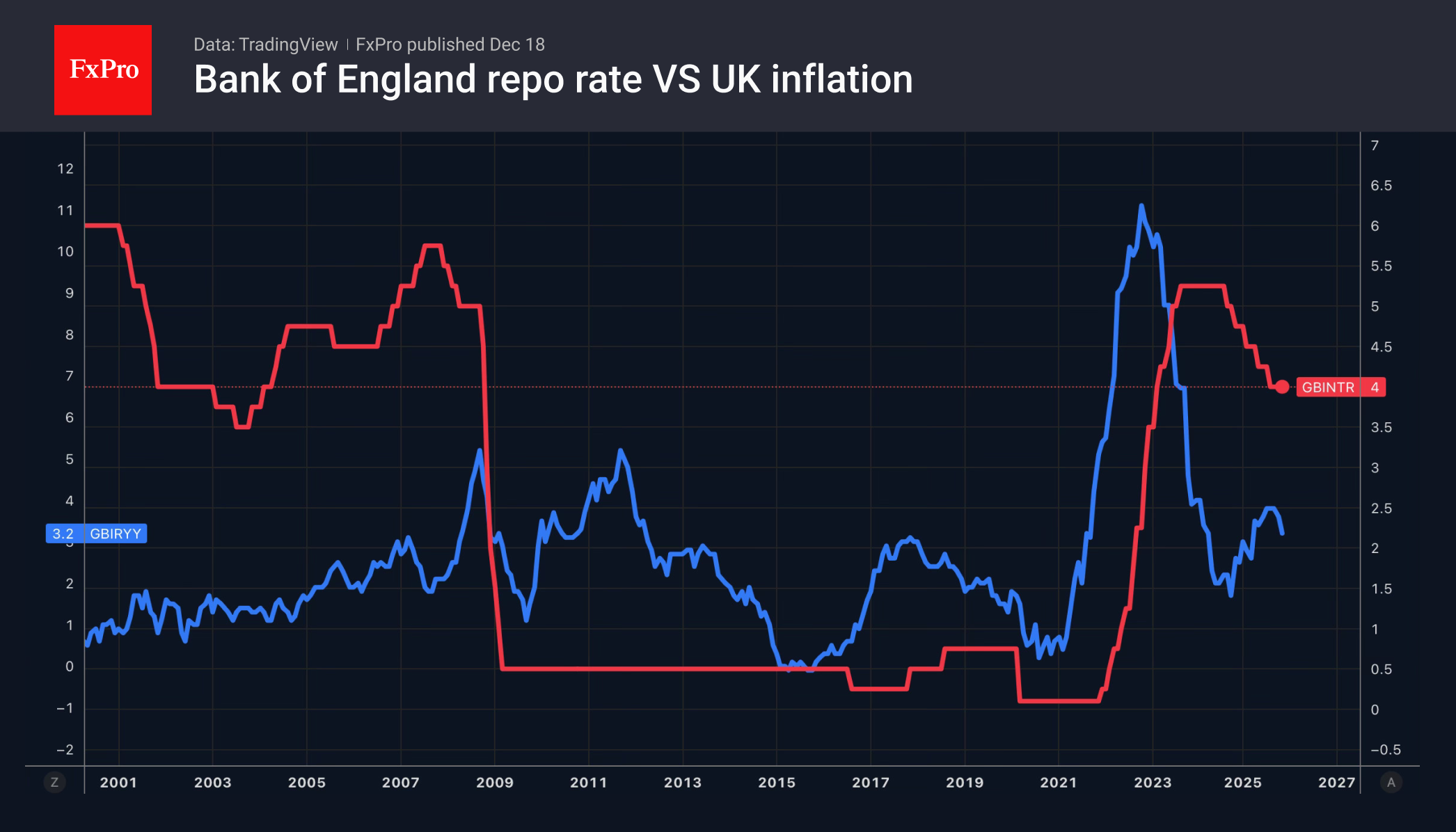

The slowdown in British inflation from 3.6% to 3.2% in November caused the pound to plummet. The futures market is confident that by April, the repo rate will be cut by 50 basis points to 3.5%. Investors doubt that the Bank of England will take a hawkish stance in December. They expect Andrew Bailey to signal a continuation of the cycle of monetary policy easing.

The FxPro Analyst Team