The dollar retreated on weaker CPI, commodities climbed

September 14, 2021 @ 16:29 +03:00

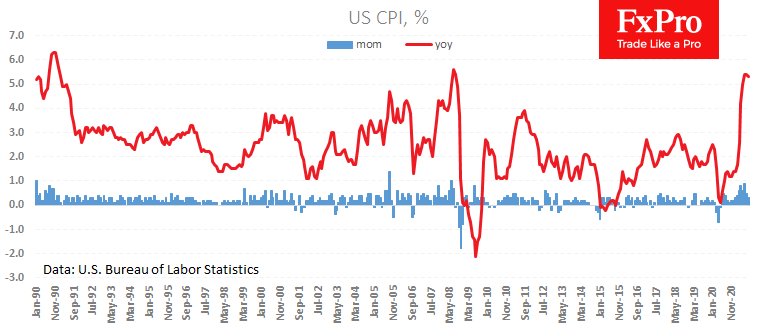

US Consumer inflation started to slow, as can be seen in the latest official data. The consumer price index added 0.3% m/m during August.

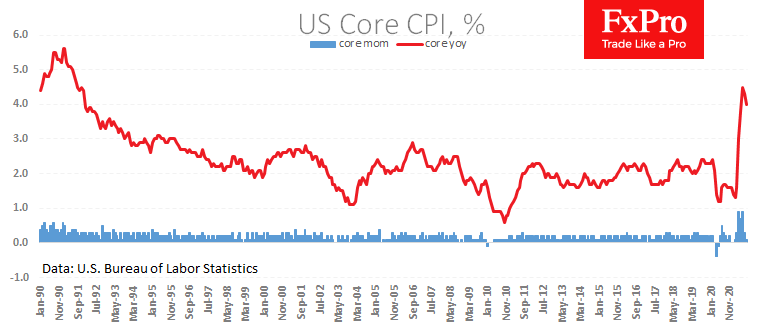

Growth to the same month a year earlier slowed to 5.3% for the overall index and to 4.0% for the core.

The data in this series came out weaker than expected for the first time in 11 months, triggering an impulsive market reaction.

A faster-than-expected slowdown in inflation should ease the pressure on the Fed with a tightening of monetary policy. However, it is too early to dismiss fears of rising prices and claim that the Fed was right to point out the transitory nature of inflation.

Still, it should not be overlooked that the rate of price increases remains one of the highest in 30 years and continues its month-to-month increase. The jump in oil and gas prices in recent days promises to keep some of the pressure on consumer prices.

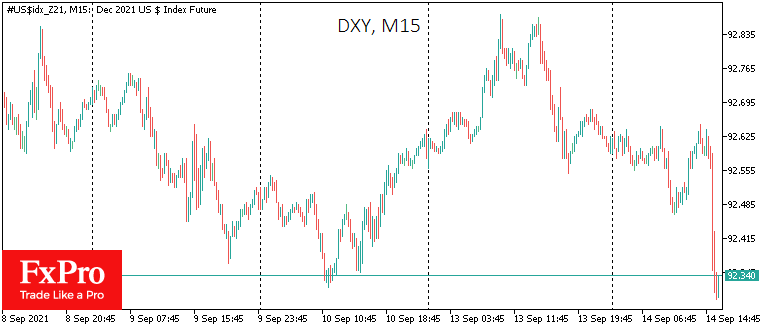

What does this CPI report mean for the markets? The Dollar index retreated to one week low on Fed measures repricing and stocks got short-term support after the recent dip.

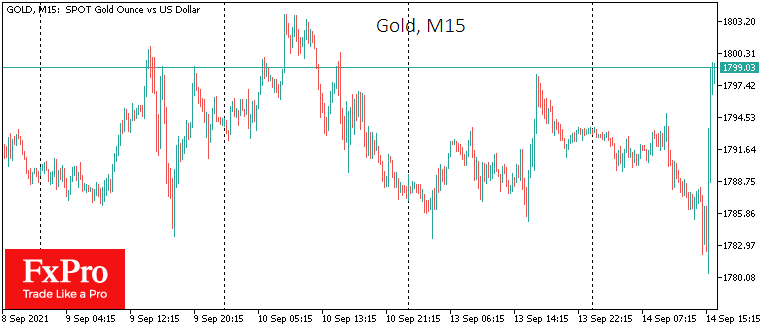

Gold has recouped its intraday losses, climbing close to $1800 on a weaker USD. It is now worth watching closely to see if Gold manages to consolidate above that level, which would clear the way for further gains to the area of the two-month high around $1830.

The FxPro Analyst Team