The dollar played out the TACO trade

January 22, 2026 @ 13:49 +03:00

- Trump’s retreat helped the EURUSD bears.

- USDJPY intends to resume its uptrend.

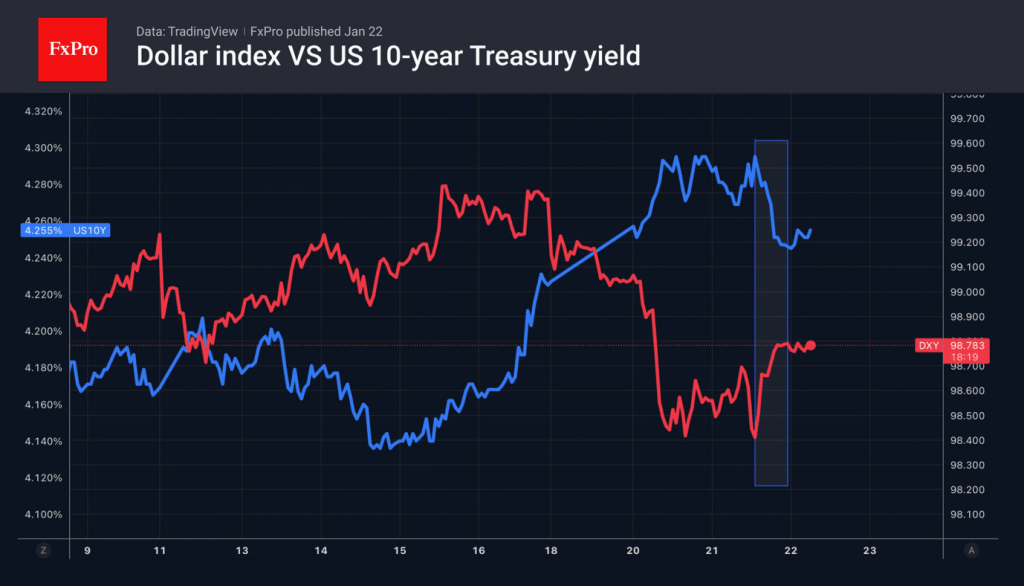

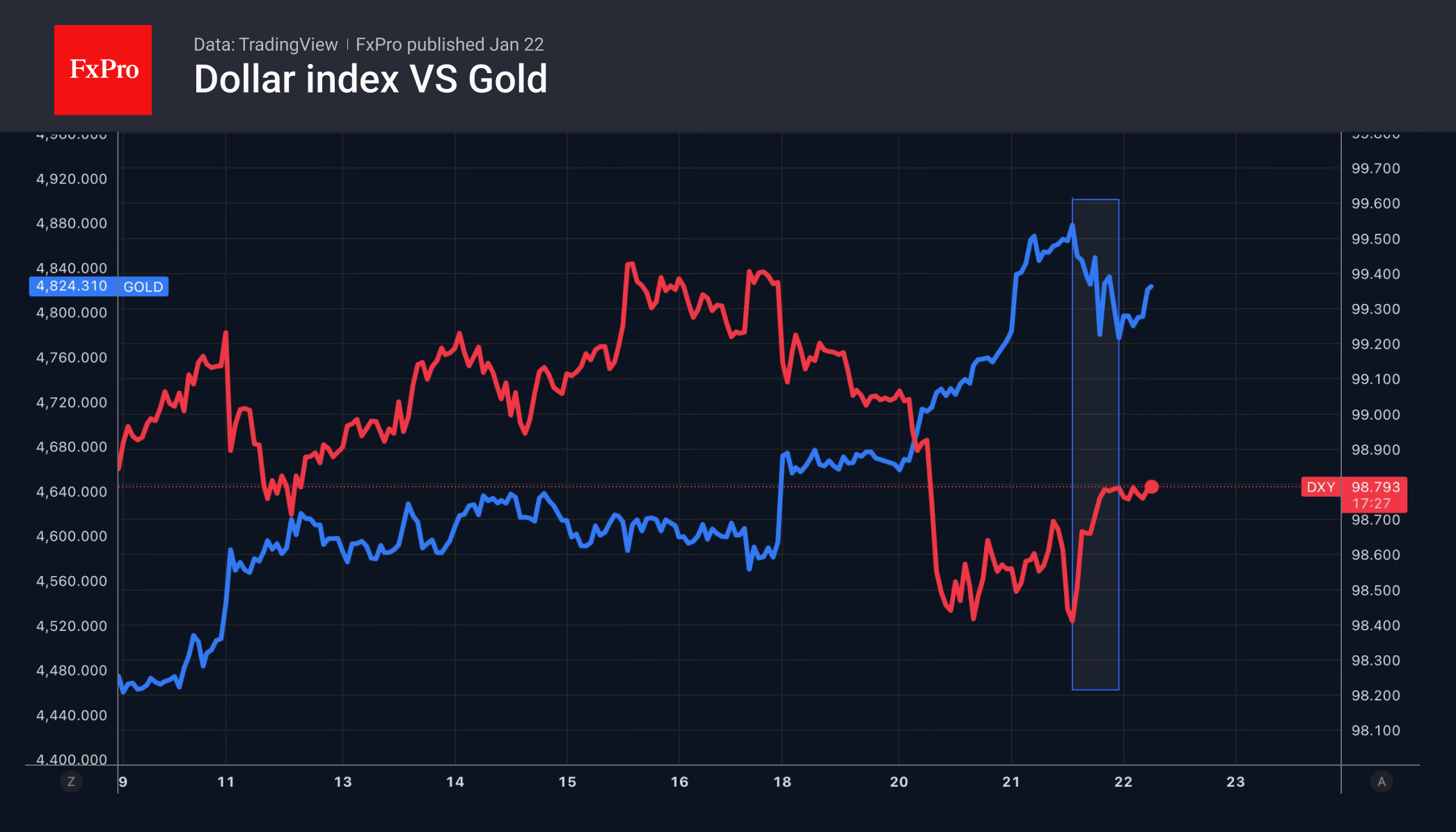

The US dollar got the upper hand after Donald Trump’s speech in Davos. The US president announced that there was some framework for a deal on Greenland and that he was abandoning his intention to impose additional tariffs on a number of European countries. The markets immediately switched from ‘sell America’ to TACO-trade or Trump-Always-Chickens-Out mode. Stock indices rose, Treasury yields fell, while EURUSD bears went on the counterattack.

The Supreme Court did not support the White House’s intention to dismiss Lisa Cook from her position as FOMC governor. The judges recognised that this could undermine the independence of the Fed. They are considering various options. The most conservative would be to keep the official in office while the lower courts discuss her mortgage case. The most radical would be to write a broad ruling on the extent of the president’s authority to remove members of the central bank.

The USD index received support from the SWIFT report, which showed that the share of the greenback in international transactions rose from 46.8% to 50.5% in December, reaching its highest level since 2023. De-dollarisation is not an urgent matter against the backdrop of a division between the West and the East. The US currency keeps its dominance and is still in demand.

The strengthening of the US dollar has been a tailwind for USDJPY. The pair risks quickly resuming its upward trend and coming under currency intervention due to large-scale sell-offs of Japanese bonds. The yield on 30-year bonds saw the biggest one-day jump in history, while yields on 10-year bonds reached their highest since 1999. Sanae Takaichi’s hints at abolishing the consumption tax on food products are forcing the Ministry of Finance to rack its brains over where to get the money.

Concerns about the financial stability of debt-ridden Japan are compounded by uncertainty over the outcome of the parliamentary elections scheduled for 8 February. The LDP’s long-time ally, Komeito, has joined the opposition, so Sanae Takaichi’s success is not guaranteed.

Donald Trump’s retreat, the Supreme Court’s defence of the Fed’s independence and the strengthening of the US dollar could have sent gold into a knockout. However, the precious metal took only a modest step back, and Goldman Sachs raised its forecast for the gold price from 4900 to 5400 per troy ounce by the end of 2026.

The FxPro Analyst Team