The dollar may be giving up reserve positions, but not the price

March 28, 2022 @ 16:10 +03:00

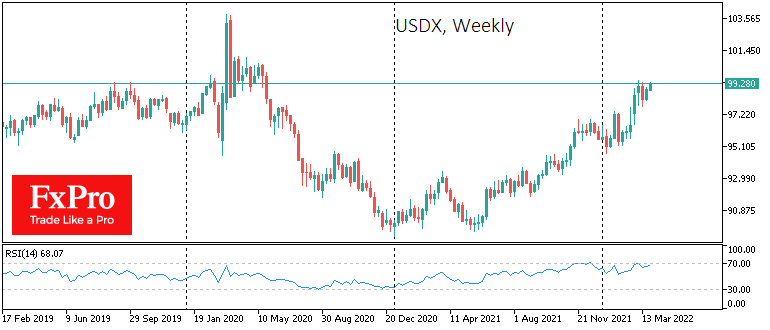

There has been a lot of talk lately about the decline of the US dollar’s reserve status. However, investors and traders should separate long-term trends from short-term market impulses.

Reserve fund managers often prefer to refrain from active selling so as not to cause unnecessary market turbulence, so all reserve trends are stretched out over decades.

As long as there is no real threat to the existence of the dollar and the solvency of the US government, managers will avoid making active moves to sell dollar assets. And all the revolutionary changes, such as switching to national currencies, will only result in CBs buying fewer new dollars. But it has little effect on the exchange rate.

Right now, we are seeing the opposite picture, as the main competitors are under pressure.

Investors are getting rid of the Japanese yen as the Bank of Japan accelerates its currency printing to buy bonds out of the market to stem rising yields. The local government is overburdened with debt, and the economy is still stalling. The only market solution is a devaluation of the yen, which would make exports from Japan more competitive and boost domestic spending.

The single currency is suffering from a spike in energy prices and economic problems related to the war in Ukraine. Trading below 1.1000, the EURUSD pair is now where it was heading for the last six months before the pandemic.

The medium-term outlook for the dollar is largely influenced by the extent to which the Fed will be able to implement policy tightening. More accurately, how Fed policy compares with the policy of the Bank of Japan, the ECB, or another major central bank.

The Fed is clearly acting with greater amplitude, setting itself up for 7 rate hikes this year, which is far more than one would expect from Japan or the eurozone. Moreover, the US remains much further away from the war in Ukraine in business and trade terms than its biggest competitors, which means it can continue to benefit from capital inflows as a haven.

The FxPro Analyst Team