The dollar is losing fans

February 10, 2026 @ 19:23 +03:00

- China is getting rid of US Treasury bonds.

- The president is actively promoting Kevin Warsh.

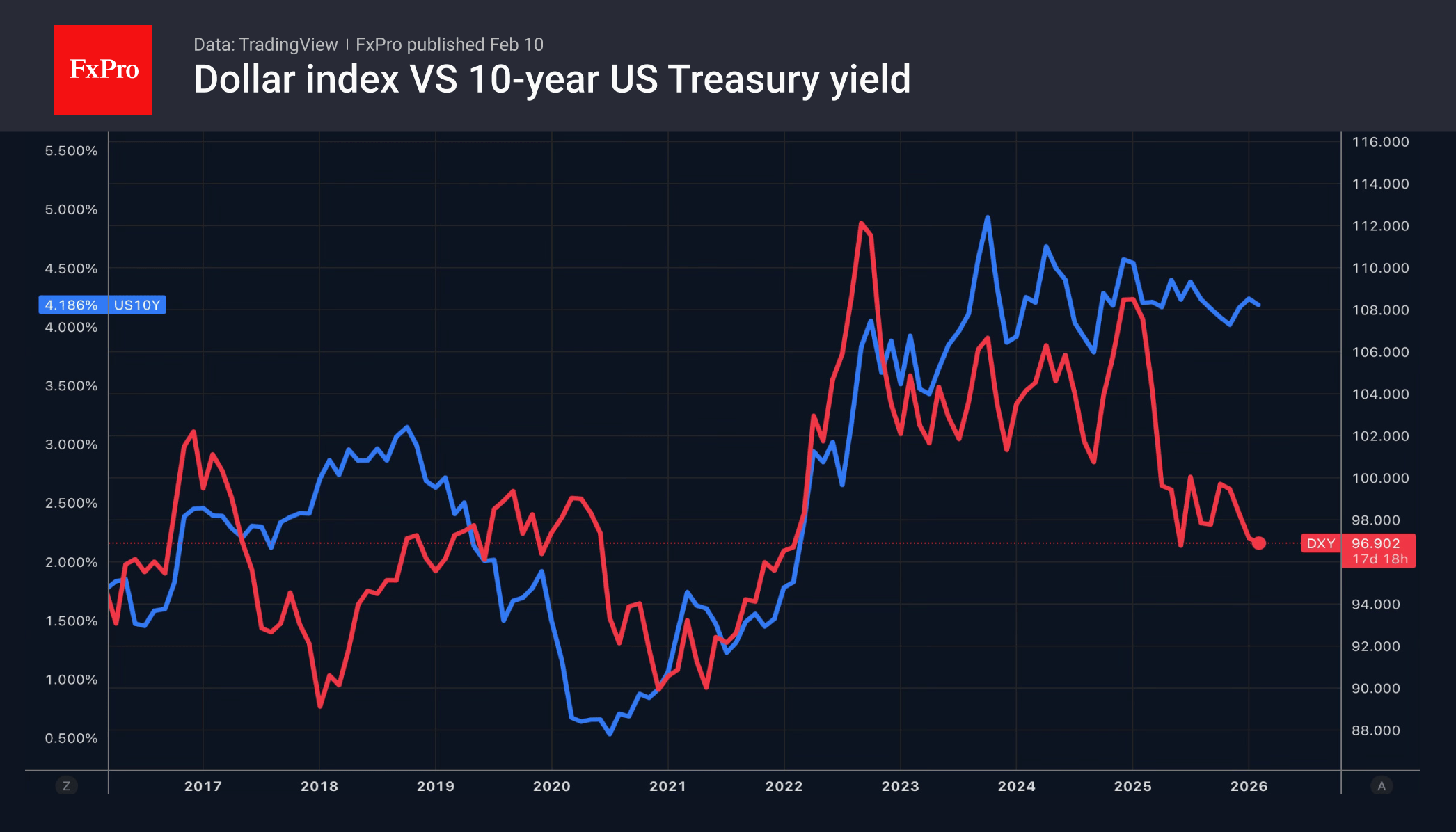

While the IMF is urging investors not to focus on the dollar’s short-term weakness, EURUSD is posting its best daily gain since the end of January. According to the International Monetary Fund, the greenback will retain its power on the Forex market thanks to the size of the US economy, entrepreneurial spirit, and the depth and liquidity of the US capital market. However, confidence in the latter has been seriously shaken, which makes the outlook for the USD index bleak.

The threat to the independence of the Federal Reserve has not gone away. Donald Trump is so keen to promote his own candidate for the position of Fed chair that he is making some surprising statements. According to the president, Kevin Warsh will help boost the US economy by 15%. Over the past five decades, US GDP has grown by an average of 2.8% per year. A 15% growth rate has been extremely rare since the 1950s. The last time it happened was during the pandemic recovery, so he probably just means cumulative growth over several years.

Meanwhile, the strength of the US economy is no guarantee of a stronger dollar. The White House intends to accelerate GDP growth through aggressive rate cuts, which will undoubtedly weaken the US currency. At the same time, uncertainty surrounding Donald Trump’s policies is prompting some countries to divest from Treasury bonds. Beijing’s recommendation to Chinese banks not to buy these securities has catalysed a rally in Treasury yields and the EURUSD.

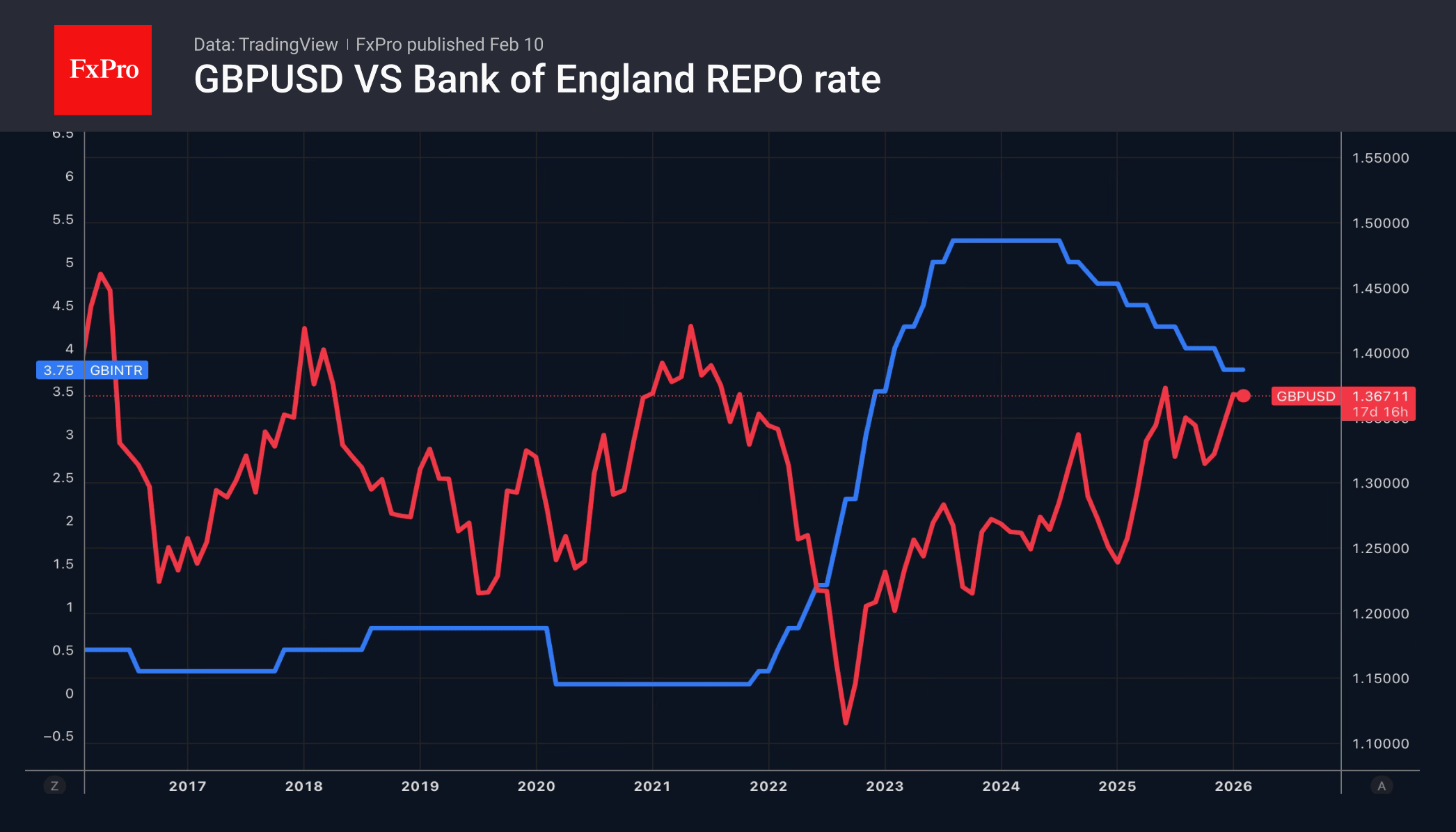

Even the extremely vulnerable Pound Sterling took advantage of the dollar’s weakness. The Bank of England could ease monetary policy as early as March, and a political scandal has erupted in Britain. As a result, Prime Minister Keir Starmer’s position has once again become unstable. EURGBP has soared amid this political uncertainty. However, GBPUSD bulls are going on the offensive thanks to shaken confidence in the dollar.

Unlike the Pound, Gold has been unable to capitalise on the fall in the USD index. This is an alarming sign for the precious metal.

This is especially true given that so-called smart money is currently on the side of the bears. Hedge funds and asset managers have reduced their net long Gold positions to their lowest since October.

The FxPro Analyst Team