Market Overview

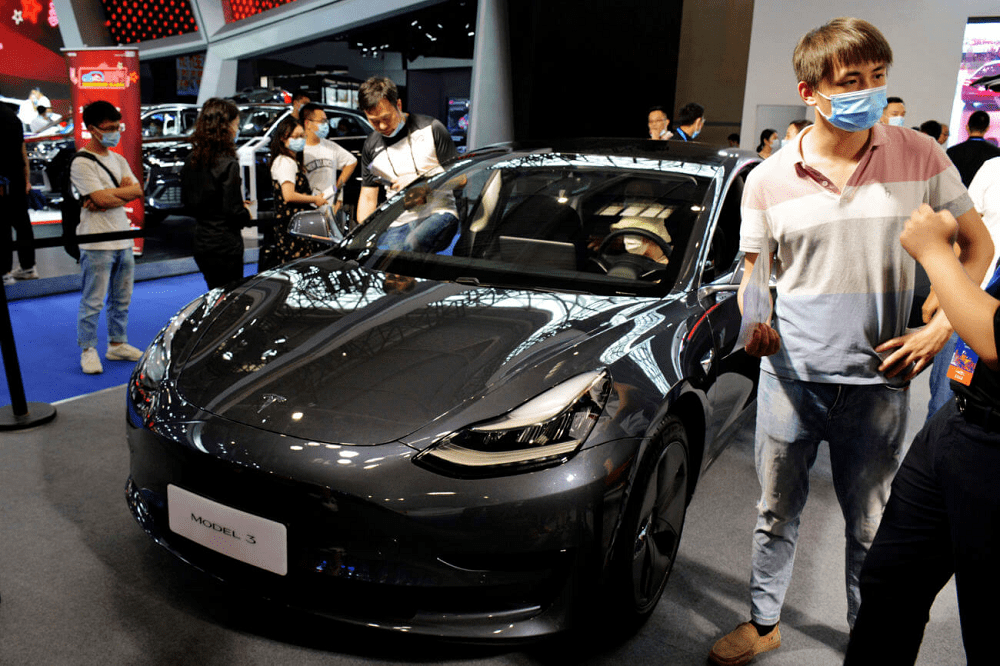

Tesla Keeps Cutting Prices; Should Investors be Worried?

July 15, 2020 @ 12:00 +03:00

Tesla has formed a habit of cutting prices of its cars nearly every other month. In the last four months, the electric carmaker has reduced the prices of both the Model 3 and the Model Y at least four times. While price reductions could signal improved efficiency, they could be a pointer to problems. Here are three things Tesla investors should be concerned about.

- Lower Gross Margins

During the first quarter, Tesla reported gross margins of 25.5%. This was more than double the average gross margin in the industry. Currently, the auto and truck industry’s average gross margin stands at 10.49%, according to New York University’s Stern School of Business. With the price cuts, Tesla’s gross margins could take a hit and erode consecutive quarters of profitability. That’s an unfortunate scenario for investors hoping that Tesla’s induction into the S&P 500 index will bring in more institutional investors. - Competition Has Its Sights On Tesla

The price cuts could be signaling that Tesla’s technological edge is over or is close to being overtaken by competitors. Already, legacy carmakers with more resources dedicated to research and development are launching electric versions of their popular brands. - Tesla Is Unwittingly Telling Buyers To Hold Out

At least four price cuts since April suggest an average price reduction every month. The danger here is that some would-be buyers might decide to delay their purchases on expectations that prices are heading even lower. That may or may not be the case, but no rational consumer wants to buy a discretionary product today when they could get it soon at a lower price. Additionally, the price cuts could have unintended consequences. They’re useful if they increase sales, but they could cannibalize sales too.

Tesla Keeps Cutting Prices; Should Investors be Worried?, CCN, Jul 15