Tesla jumps 14% on S&P 500 inclusion speculation

July 13, 2020 @ 19:55 +03:00

Shares of Tesla hit a new all-time high on Monday, extending the stock’s record run, as investors continue to pile into the Elon Musk-led company. And as the company’s valuation climbs ever higher, speculation is growing that the company will soon join the S&P 500. After Monday’s open, Tesla’s market value increased to $321 billion, according to FactSet. That makes it the 10th largest U.S. stock by market value, leapfrogging Procter & Gamble, according to FactSet.

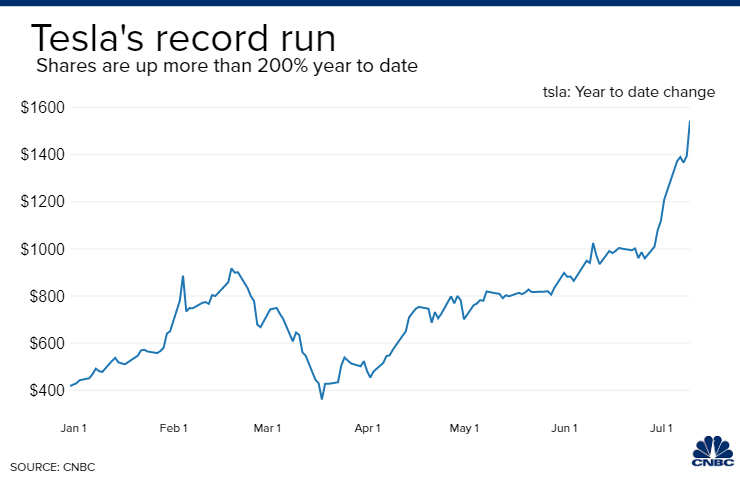

After closing at an all-time high on Friday, shares were another 14% higher on Monday. For the year, the stock is up more than 300%. Earlier in July Tesla topped Toyota to become the largest automaker in the world by market value.

The stock is up more than 55% in July alone after the company handily beat delivery estimates in the second quarter, delivering about 90,650 vehicles. Analysts polled by FactSet had been expecting 72,000.

Investors now believe that the company could report a fourth straight quarter of GAAP profits when it posts second quarter results on July 22, meaning it could be considered for inclusion in the S&P 500.

According to estimates compiled by FactSet, the highest target on the Street is $1,525 — also below where the stock currently trades — while the average target is just $805.

Tesla jumps 14% on S&P 500 inclusion speculation — Now the 10th biggest U.S. stock by market value, CNBC, Jul 13