Strong US retail sales did not spook the stocks

October 17, 2023 @ 19:10 +03:00

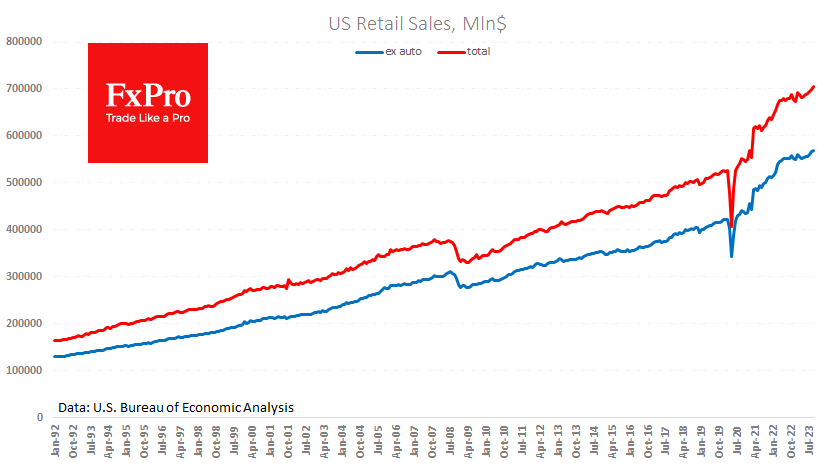

US Retail sales exceeded expectations. For September, sales rose 0.7% after rising 0.8% a month earlier. During six months of back-to-back spending increases, Americans added 3.4%. This is new evidence that suppressing inflation is not easy for the central bank with a strong labour market (abundant income) and high inflation expectations (due to rising fuel prices). And it runs counter to expectations that high interest rates will cool demand in the economy. Perhaps not until the labour market turns around, forcing Americans to adopt a saving behaviour.

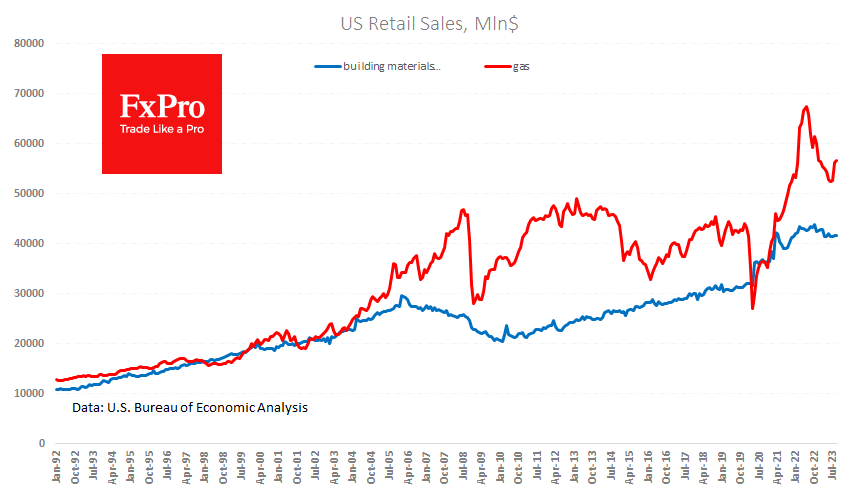

Fuel sales have risen sharply since July, reaching their highest level this year. In contrast, spending on building materials and home improvement has continued to trend downward, although at historically high levels.

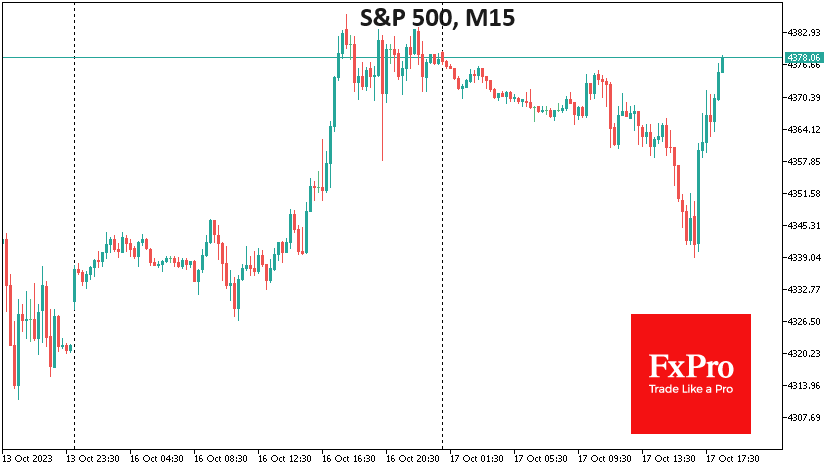

The big question now for the markets is whether this data will change the Fed’s mind. Generally, strong retail sales increase markets’ demand for risk. Over the past two months, the market has played up robust statistics as a negative for equities, expecting new Fed rate hikes or keeping them high for longer. However, over the last couple of weeks, markets have reverted to a classic pattern where good news on the economy is good news for the market.

The FxPro Analyst Team