Strong US Durable Goods, Jobless reports may stretch risk-on rally further

February 25, 2021 @ 17:33 +03:00

Very good macroeconomic data from the USA could further increase demand for risky assets and potentially add more pressure on the dollar.

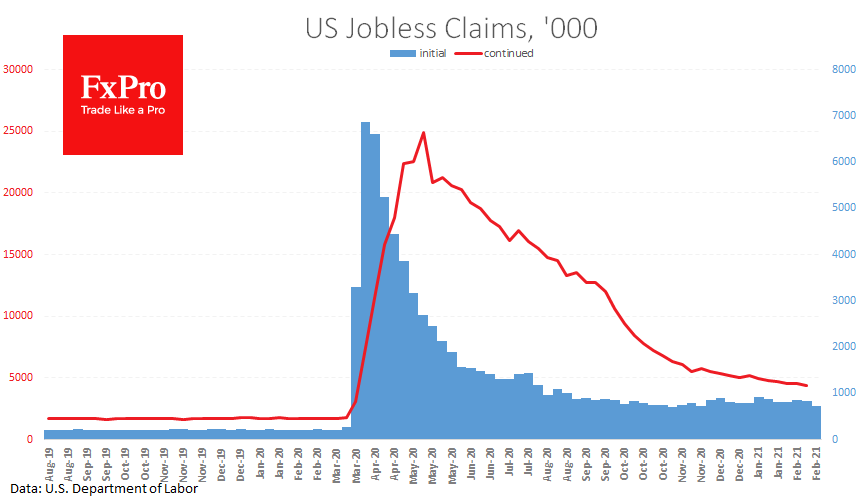

The number of Initial Jobless Claims fell sharply last week from 841K to 730K, the lowest since November. The number of continued claims fell by 100k to 4.419M. Perhaps this improvement can be attributed to bad weather when some prefer not to apply for benefits.

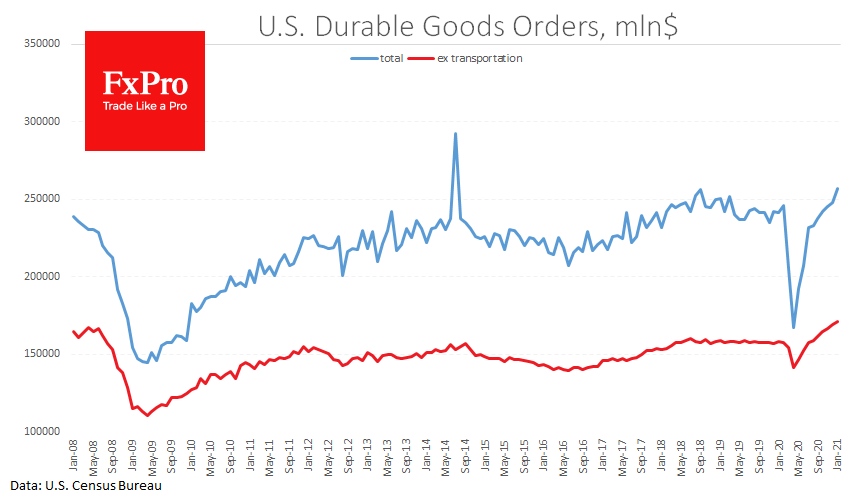

The other good news is that Durable Goods Orders rose by 3.4% in January, which is better than the expected 0.9%. Orders ex transportation sector grew 1.4%, marking a new historical record. The figures here indicates a V-shaped recovery and is an important signal of business confidence in the long-term economic outlook. Businesses buy durable goods only when they are confident of expansion.

And it is also good for equity and commodity markets, pointing to a brighter demand outlook. Simultaneously, it undermines the value of the dollar, as the Fed assures that monetary policy will remain ultra-soft in the near term, weakening the value of the currency.

The FxPro Analyst Team