Strong macro data could spark unwelcome central bankers optimism

January 22, 2021 @ 15:56 +03:00

A wide range of data from jobless claims and housing starts to the Philly Fed manufacturing index significantly exceeded expectations today. All of this is adding to strong corporate reports.

On balance, the markets have a rationale for further buying of risky assets in the expectation that the impending stimulus will support the economy. US indices headed for a new assault on the highs at the start of the trading session.

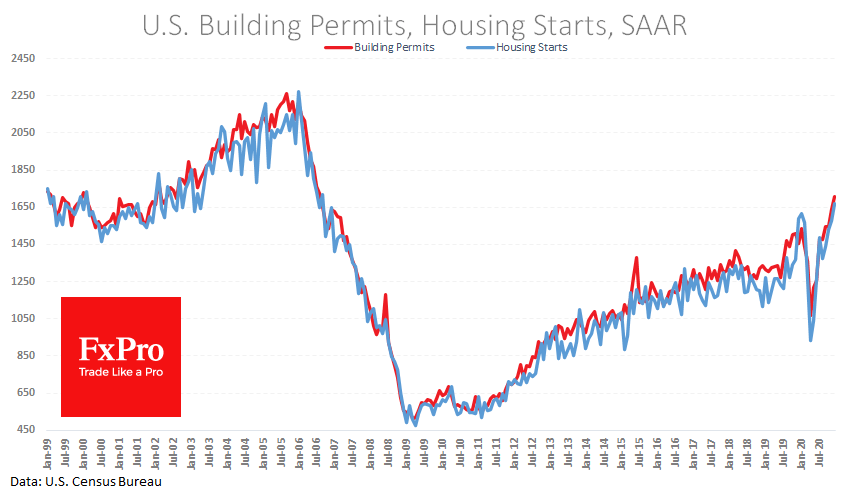

The number of new home starts and permits rose to a 14-year high in December, clearly reflecting the construction boom.

But in this optimism, there is also cause to wonder whether the strong data could spark an impending policy tightening. Observers had already noted a hint in the text of the ECB comment today that the PEPP might not be fully implemented.

The ECB had fallen into the trap of a quick recovery in 2009, raising rates in the spring of that year, only to cut them even lower six months later. Even worse was the US experience at the start of the Great Depression, which started to normalise policy too early.

The FxPro Analyst Team