Stocks Rise as Busy Week Ends; Dollar Extends Drop

September 14, 2018 @ 12:12 +03:00

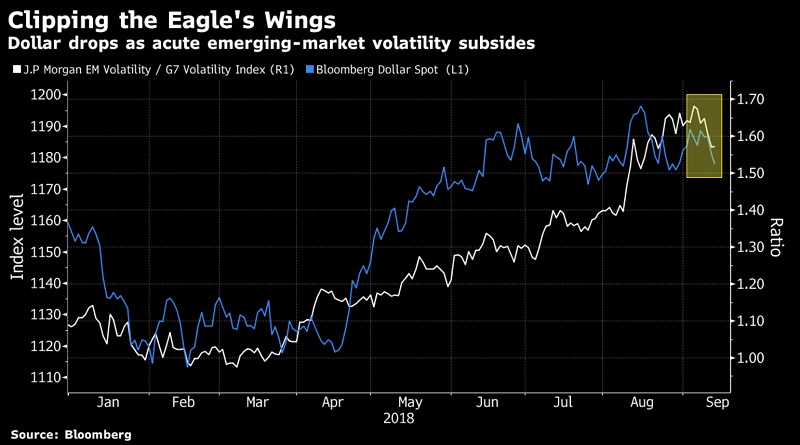

Stocks in Europe gained along with U.S. equity-index futures as prospects for U.S.-China trade talks and action by Turkey to support its currency fostered a positive mood. The dollar deepened its decline. Miners and car makers led the advance in the Stoxx Europe 600 Index, following a rally in most Asian benchmarks as they extended their rebound from the worst run of losses in 16 years. As appetite for risk returns, the greenback is heading for its biggest weekly loss since February, while Treasury yields nudged toward 3 percent. The pound headed for a six-week high and gilts fell after Bank of England Governor Mark Carney was said to have told cabinet that a no-deal Brexit would see interest rates rise rather than fall. Oil headed for a weekly gain as traders keep watch on Hurricane Florence.

Shares in Japan, South Korea and Hong Kong climbed. China’s yuan stayed lower and equities in Shanghai slipped after August economic data showed the economy in a modest slowdown. But overall Asian equities are ending the week on a high after enduring the longest daily losing streak since 2002. Emerging-market stocks and currencies extended a rally following Turkey’s larger-than-expected rate increase. From cooling U.S. inflation to central-bank meetings in Europe, the U.K. and Turkey, it’s been a busy week for investors. Next up is the Russian rate decision, before American retail figures shine more light on the world’s biggest economy. News that the U.S. and Chinese governments are working out the details for a new round of trade talks helped lift sentiment, though the outcome remains far from certain.

The Stoxx Europe 600 Index climbed 0.1 percent as of 9:17 a.m. London time. The MSCI All-Country World Index jumped 0.3 percent. The U.K.’s FTSE 100 Index increased 0.2 percent. Germany’s DAX Index gained 0.3 percent. The Bloomberg Dollar Spot Index dipped 0.2 percent to the lowest in more than six weeks. The yield on 10-year Treasuries climbed one basis point to 2.98 percent, the highest in six weeks.