Stock Market Bears Sweat Because This V-Shaped Recovery is No Myth

June 08, 2020 @ 13:53 +03:00

The U.S. stock market is nearing its all-time high as investors dismiss stark warnings from billionaires. “Too many people” expect a V-shape recovery, billionaire Sam Zell said last month. He was one of many billionaires who suggested the U.S. economy is permanently damaged from the pandemic.

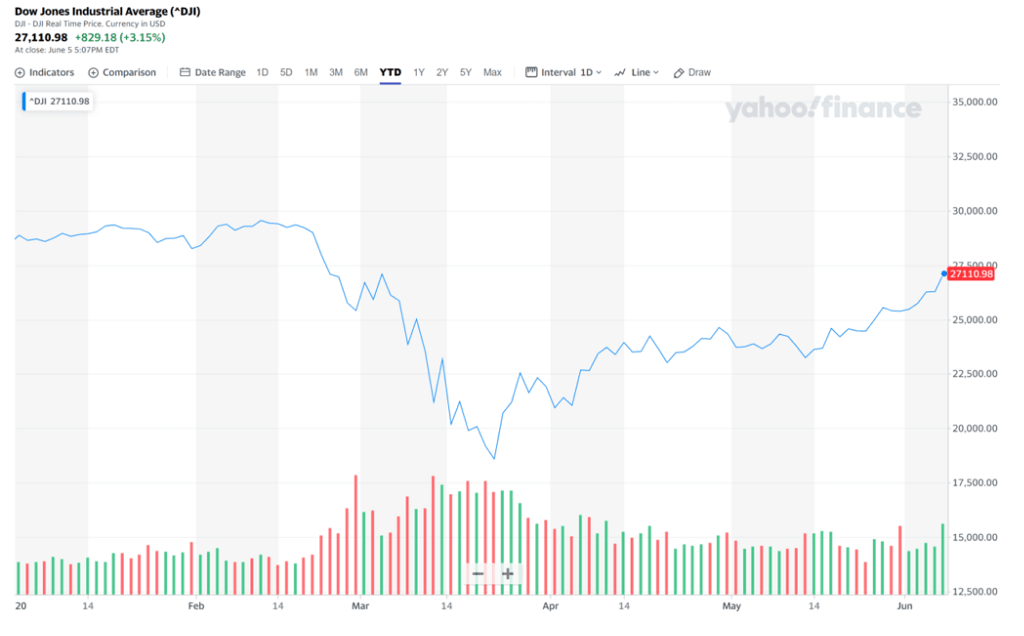

But, stock market bulls are proving to be right. The Dow Jones Industrial Average (DJIA) surpassed 27,110 points as it smashed through a key technical resistance level at 27,090 points.

Three months ago, the U.S. stock market recorded a 37% drop from its local peak. The uncertainty around the pandemic, jobless claims, and the economy scared investors away from equities.

Hedge funds experienced their biggest quarterly outflows in over 10 years in the first three months of 2020, according to HFR. Fearful investors withdrew upwards of $33 billion, rushing to safer alternatives like low-risk bonds and cash. With a double-digit unemployment rate and millions of small businesses at risk of capitulation, the logical prediction was a stock market downtrend.

But, the stock market has been nothing but logical. Major bailouts, an aggressive Federal Reserve policy, and the Trump administration’s determination to reopen the economy pleased retail investors. Now, the stock market is about a 9% gain from hitting its record high for the second time in 2020.

There is a real chance that institutional fear of missing out (FOMO) could trigger an enormous stock market rally in the coming months. Hundreds of billions of dollars are sitting on the sidelines at hedge funds and money markets holdings rose to $4.7 trillion. UBS says the high level of cash savings investors stacked up in the past two months can prevent a further stock market downtrend. If investors have large cash reserves, it will prevent them from selling stocks at a low point.

Stock Market Bears Sweat Because This V-Shaped Recovery is No Myth, CCN, Jun 8