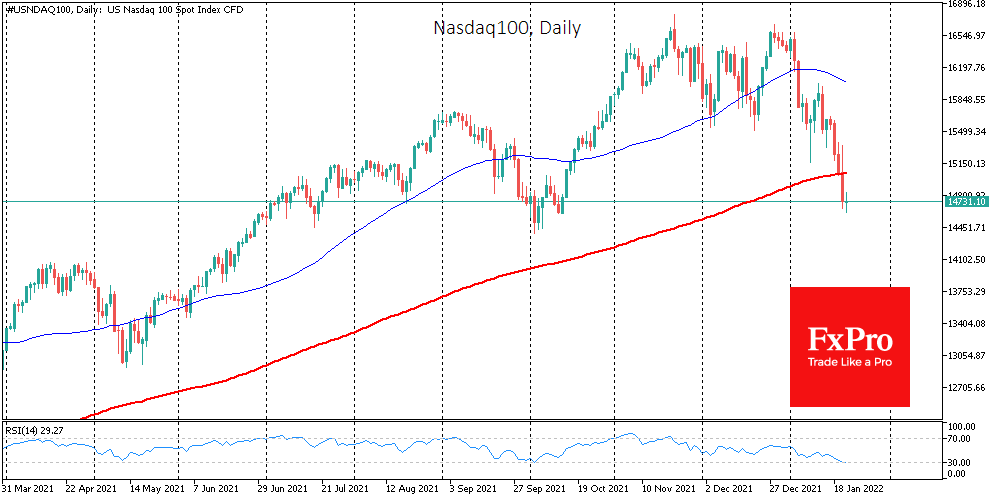

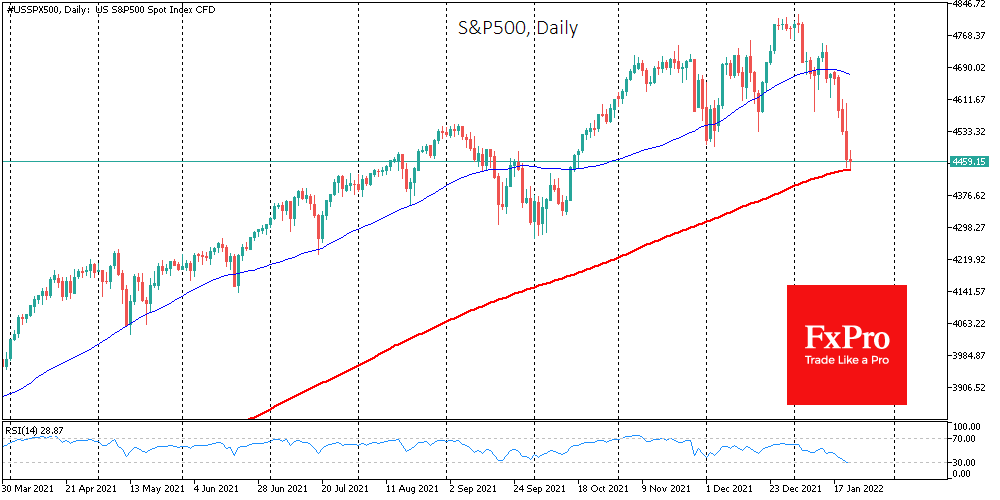

Stock dynamics say the Fed has taken the pace of rate hikes too high

January 21, 2022 @ 17:54 +03:00

The buying reflex on drawdowns can provide a false start for short-term investors. In the previous two years, markets fell on fears of pandemic effects, but central bankers and governments gave a supporting hand to the economy and pulled the markets through it.

Since the beginning of the year, the downside driver has been an increasingly hawkish tone of commentary, pushing up the risk-free interest rate level. We do not rule out that markets are going too far in their expectations, predicting more than four Fed rate hikes this year.

Since the beginning of the month, market turbulence should send a clear signal to the Fed that the market (or economy) is not ready for such a drastic move.

Previously, Powell missed such a signal in autumn 2018 by insisting on further rate hikes in 2019. This harshness was misguided, which the Fed acknowledged by softening the rhetoric and then lowering the rate in 2019.

Did Powell draw the correct conclusions from that episode? This is a question for hundreds of billions of dollars, which could be added to or wiped from the stock market capitalisation.

The FxPro Analyst Team