Speculators gave Turkish Lira some respite

January 18, 2022 @ 21:39 +03:00

Volatility in the Turkish lira has declined dramatically, finding other hotspots. Risky attempts by the Turkish Central Bank to thwart a speculative attack have paid off, providing respite to the national currency.

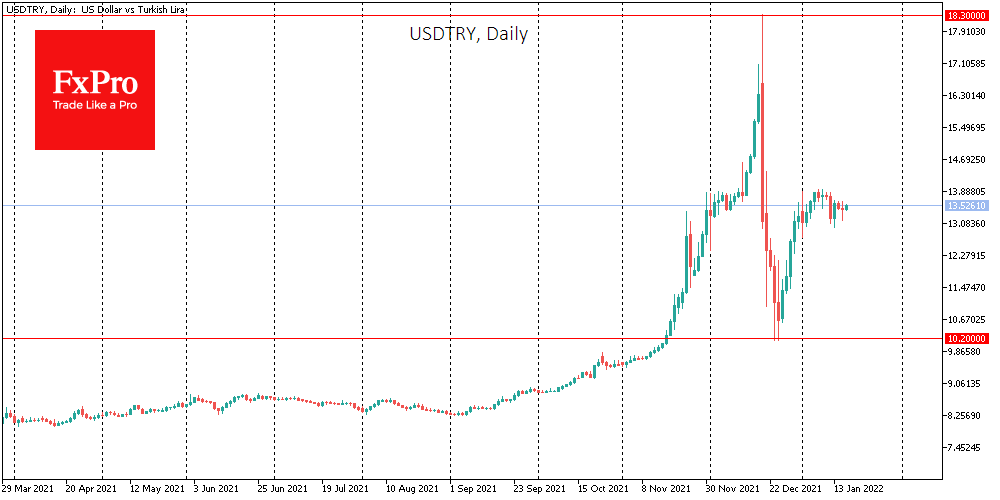

The dollar has been mainly in a range of 13.10-13.90 Turkish liras so far this year after the tremendous fluctuations in December when a 45% USDTRY surge to 18.30 followed a 38% dip to 10.45.

The Turkish government is in a hurry to assure financial markets and investors that inflation will return to single-digit levels by the middle of next year, which is just in time for the presidential election. This looks like an attempt to favour the country’s autocratic leader.

However, in our view, the interest of the most aggressive speculators has shifted to locations with higher yield/risk ratios. Ukraine and Russia have become such destinations, where rising geopolitical tensions create conditions for the flight from national currencies and assets. Speculators are also rocking the boat by trying to be proactive.

Thus, Turkey is fortunate to get a period of stability for its national currency. During this time, the economy may show signs of recovery from the shock. But still, investors should keep in mind the sharply reduced foreign reserves of Turkey, which drastically limits the scope for further speculative attacks, as was the case in December. We now see nothing more than a pause in a long-term retreat.

The FxPro Analyst Team