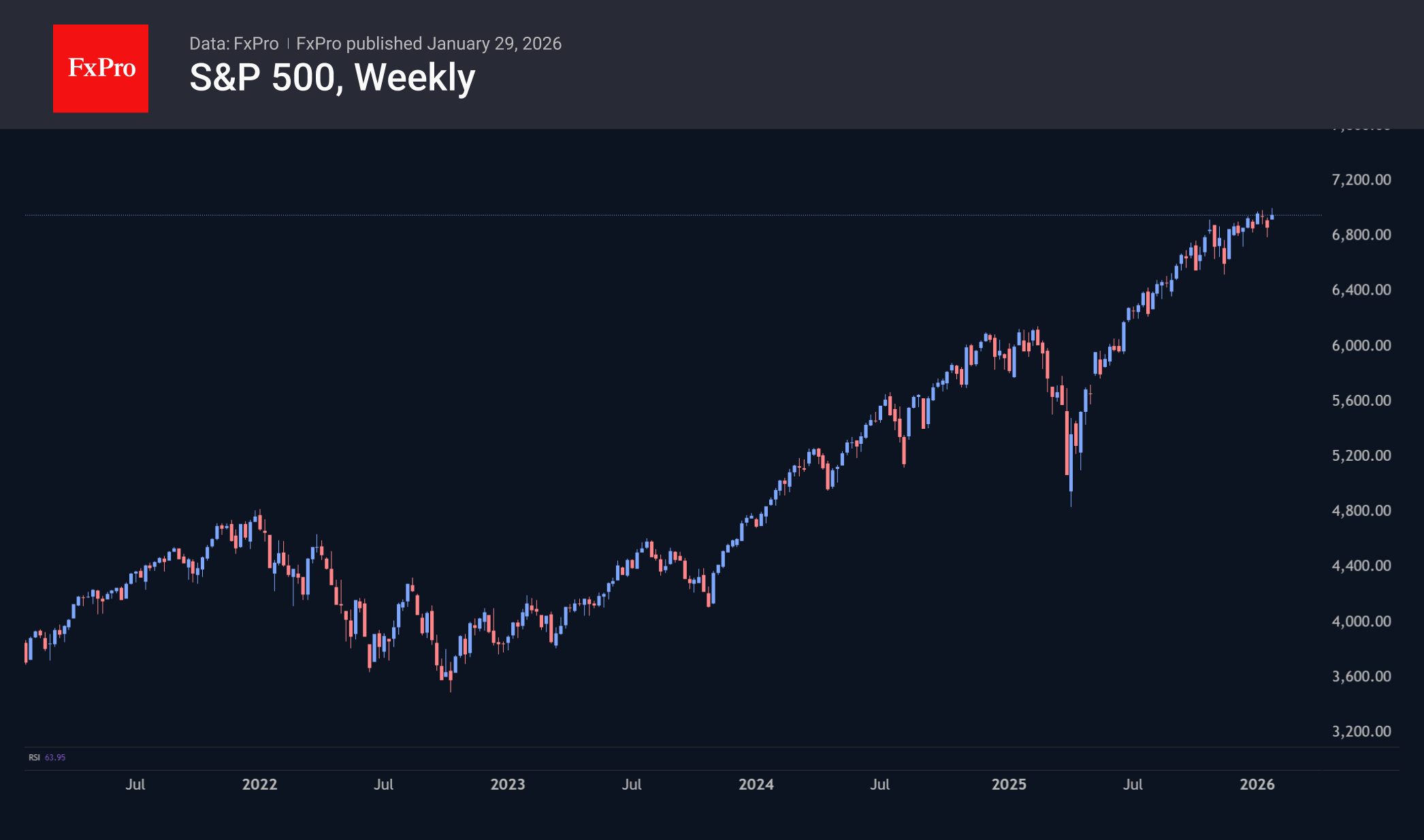

SP&500 hits 7000 milestone on strong expectations

January 29, 2026 @ 18:54 +03:00

Expectations of strong corporate earnings from tech giants allowed the S&P500 to update its record high, overcoming another milestone of 7,000. Investors are turning a blind eye to the Fed’s intention to keep rates on hold until at least June, as well as to geopolitics and Donald Trump’s tariff threats. All of this is perceived as market noise. As long as the US economy remains strong, it should be ignored.

The consensus estimate of Wall Street experts is for earnings per share to grow by 15% in 2026 and again in 2027, up from 13% in 2025. If the forecasts come true, this will be the longest period of double-digit growth since 2008. Unsurprisingly, US stock bulls are ignoring all other factors.

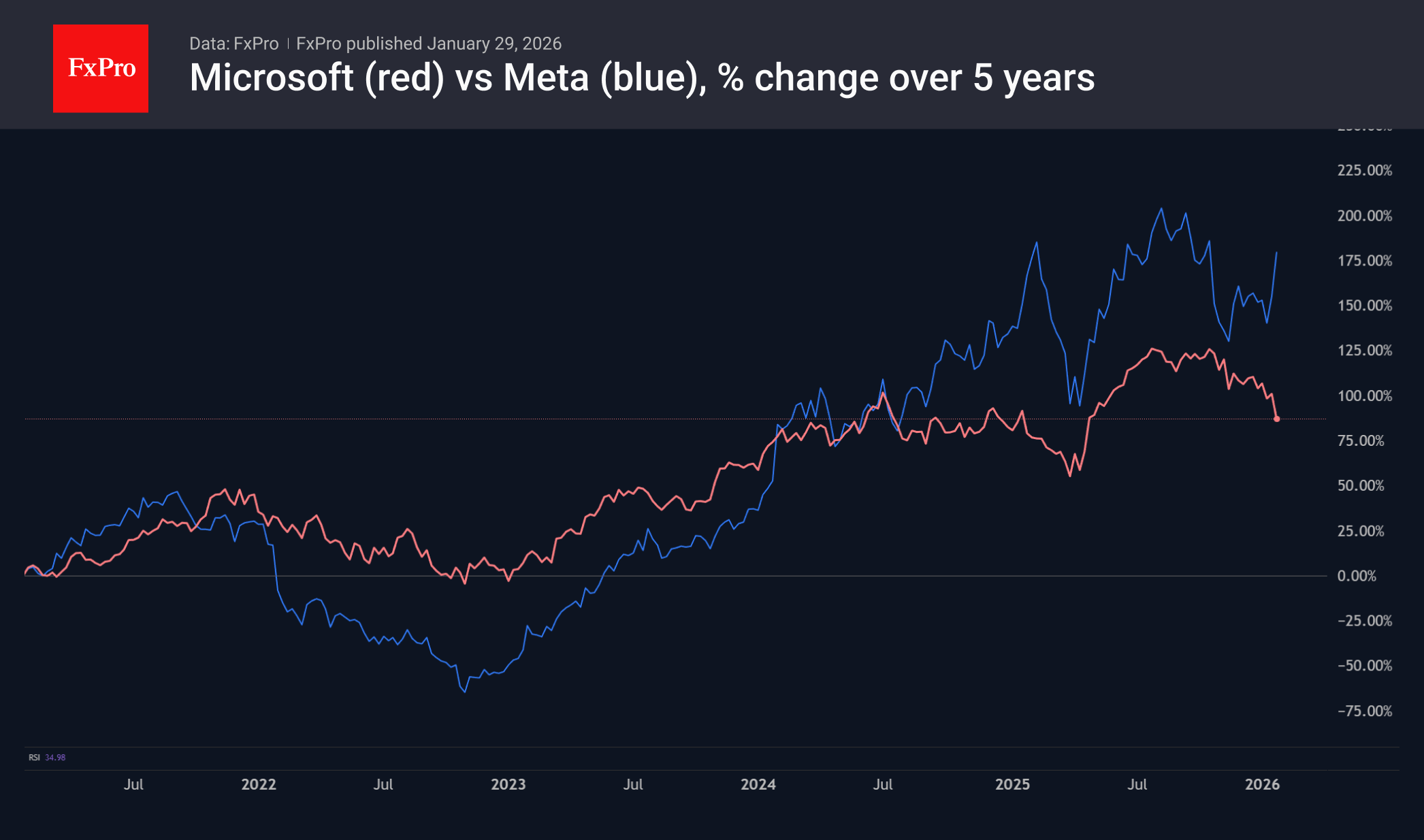

On the other hand, earnings per share growth is widely known. If the corporate reports of tech giants disappoint, the broad stock index will undergo a correction. Thus, Microsoft’s disappointing financial results dragged the company’s shares down in extended trading, while Meta Platforms’ positive results lifted its shares. All this created a bumpy ride for the broad stock index.

The FxPro Analyst Team