SNB suddenly hikes interest rate, triggering Franc rally

June 17, 2022 @ 11:51 +03:00

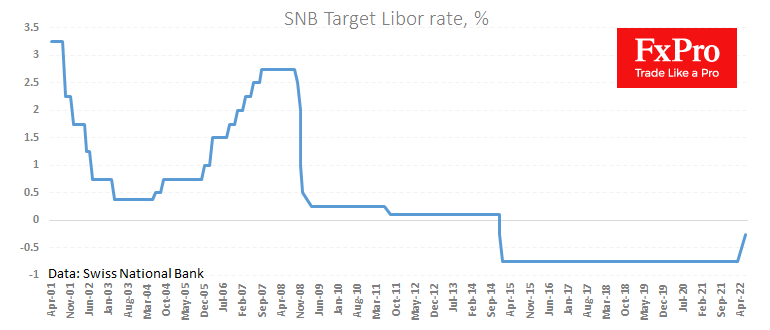

In a surprise decision, the Swiss National Bank raised its key rate by 50 points to -0.25%, the first increase in the country in 15 years. The SNB commented on the decision that it does not rule out further rises.

The main reason cited was to fight inflation, which reached 2.9% y/y in May. Inflation around Switzerland (in the Euro-region) is more than double, but rates have not been raised there. Therefore, analysts and traders did not expect to see policy tightening in Switzerland on Thursday.

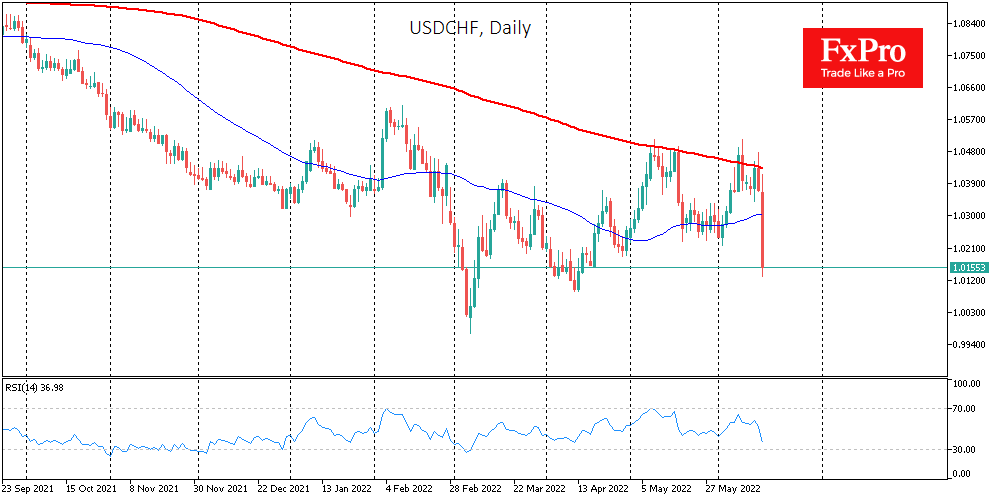

The hawkish surprise caused the USDCHF to fall more than 2% to 1.013, subsequently pulling back to 1.018.

It is fair to say that the SNB is acting pre-emptively by actively raising the rate now in order not to raise it longer and higher later. The Fed, the ECB and the BoJ are getting their share of criticism for not doing the same.

However, traders and investors should be cautious. The NBS has warned that it will remain active with currency interventions that could contain the strengthening of the franc.

However, the last point is highly controversial. A rate hike and strengthening the national currency vs. competitors both suppress inflation, so FX activity from the SNB is likely to reduce volatility but not reverse the market.

Over the last half-century, monetary and fiscal policy has helped the franc methodically strengthen against the euro and the Dollar. Recent actions by the SNB suggest that this historical trend will continue, bringing the EURCHF steadily below parity before the end of the year.

The FxPro Analyst Team

GBP | BOE Governor Andrew Bailey Speaks

GBP | BOE Governor Andrew Bailey Speaks