Slower US inflation clears the way for a rate cut

June 12, 2024 @ 16:30 +03:00

Inflation in America came out weaker than expected, actualising the question of a key rate cut. This is negative news for the dollar, which at the same time fuels appetite for equities.

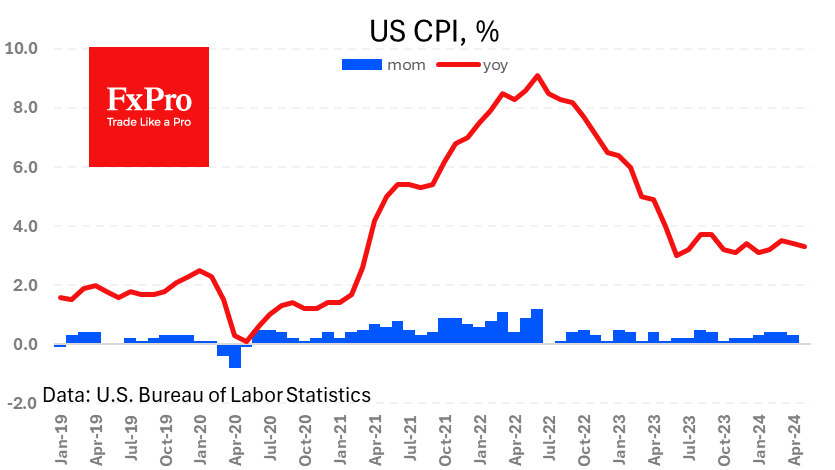

The Consumer Price Index was virtually unchanged last month, showing 0.0% m/m and slowing on an annualised basis to 3.3% y/y. Average forecasts had expected to see figures 0.1 percentage point higher. However, market reaction shows that some traders were tuning in for an “upside surprise”.

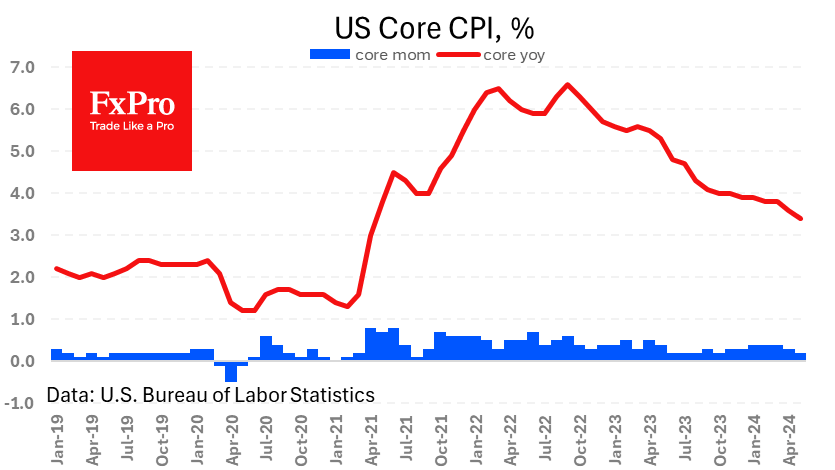

The core CPI, which excludes changes in food and energy prices, showed an even more significant decline. It rose 0.2% m/m (the lowest since October 2023) and slowed to 3.4% y/y (the lowest in three years).

The fresh data is a sigh of relief for the Fed, which will put interest rate cuts back on the near-term agenda. The markets will probably get stronger in expectations of 2 rate cuts this year, soon joining other G7 central banks that have already started easing. The probability of a rate cut in September has risen from 53% yesterday to 69% now.

The FxPro Analyst Team