Russia’s Crude production slump has brought back the focus on deficit

April 13, 2022 @ 13:16 +03:00

The price of oil rose more than 6% on Tuesday, with the main driver being news that Russia is sharply cutting its oil production.

Reuters sources report a fall in production in the first days of April to 10.32m BPD, down from an average of 11M in March and 11.06M in February. But the same sources report that only 9.76M was produced on Monday, noting an increasingly rapid drop in production. By comparison, the low point of Russian oil production at the deep of the coronavirus restrictions was 9.37M barrels.

A 12% drop in production or 1.7M BPD in just a month and a half calls this quarter’s global oil stockpile growth projections into question. Another source, the International Energy Agency, expects Russian production to fall by 1.5M BPD in April and 3m BPD in May. A gradual production ramp-up cannot offset such a dip. Neither will it help to reduce forecasted demand growth rates.

Russia probably has not yet solved the problem of drastically changed logistics due to sanctions. But investors should also bear in mind how devastating the sanctions have been on the energy sectors of Iran and Venezuela, where production decreased 2-4 times from the pre-sanctions peak. The falling volumes of these countries have been replaced by Russia, the US and Saudi Arabia, but there is little indication that the latter two have the strength to pick up the former’s export share.

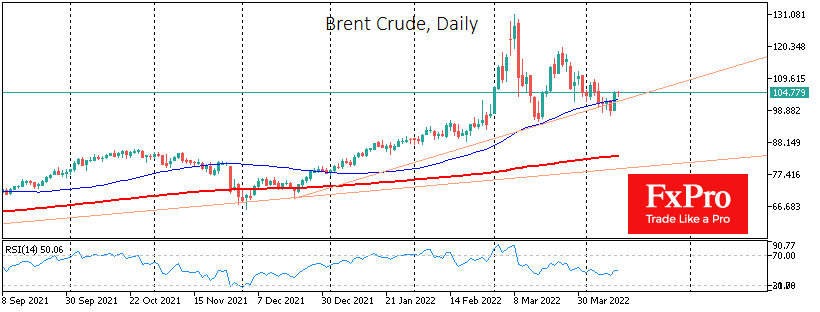

Oil prices have been bouncing back since March 24th on reports of increased sales from strategic reserves by the US and its allies. Meanwhile, OPEC+ has increasingly failed to keep up with its quotas, not just because of Russia but because of all other members. A sharp fall in Russian production has brought worries about energy shortages back to the market.

These reports have helped oil stay within the uptrend formed in early December. It will not be surprising if the oil price manages to bounce back from this five-month support in the coming days, again going on to storm levels above $110.

Until recently, the USA has been unable to take advantage of the situation and has been increasing its production much more slowly than it has since the global financial crisis. Perhaps we will see a change in this situation in the weekly US oil production and reserves data published later today.

The FxPro Analyst Team