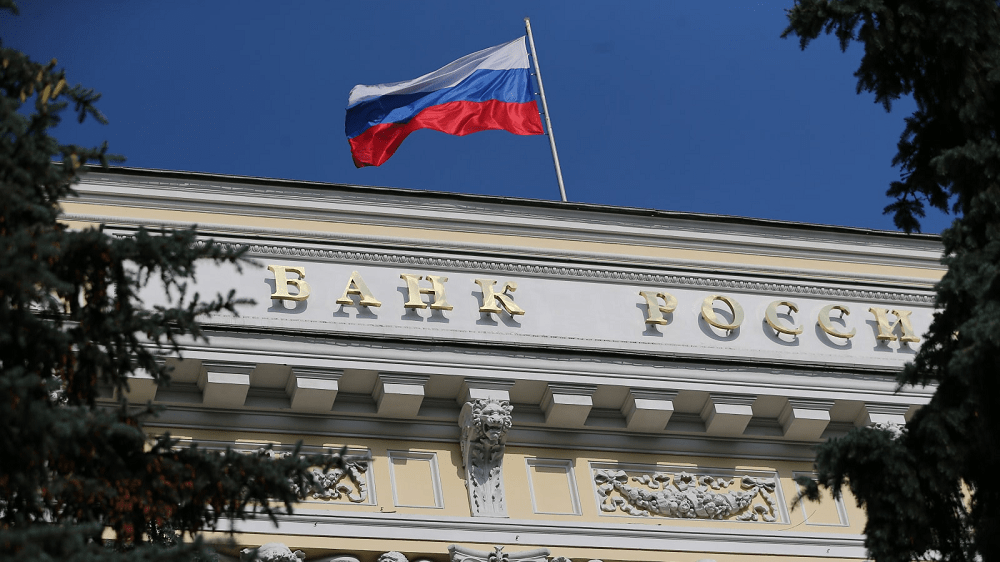

Russia cuts interest rates to a post-Soviet Union low

June 19, 2020 @ 20:19 +03:00

The Central Bank of Russia on Friday cut interest rates by 100 basis points to 4.5%, their lowest level since the fall of the Soviet Union, as it looks to shore up an economy reeling from the impact of the coronavirus pandemic.

The CBR had already cut rates by 50 basis points in April, and suggested that it could further reduce lending costs as inflation risks remain low and the economy continues to contract. Russian GDP (gross domestic product) plunged 28% in April.

In a statement, the CBR said that disinflationary factors have been “more profound than expected due to a longer duration of restrictive measures in Russia and across the world.”

The bank said the effect of short-term pro-inflationary factors has been “largely exhausted,” while financial stability risks arising from volatility in global financial markets have also declined.

Russia is currently the third worst-affected country in the world by the coronavirus pandemic, with more than 568,000 confirmed cases. The bank mentioned that lockdown measures had weighed on economic activity for longer than expected, with GDP likely to contract by more than previously thought in the second quarter.

The CBR has acted more slowly than many other emerging market central banks since the pandemic began to spread in March, but conditions for further monetary policy easing are now firmly in place, according to Liam Peach, emerging Europe economist at Capital Economics.

Erik Norland, senior economist at CME Group, told CNBC that the decision reflected the central bank’s confidence in the stability of the ruble, along with increasing investor recognition of Russia’s strong economic fundamentals.

“Unlike in 2008 and 2014-16, so far in 2020 the ruble has remained fairly steady versus the U.S. dollar, falling only about 15% so far this year, in line with other emerging market currencies,” Norland explained.

“This is a sharp contrast to downturns in 2008-09 and 2014-16 when the currency fell by 35% and 60% versus USD, respectively, causing a sharp rise inflation that Bank of Russia quelled by raising interest rates.”

The Russian economy remains heavily reliant on exports of oil and other natural resources, and has been particularly hard hit by the virus, but Norland highlighted that it also has one of the lowest levels of debt of any major country in the world.

“Russia’s public and private sector debt totals just 80% of GDP, compared to 250%+ in China, Europe, Japan and the US,” he said, adding that the CBR’s rate cut also reflects Russia’s reliance on monetary policy to boost its economy, given the “relatively modest” fiscal support offered by the Russian government.

Russia cuts interest rates to a post-Soviet Union low, CNBC, Jun 19