Rising incomes and slowing inflation in the US support the markets

February 29, 2024 @ 18:55 +03:00

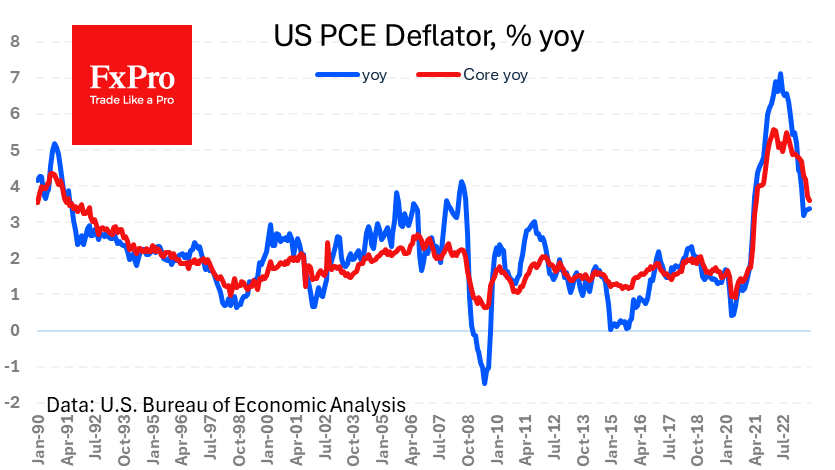

This week, the markets were mostly looking forward to the release of the US personal income and spending data, with a focus on the accompanying price index. The Personal Expenditure Price Index, excluding food and energy, rose 0.4% m/m and slowed from 2.9% y/y to 2.8% in January, in line with expectations.

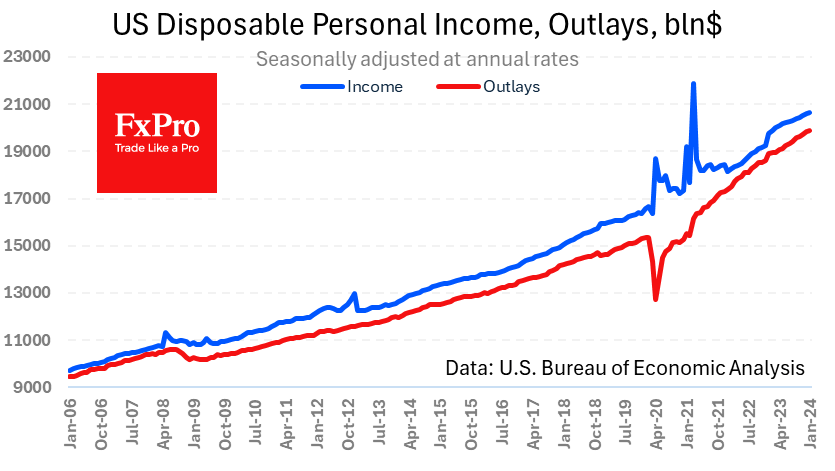

A 1% rise in personal income came as a surprise, against expectations for a 0.4% rise. However, personal disposable income rose by 0.3% m/m, which did not break the trend of recent months.

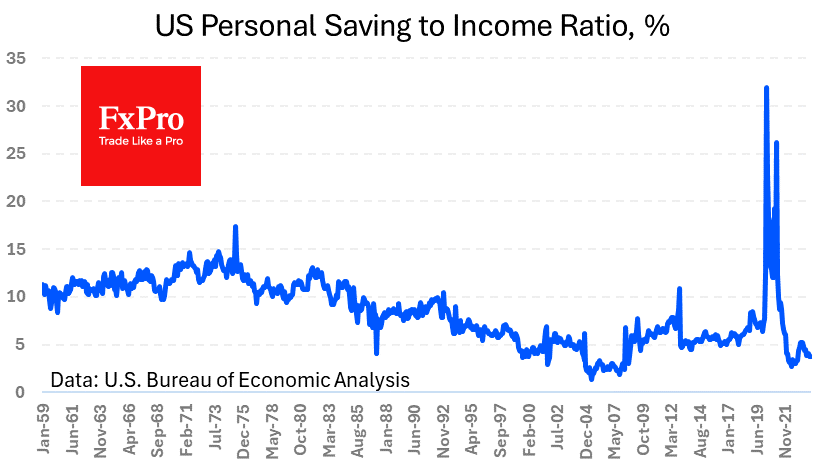

At the same time, there was no acceleration in spending, which rose by 0.3% m/m. They rose by 5.2% y/y, against a 4.8% rise in total income and a 4.5% rise in disposable income. A worrying result – the savings rate of 3.6% is about half the pre-pandemic level. But the good news for markets is that this won’t cause inflation to accelerate, meaning the Fed won’t have to fight it and delay policy easing.

In the wake of this report, gold is storming through the resistance of the downward channel, and the Nasdaq100 and S&P500 indices are testing all-time highs again.

The FxPro Analyst Team