RBNZ accelerated policy easing, knocking out NZD

October 09, 2024 @ 17:17 +03:00

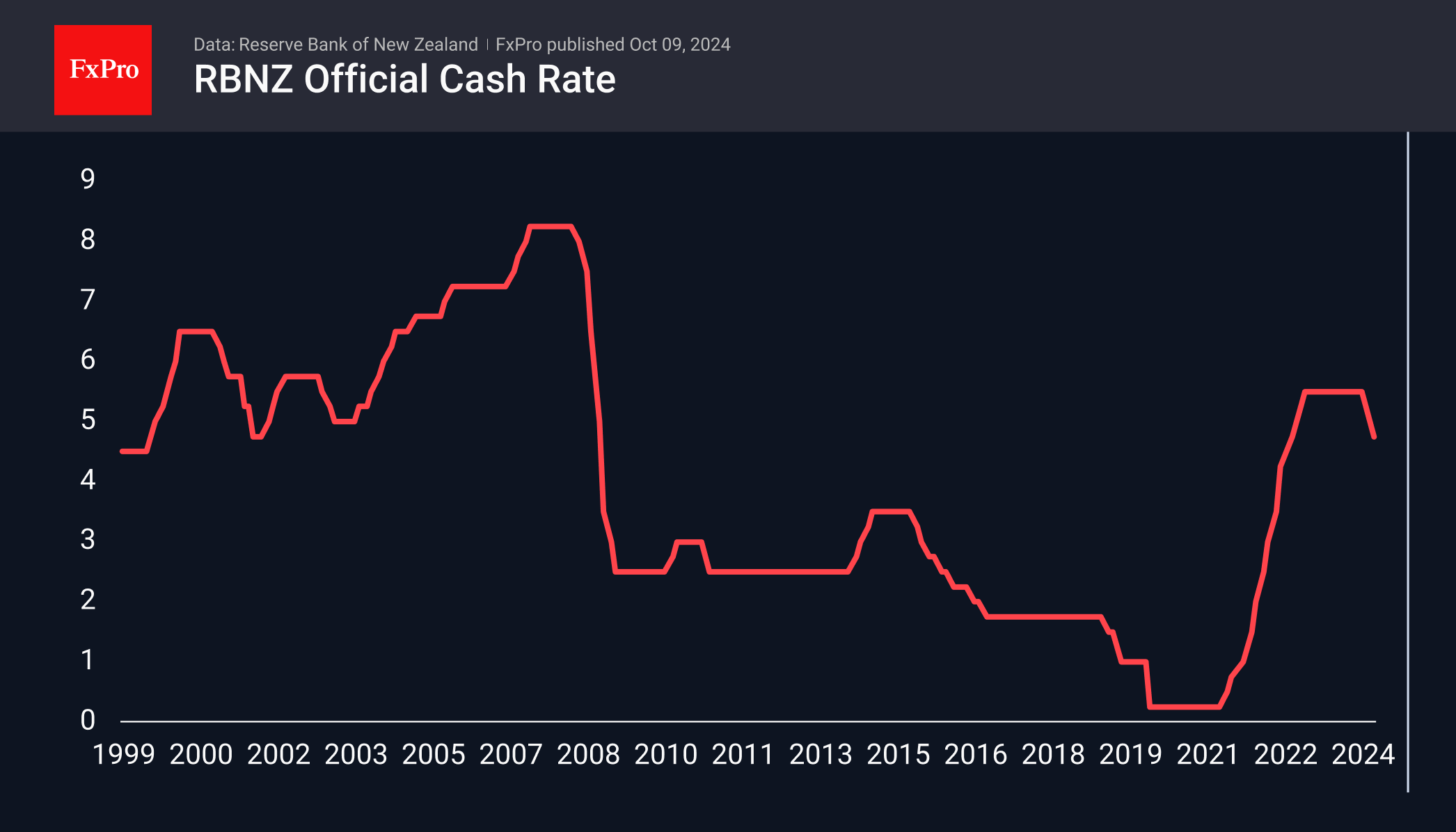

The Reserve Bank of New Zealand cut its key interest rate by 50 basis points to 4.75%, following a 25 basis point cut in August. Explaining its decision, the RBNZ noted that inflation was approaching 2%, the midpoint of the target range of 1-3%. Inflation is, therefore, moving away from the circle of concern. Meanwhile, economic activity is subdued, partly as a result of restrictive monetary policy.

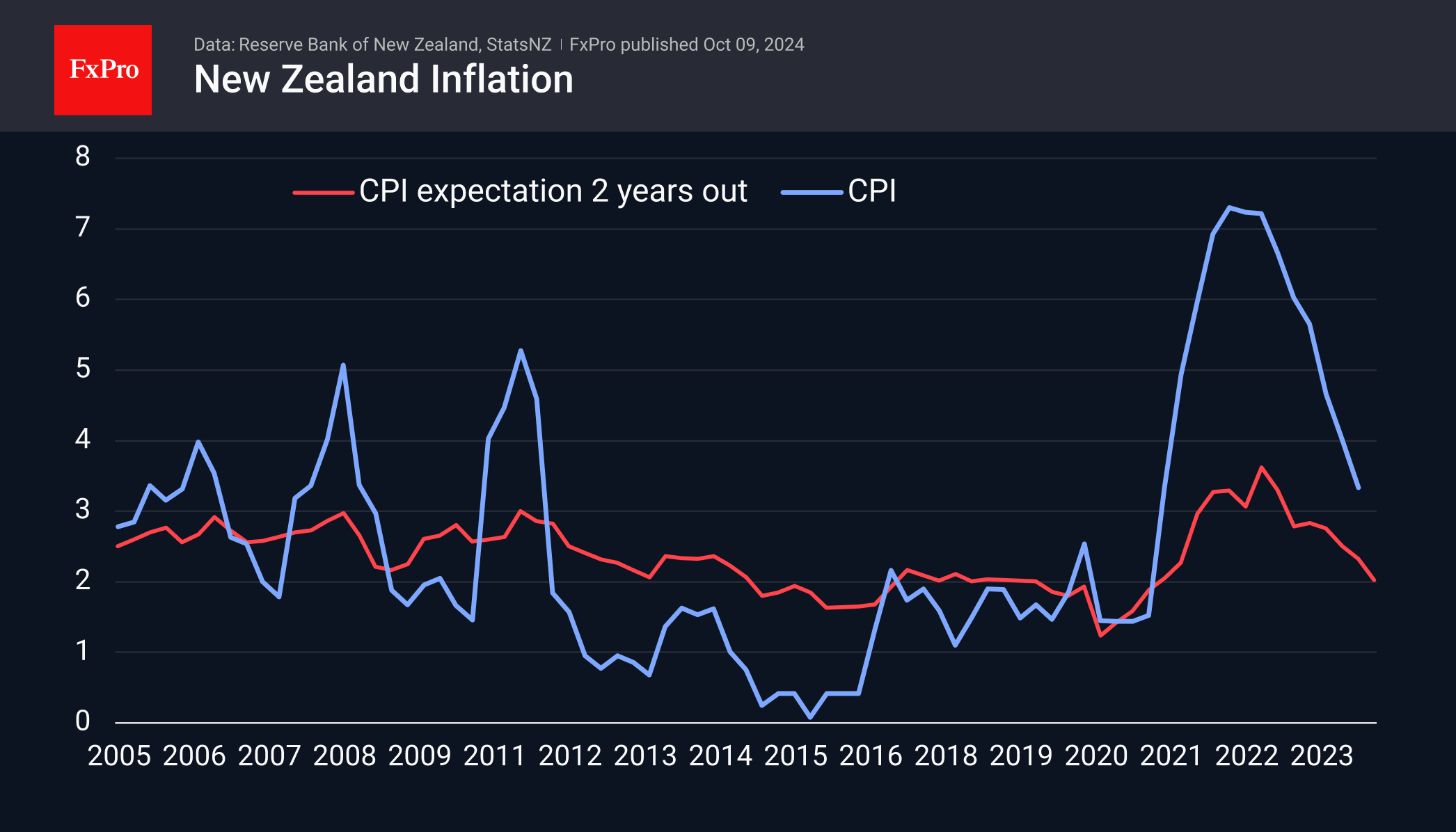

According to the latest data, actual inflation slowed to 3.3% in the second quarter (estimates for the third quarter will be published next week). This is above the target, but there has been a steady deceleration since the end of 2022. Inflation expectations two years ahead eased to 2% in the third quarter, further underpinning confidence in inflation normalisation.

At the same time, employment growth fell to 0.6% year-on-year, the lowest since early 2021. Retail sales have been declining for the past two and a half years, which was also the case during the global financial crisis.

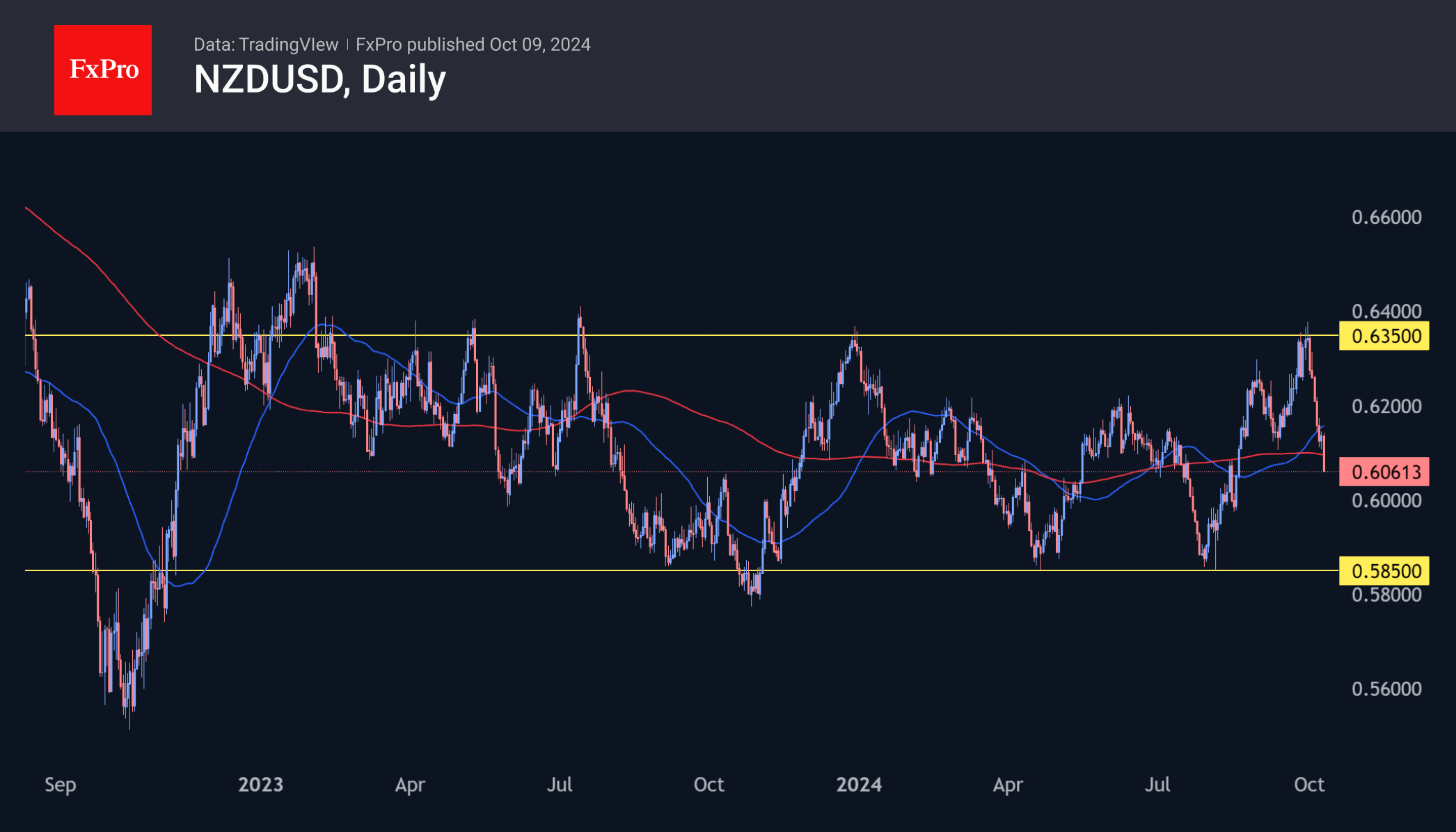

The acceleration of policy easing and the apparent dovish tone have intensified the sell-off in the NZDUSD, which has lost over 1% since the start of the day on Wednesday. The pair also fell below its 200-day moving average today, bringing the decline since the beginning of last week to 4.9%.

Since the beginning of 2023, the NZDUSD has traded in a range of 0.5850-0.6350. An attempt to break higher late last month failed as the RBNZ followed the Fed in accelerating the pace of monetary easing. The Kiwi appears to be moving towards the lower boundary of this range. If the NZDUSD maintains its downward momentum, it could stay there until the end of November.

The FxPro Analyst Team