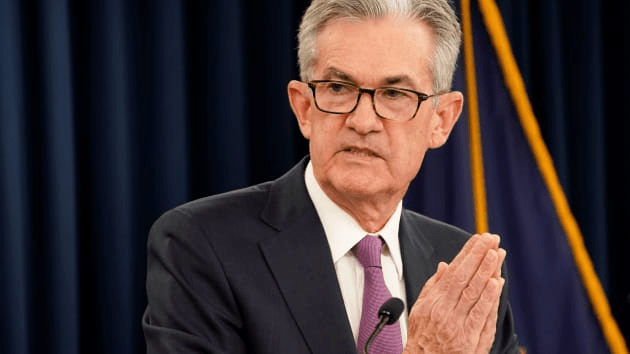

Powell says GDP could shrink more than 30%, but he doesn’t see another Depression

May 18, 2020 @ 13:49 +03:00

The U.S. economy could shrink by upwards of 30% in the second quarter but will avoid a Depression-like economic plunge over the longer term, Federal Reserve Chairman Jerome Powell told “60 Minutes” in an interview aired Sunday.

The central bank chief also conceded that jobless numbers will look a lot like they did during the 1930s, when the rate peaked out at close to 25%.

However, he said the nature of the current distress coupled with the dynamism of the U.S. and the strength of its financial system should pave the way for a significant rebound.

Asked by host Scott Pelley whether unemployment would be 20% or 25%, Powell said, “I think there’re a range of perspectives. But those numbers sound about right for what the peak may be.” Pressed on whether the U.S. is headed for a “second depression,” he replied, “I don’t think that’s a likely outcome at all. There’re some very fundamental differences.”

In a part of the interview that did not air, Powell said shrinkage of U.S. economic growth “could easily be in the 20s or 30s,” according to a CBS transcript.

Among the factors that he said are different from the Depression era are an activist Fed and a Congress that already has passed close to $3 trillion in rescue funds and is contemplating another round. Also, the cause of this downturn is not an asset bubble or another associated more fundamental reason but rather a self-induced economic freeze brought on by efforts to combat the coronavirus.

Those efforts have led to 36.5 million Americans filing unemployment claims over the past two months and an unemployment rate currently at 14.7% and headed higher.

Powell says GDP could shrink more than 30%, but he doesn’t see another Depression, CNBC, May 18