Pound looking into the abyss

November 12, 2024 @ 19:17 +03:00

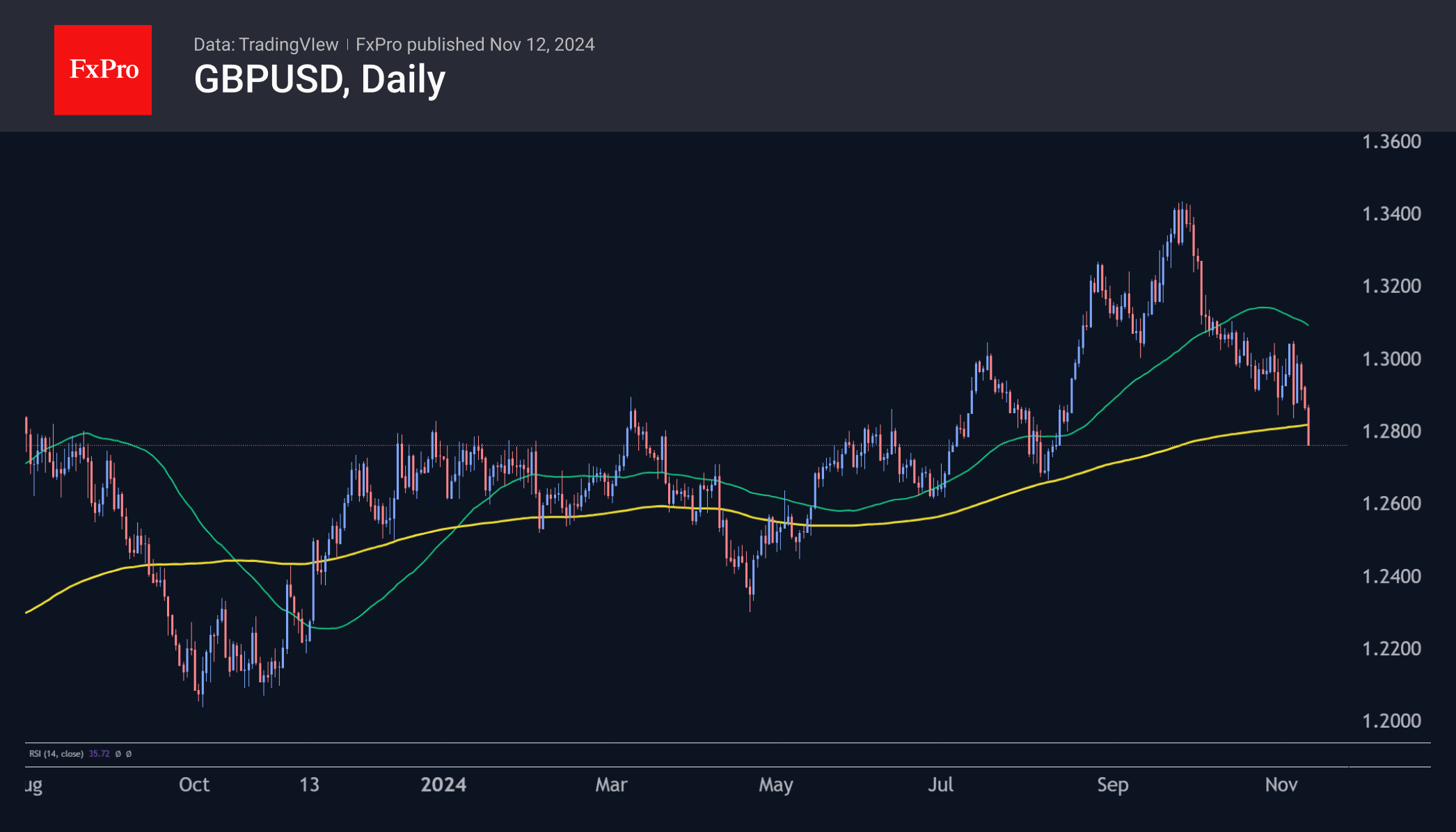

Sterling continues to lose ground against the Dollar for the third session in a row, down a cumulative 2% and nearly 5% from its peak in late September as markets turned to the Trump rally.

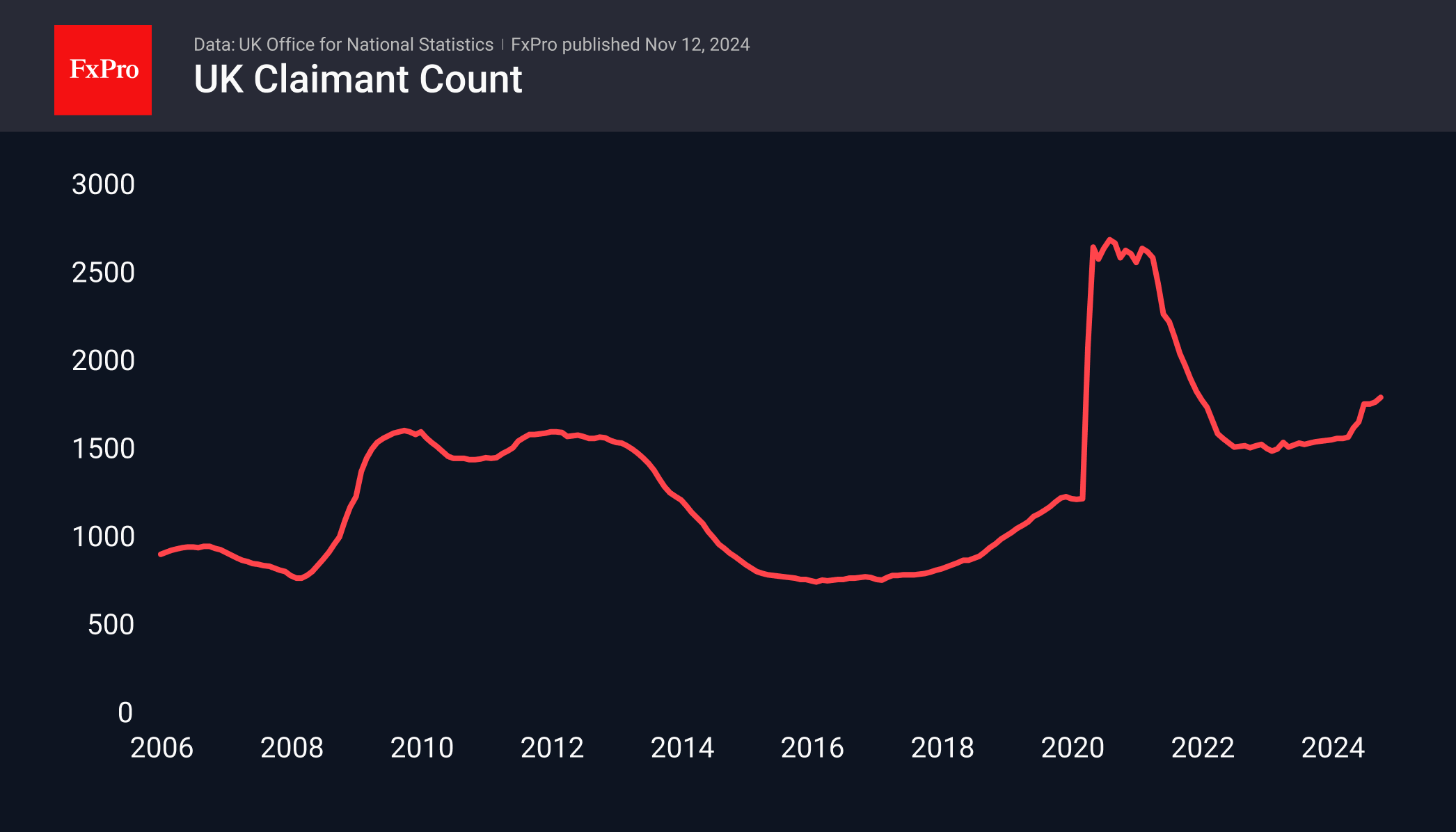

Weak macroeconomic data have driven the recent bearish momentum. The unemployment rate rose to 4.3% in the three months to September, reversing a recent decline. Claimant count number have been on an upward trend since last June, with only a few months of weak declines. In October, claims rose by a further 26.6k, higher only during the lockdowns, highlighting the need for monetary easing to support the economy.

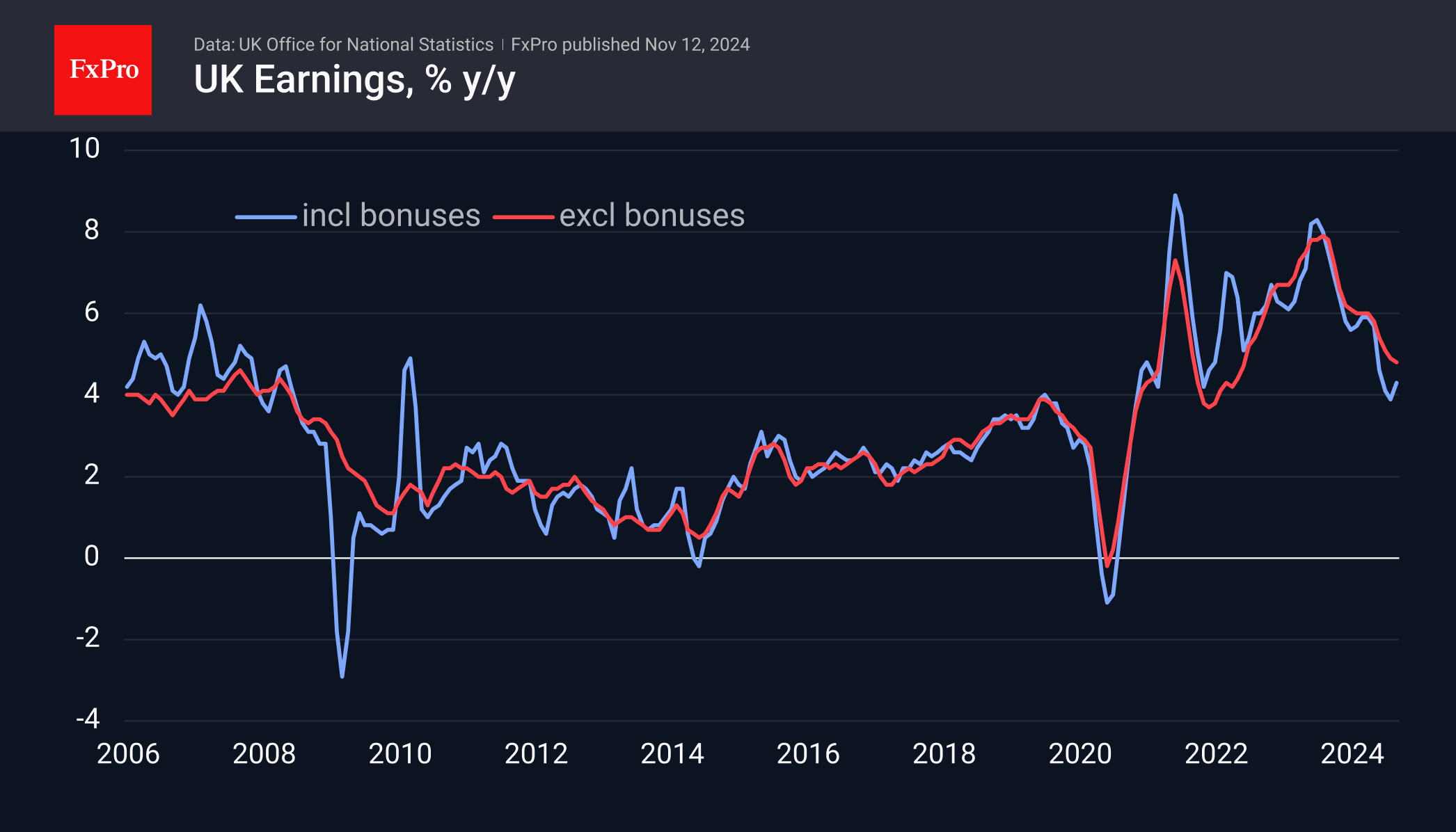

The slowdown in wage growth also presents the opportunity to do so. The rate of regular wage growth has fallen to 4.8% over the past year, reducing pro-inflationary risks.

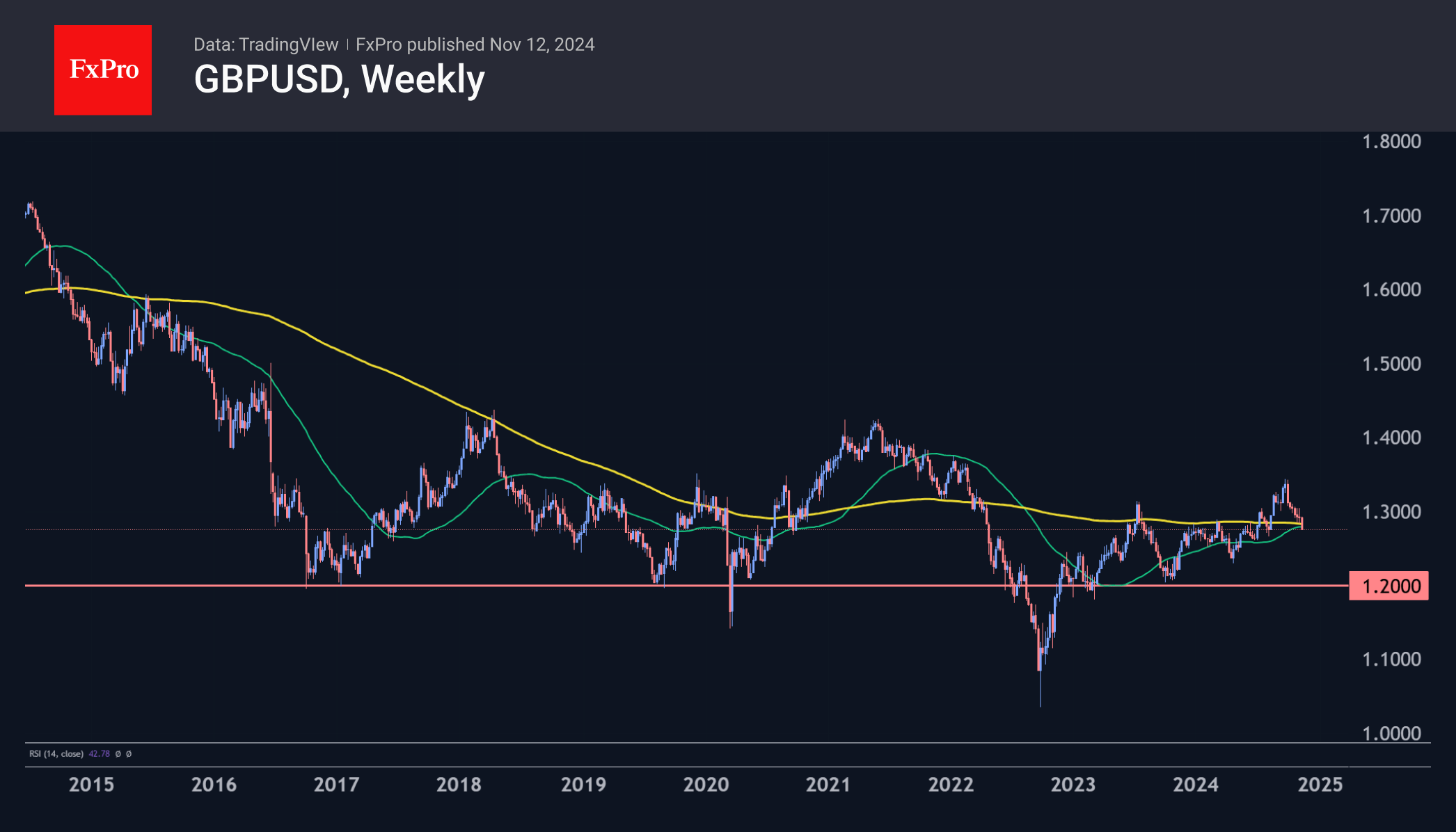

The GBPUSD has broken below its 200-day moving average for the first time since May. This is an important signal of a change in trend from bullish to bearish. But more importantly, the Pound rolled back below its 50- and 200-week moving averages this week. The chart clearly shows the struggle for the 200-week at the end of October.

Over the past 10 years, there have been six dips below this curve with an average decline of 14%, the most recent of which was the smallest at 7%.

A consolidation below 1.2820 would open the potential for a further decline below 1.2000 despite the accumulated oversold condition in the month and a half of declines. At the same time, traders should keep in mind that the 1.2000 level is an important psychological mark. The Pound rebounded sharply from there between 2017 and 2020 (apart from a brief dip below at the start of the pandemic) but failed to withstand the bear attack in 2022.

The FxPro Analyst Team