Pound Investors Have Too Much on Plate to Obsess About Brexit

June 01, 2020 @ 19:03 +03:00

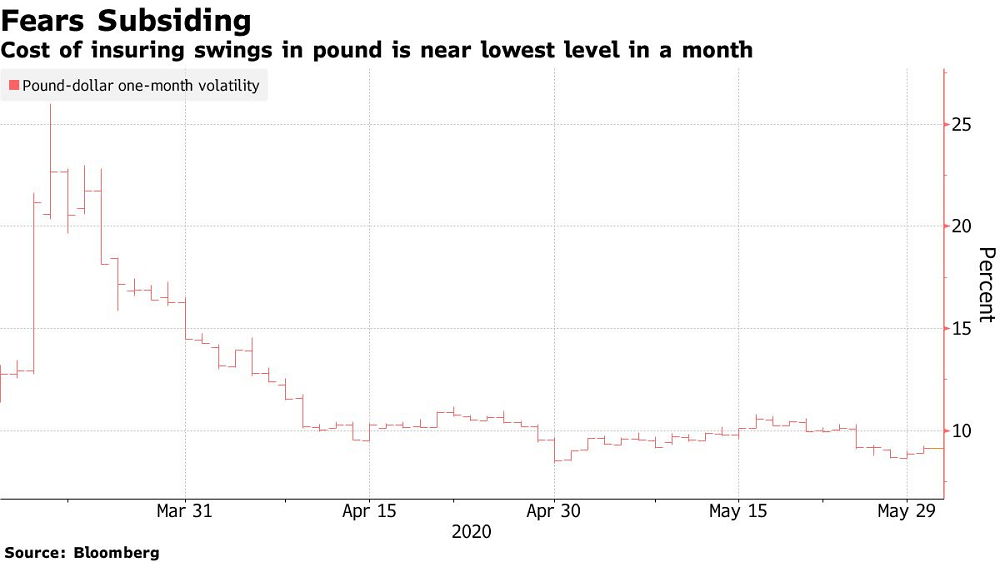

Even with the risk of a hard Brexit hanging over their heads, pound traders seem to be looking the other way. The currency touched a three-week high against a weaker dollar, one day before fraught trade negotiations resume between London and Brussels. A gauge of sentiment in sterling over the next month, which covers the deadline for an extension to the U.K.’s Brexit transition period, is the least negative since late March.

It’s a sign Brexit has lost some of its power to rattle investors, as concerns shift to the economic impact of the coronavirus pandemic and the possibility of a second wave of outbreaks after the U.K.’s lockdown eases. The pound rose as much as 0.7% to $1.2426 on Monday, the highest since May 11. It snapped a three-day losing streak against the euro, advancing the most in nearly a week. Few analysts expect a political breakthrough this week. There could be damaging headlines for the process in coming days after the bloc’s chief negotiator Michel Barnier told the Sunday Times the U.K. needs to be “more realistic” in its demands.

Still, there’s been no spike in the cost of insuring against a swing in the pound against the dollar in options. For the next month, it’s hovering near the lowest level since early May. That contrasts with the roller-coaster ride suffered by the pound throughout 2019 on fears of a no-deal exit and turmoil in Parliament. These have been swept away by more immediate concerns about shuttered factories and consumers stuck at home. The influence of politics is diminishing, while focus intensifies on the risk of large-scale unemployment and emergency changes to fiscal and monetary policy.

Traders have stopped hanging on the words of lawmakers and are instead scrutinizing comments from Bank of England policy makers on the possibility of negative interest rates, which have weighed on the currency. It also narrowed the spread between 10-year gilt and bund yields to the smallest gap since since 2016.

Negative rates may become unavoidable especially if there is a no-deal Brexit at the end of the year, said Christian Schulz, director of European research at Citigroup Inc. Such a move by the BOE could lead the pound to revisit 35-year lows hit in March, according to Lee Hardman, a foreign-exchange strategist at MUFG.

Investors are betting the U.K. will join the negative-rates club by the end of February, according to overnight interest-rate swaps. Last month, the market saw such a move in November this year.

Pound Investors Have Too Much on Plate to Obsess About Brexit, Bloomberg, Jun 1