Oil: the final upward momentum?

May 17, 2022 @ 12:49 +03:00

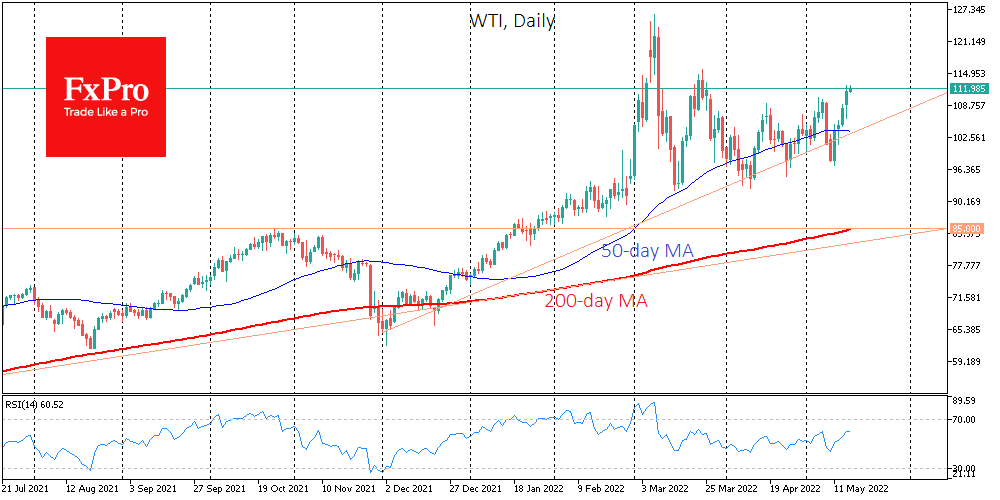

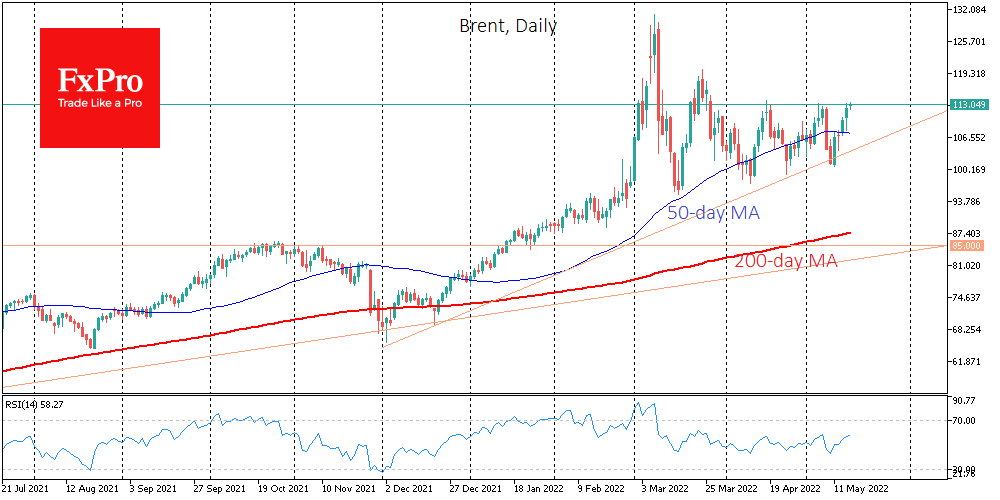

Crude oil has added 15% since last Wednesday, rising to $112/bbl WTI and $113/bbl Brent. Both grades reached new two-month highs on Tuesday morning, despite a decidedly bearish news backdrop.

A sharper than previously estimated slowdown in China and not yet agreed package with Russian Crude oil phased embargo was met with buying in Crude, despite those suggesting lower demand and higher supply.

Since early April, WTI has seen a sequence of higher highs and higher lows. Oil’s dip under the uptrend line last week only encouraged buyers, kick-starting the latest upward momentum.

This is the third time Brent has reached that horizon, from which it has rolled back in April and early May. A consolidation above $114 could signal a new buying wave and quickly take prices to the $120 area – near the late March peaks.

In this case, the North Sea Brent lags behind the US WTI as the supply-demand balance favours the latter. It should not be surprising if WTI becomes more expensive than the heavier Brent in a few weeks, restoring the historic balance broken by tight OPEC+ quotas and once rampant US production.

Nevertheless, be prepared that the oil rally that started from lows in April 2020, culminating in the war events in Ukraine, is coming to an end. The global economy and energy consumption are slowing to recover while the cartel continues to raise quotas.

Temporarily, due to lower investment in production in previous quarters, OPEC has not kept pace with production increases. Still, this balance will change sooner rather than later, promising to keep the price from rising.

The FxPro Analyst Team