Oil started the year with a decline

January 05, 2023 @ 16:13 +03:00

The first two trading sessions of the year have clearly shown that traders are sticking to the bearish patterns formed in the previous six months. Interestingly, oil is not even helped by apparent producer lethargy, which translates into stagnant production and shrinking inventories.

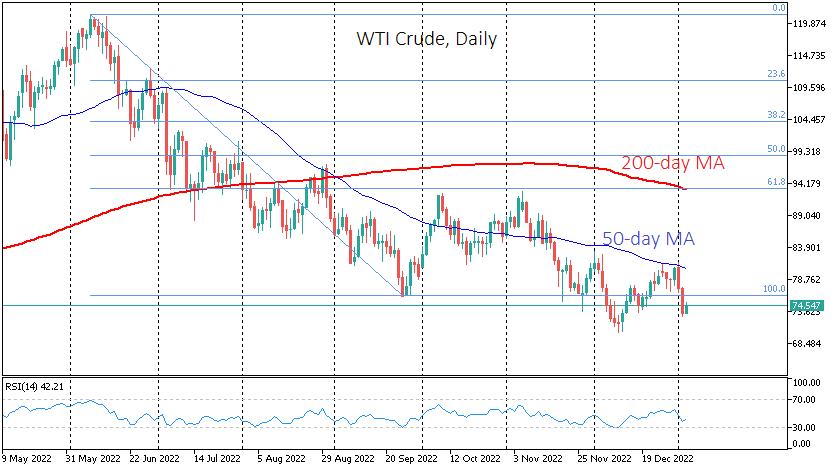

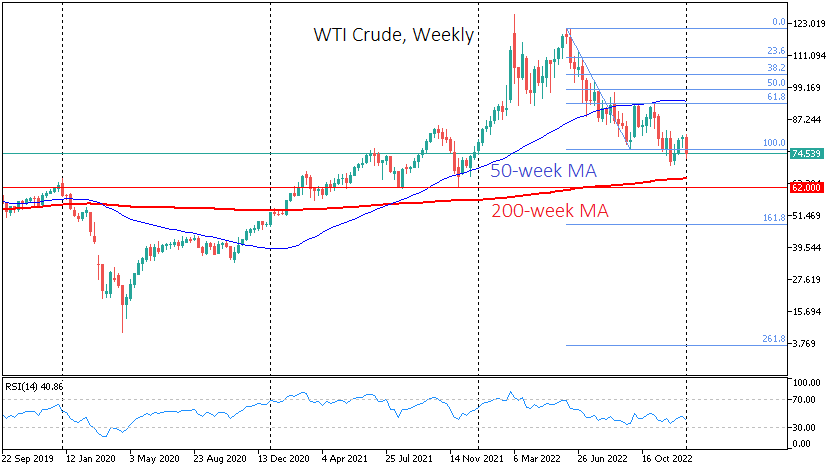

Oil, which had been gaining for the last three weeks of the year, faced intense selling pressure below $80 for a barrel of WTI Crude, near which the 50-day moving average also passed. The sharp, almost 10% decline from that line in two days, as in previous similar episodes last year, sets the stage for a further drop.

A bearish pattern in oil since June persists with a sequence of lower highs and lower lows. This trend will be further confirmed, with WTI falling below $70 as part of the downward momentum that has begun.

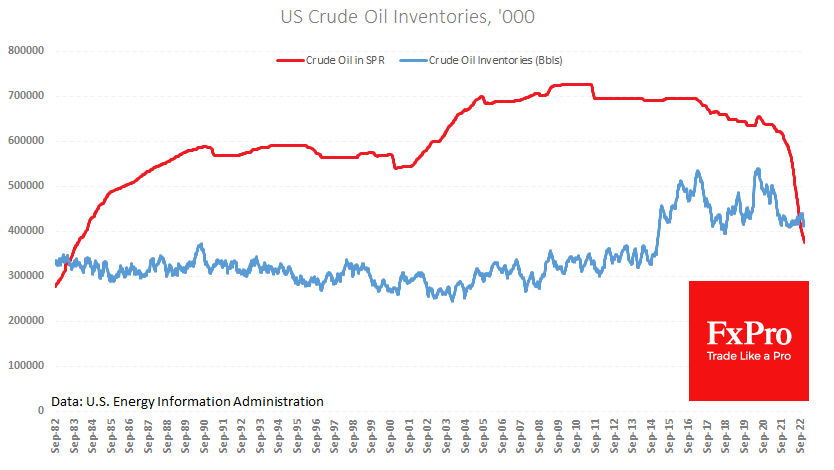

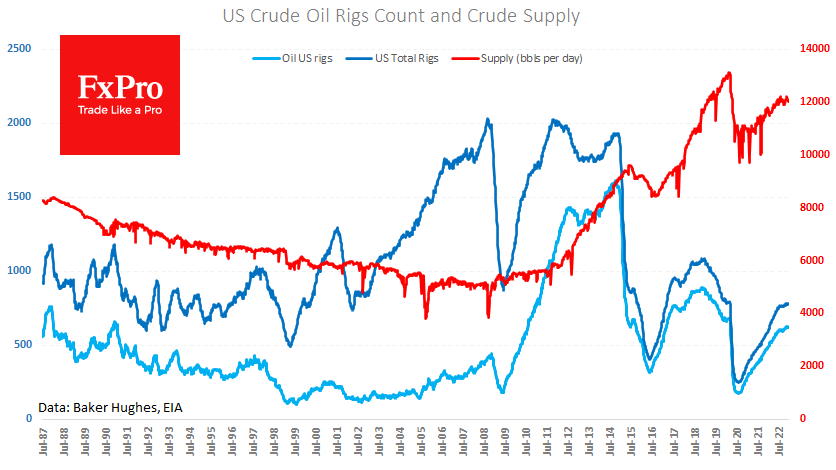

Another batch of weekly inventory data is released today, from which a slight increase in commercial inventories is expected. If we ignore the high-frequency noise of the data, however, what catches the eye is stagnant production, which has been hovering around the 12m BPD level since last May. This is markedly lower than the peak of 13m in March 2020, with employment and GDP levels above pre-pandemic levels.

Producers thus refrain from competing with the state, which continues to sell off reserves at a lower rate.

In the short term, a fall in demand in China, where economic pain from the coronavirus pandemic is intensifying, is in favour of further price reductions. In addition, traders are under pressure from increasing recession risks in a third of the world economy, as predicted by the IMF. Signals that developed countries remain committed to fighting inflation and are willing to sacrifice growth are not helping oil now. Neither are all the new signs that financial institutions continue to tighten the terms of their hydrocarbon loans.

The more than 40% collapse in US gas prices over the past three weeks does not add to the optimism of oil buyers either. The price is now back where it was in January 2022, having put back a market premium due to fears of a supply disruption from Russia to Europe.

Potentially, oil could retreat to the $62-65 area, where it has repeatedly fumbled for support since April 2021. If economic indicators deteriorate further, the price may stop its decline at as low as $50.

The FxPro Analyst Team