Oil Is a Step Away from Falling Off a Cliff

July 29, 2024 @ 14:01 +03:00

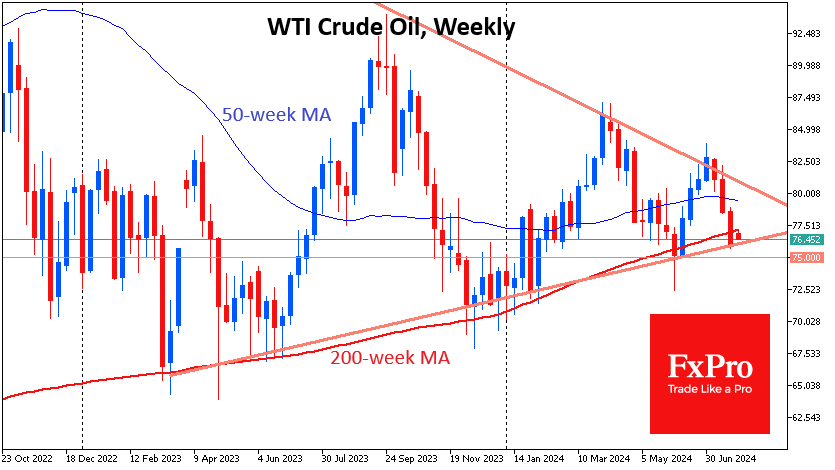

Oil is currently adding 0.6% to $76.45 per barrel WTI, but that’s only half of the spurt at the start of trading after the weekend. An important technical signal is forming in oil, as it closed last week below its 200-week average (now at $77.19) for the first time since January 2020 and was unable to quickly get back above it.

Cautious traders will probably prefer to wait for a failure below $75, which would cement a technical break of support through the area of the past 16 months lows.

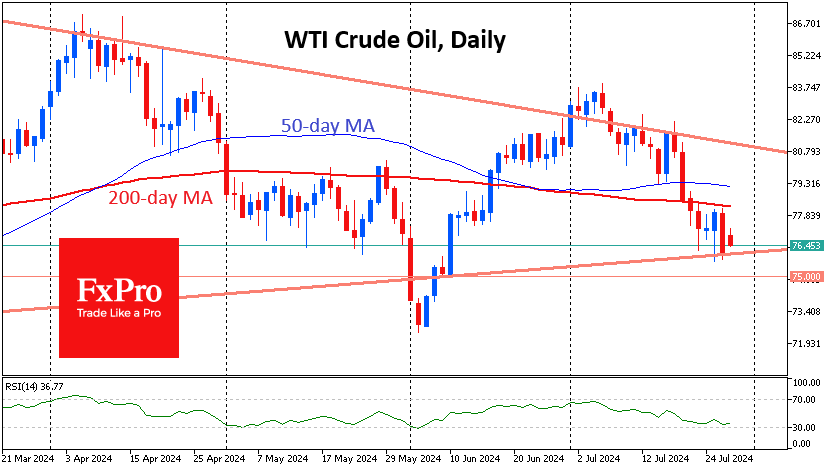

On the daily timeframes, the bears’ local victory has already manifested itself in the active oil sell-off at the touch of the 200-day average last week. On the other hand, oil has so far managed to avoid a violent emotional sell-off on breaking this level, in contrast to how it was at the end of May, as well as in February and November.

Oil has so far failed to ride the favourable news background with the tightening geopolitical tensions in the Middle East. In the second half of last week, reports of a 3.7 million drop in commercial inventories to 436.5 million (-4.5% y/y) also failed to attract buyers.

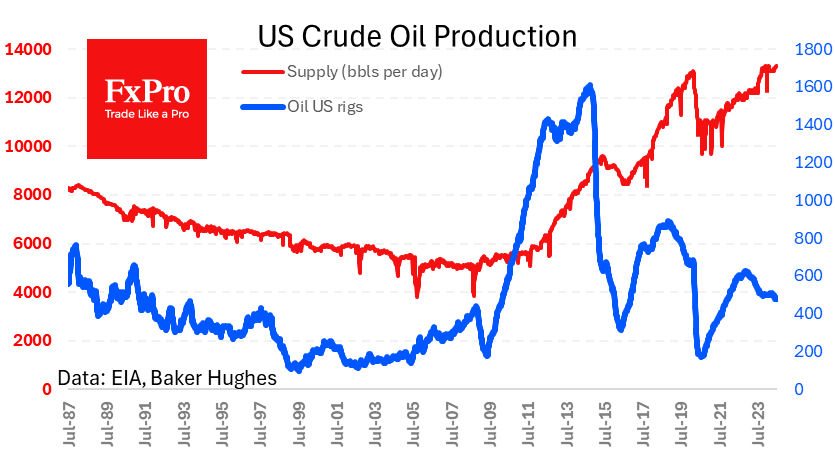

Among the moderately negative factors for oil were a rise in the number of oil drilling rigs by 3pc to 482 and a continuation of record US production at 13.3m bpd. However, the most important selling factor is the signs of a cooling economy that the market fears. So far, this has manifested itself in a slowdown in consumer spending, reduced price pressures, and weak home sales.

This week, the market will face how the Fed assesses the trajectory of the economy on Wednesday and housing market data later in the week. This is a strong enough set to trigger a sell-off in oil or, conversely, to convincingly support buying.

The FxPro Analyst Team