Oil in no rush to decline, despite lower demand for risks

October 16, 2020 @ 12:51 +03:00

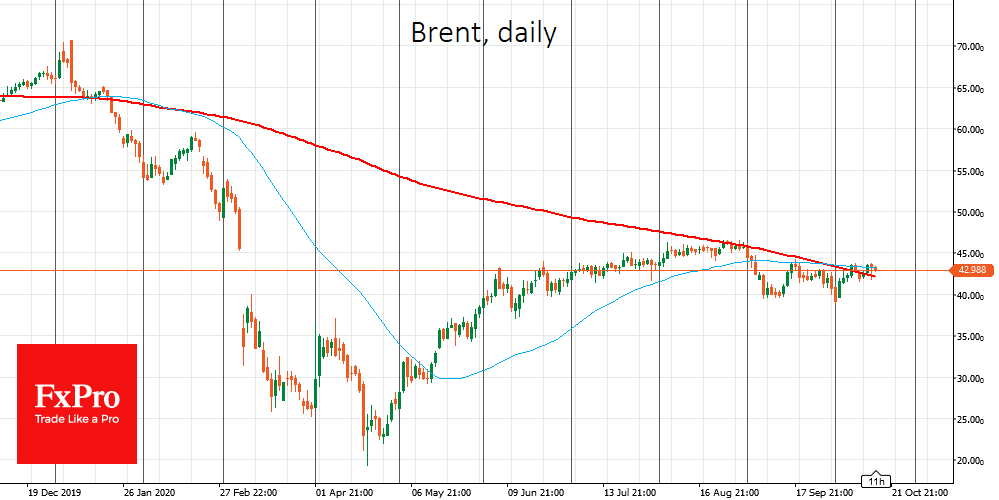

Despite the lower demand for risk assets this week, oil was able to gain support from the inventory report yesterday. Buyer support came in handy, allowing oil to stay above significant technical levels. The ability of the Brent and WTI futures to perform “above the market” is an important bullish sign about its near-term prospects.

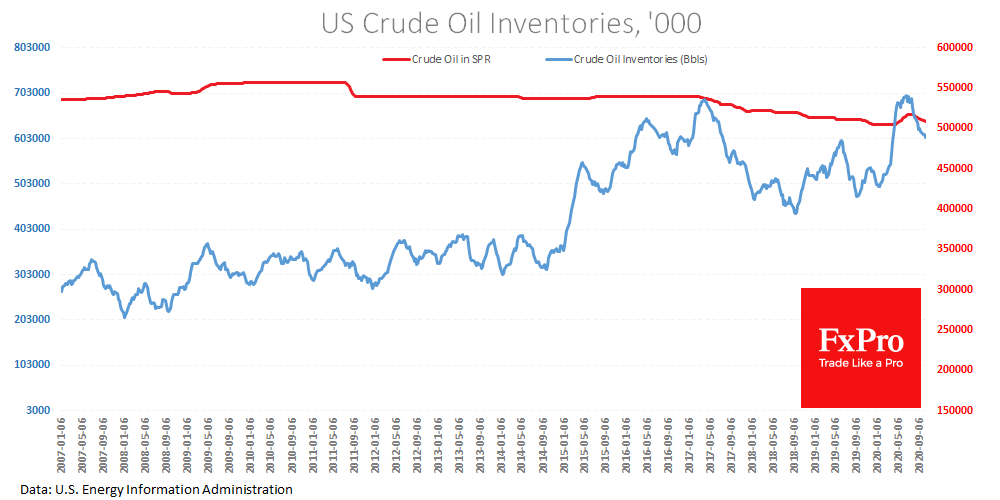

New weekly data showed a 3.8-million-barrel decrease in inventories last week. Inventory growth by the same week decreased to 12.5% from 15.8% a week earlier and from over 20% in early September and July.

The current inventory level is 10% below its peak in June, clearly reflecting the recovery in demand for oil. On the other hand, there has been no actual production growth in recent weeks due to the long hurricane season.

Although there is still a significant oil reserve overhang on the market, the balance recovery has so far been slightly better than expected, helping the Brent price to recover, which more than doubled from its April low.

Technical levels also have a short-term psychological effect on prices. Yesterday’s growth momentum helped Brent to remain above the 200-day average, a level monitored by large fund managers. The support from this level indicates confidence that prices would continue to grow. However, prices remain below the shorter-term signal 50-day average.

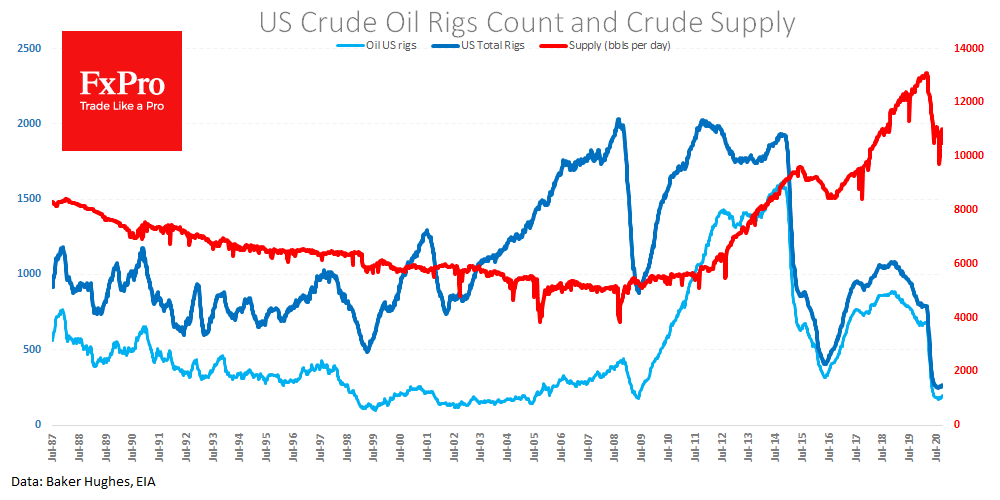

In the last two months, the number of oil drilling companies in the US has stabilised and moved upwards. However, this growth is markedly weaker than what we saw earlier in 2009 and 2016. The graph shows that the increase in the number of drilling rigs during the weeks is more like the fluctuations at the bottom.

The time lag between drilling activity and production ranges from 3 to 9 months. This may mean, that Crude Oil producers do not intend to return to pre-crisis production levels in the near future. It could take years for production in the US to return to above 13.3 million barrels per day, where it was at the beginning of March compared to the current 11 million barrels.

However, it is not easy to be bullish on the oil outlook. New records for new coronavirus sufferers raise doubts about the prospects for demand recovery. Economic growth forecasts are likely to be revised downwards in the coming weeks. This will require less oil, even if politicians avoid national lockdowns like in spring.

At the same time, production growth could quickly come from OPEC+, which is still planning to increase quotas from December. Libya is gradually recovering its production. It seems that at the first signs of demand, traditional producers are ready to deliver their oil to the market quickly, as they are desperate to need money with dire budget deficits.

The FxPro Analyst Team